KBRA forecasts softening recovery rates as used-vehicle prices dip

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Kroll Bond Rating Agency (KBRA) released new research on Tuesday that analyzed the impacts of “skyrocketing” used-vehicle prices on auto finance credit performance metrics, as well as discusses future implications as the economy marches toward a return to pre-pandemic norms.

Analysts expect supply and demand imbalances to abate gradually, which may negatively affect recovery rates on future defaults, leading to higher net losses.

But KBRA pointed out that strengthened underwriting criteria amid the rising values may help mitigate this risk.

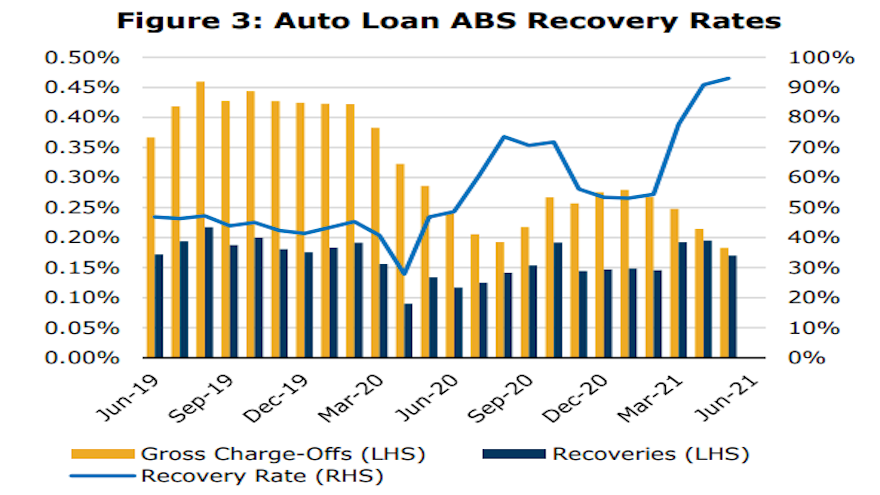

“Unsurprisingly, when borrowers default on their loans (and their vehicles are repossessed and sold), higher resale values translate into higher liquidation proceeds. This outcome is playing out in securitized auto loan pools, which have exhibited elevated recovery rates over the past year,” KBRA said in the research report.

Analysts determined that pool-level recovery rates — calculated as the total amount of liquidation proceeds divided by the total principal amount of contracts charged-off in each month — surpassed 90% in June, which is well above the 40% to 50% historical average.

“However, elevated auto loan recoveries so far have been heavily influenced by lower charge-off rates in recent months,” KBRA said. “This was likely because of an influx of cash to borrowers through tax rebates and a third round of federal stimulus earlier this year, providing borrowers the ability to remain current or satisfy past due payments.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts offered forward-looking perspectives based on the presumption pandemic-related supply and demand imbalances abate and used-vehicle prices soften. They pointed out that contracts originated in today’s market will likely experience higher loss severities and net loss rates compared to historical norms.

To help mitigate this risk, analysts pointed out that many of the paper originators in KBRA-rated transactions have indicated that valuation-related underwriting criteria, such as loan-to-value (LTV) and debt-to-income (DTI), have been strengthened or maintained amid the rising values.

“For example, many auto finance companies have maintained the same maximum borrower DTI knockout rules in their underwriting criteria,” KBRA said. “If the value of the financed vehicle increases more than the borrower’s income, the maximum financed amount will be capped to maintain DTI ratios within required thresholds. If DTI criteria is exceeded, the loan will be declined, or the customer would be offered a less expensive vehicle or require a higher down payment.

“Additionally, many loan originators we interact with have reported increasing the down payment a borrower is required to make, helping to reduce initial LTVs,” analysts continued. “Only a handful of issuers to date have contributed loans on used vehicles that were originated since prices took off in March, as originators typically warehouse their loans for four to 12 months before they are sold into a securitization trust.”

Still, KBRA spotted within the most recent ABS transactions from GM Financial and Exeter Finance contracts originated over the past few months.

“In both cases, average used-vehicle values were approximately 20% above pre-pandemic levels, while loan amounts have increased just 10% to 15%,” KBRA said. “This indicates that originators in the sector are indeed reducing LTVs to mitigate the risk of a future softening used-car market.”