KBRA describes January data as ‘seasonal’

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Kroll Bond Rating Agency had the opportunity to use an adjective to describe its latest auto-finance data that’s quite familiar to executives and managers.

Analysts included the word “seasonal” when recapping its January indices that are based on information accumulated through the securitization market.

“January remittance reports showed weaker credit performance across prime and non-prime auto loan pools during the December collection period as the seasonal impact of holiday spending weighed on consumer budgets,” KBRA said in its latest report.

Analysts determined annualized net losses in KBRA’s prime auto loan index increased a “modest” 2 basis points month-over-month to 0.25%, while the percentage of borrowers that were 60+ days past due remained flat at 0.35%.

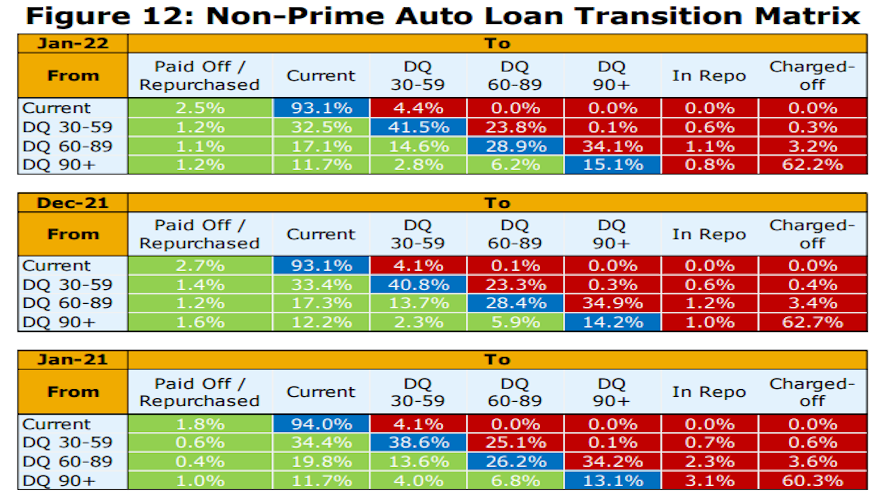

Meanwhile, analysts found that annualized net losses and 60-day delinquency rates in KBRA’s non-prime index increased at a much faster pace, jumping 91 basis points and 41 basis points month-over-month to land at 5.44% and 4.88%, respectively.

KBRA pointed out that continued strength in the used-vehicle market has pushed recovery rates to historically high levels.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts noted that prime and nonprime recovery rates began to normalize during the second half of 2021, but still remain elevated in January, coming in at 58.3% and 51.9%.

“We expect credit performance to continue to weaken in both indices throughout 2022, as inflationary pressures and the remaining wind down of stimulus programs weigh on consumer balance sheets,” analysts said.

“However, tight labor markets, excess savings built up throughout the pandemic, and the approaching tax refund season should help to hamper any meaningful deterioration in credit over the coming months,” KBRA added.