KBRA joins argument saying subprime scene not as bad as portrayed

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Similar to an extensive response by the American Financial Services Association, Kroll Bond Rating Agency (KBRA) also refuted recent assertions by the Wall Street Journal that extrapolated TransUnion data to say that more than 9% of subprime auto financing was more than 60 days past due in the closing quarter of last year, which the article said was the highest quarterly figure since 2005.

However, KBRA explained when analysts detailed their monthly ABS indexes showed that the delinquency readings are not that high. In fact, KBRA said March remittance reports indicated auto credit trends remained strong during the February collection period.

According to its latest report, early-stage delinquencies (30-59 days past due) in the KBRA Prime Auto Loan Index rose 1 basis point month-over-month to 0.90%, while late-stage delinquencies (60 days or more past due) declined 1 basis point to 0.35%.

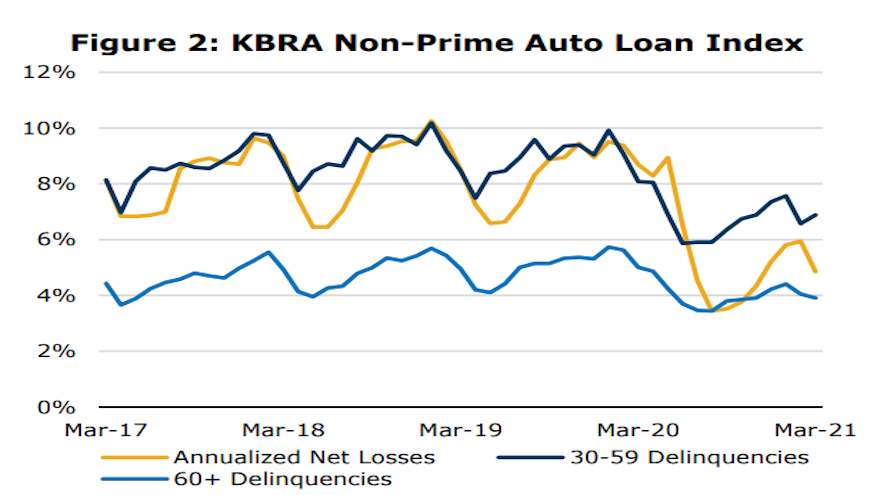

Furthermore, early- and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index moved in different directions, up 31 basis points and down 14 basis points, respectively. The actions left those delinquency readings at 6.88% and 3.91%, respectively.

“Annualized net losses in both indices came down from the prior month due to range-bound roll rates and favorable delinquency metrics earlier this year,” KBRA said.

“In both indices, delinquency rates remain meaningfully lower than year-ago levels, as government stimulus and hardship assistance programs have helped to keep many borrowers current on their loan payments,” analysts continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The recent Wall Street Journal article certainly triggered an industry response, as AFSA delved into a large well of data to form a completely different argument about the current status of auto financing.

KBRA pointed out that its non-prime index shows that 60-day delinquencies have remained around 4% over the past year, below pre-pandemic levels, as well as pre-crisis levels when adjusted for issuer composition.

Why did the Wall Street Journal create such a stir? KBRA explained the divergence is likely the result of several key factors:

▪ Credit score: The KBRA Non-Prime Index tracks the performance of securitizations with a weighted average credit score of below 680, and analysts estimated that the weighted average credit score of the index is approximately 620. Meanwhile, KBRA the article cited the performance of contracts with a much lower borrower credit score ranging from 300 to 600.

▪ Credit drift: While the KBRA Non-Prime Index considers the credit score of a consumer at the time of origination, TransUnion’s reporting, “in our understanding,” uses the borrower’s current credit score, according to KBRA, meaning borrowers can drift in and out of TransUnion’s definition of subprime.

“Since subprime is TransUnion’s lowest credit cohort, performing borrowers may improve their scores and transition to a higher credit tier, while underperforming borrowers may fall from a higher tier at origination into this cohort, resulting in adverse selection within the subprime category,” KBRA said.

▪ Securitization accounting: KBRA noted that most securitization documents specify that a contract must be charged-off at 120 days delinquent, at which time the contract is no longer counted as delinquent in servicer reports, and by extension, in its nonprime index.

“Once a loan meets this criterion, the charge-off amount will be reflected in our index’s annualized net loss (ANL) rate. This is in contrast to TransUnion’s data, which may continue to count borrowers as delinquent past 120 days,” KBRA said.

▪ Denominator and seasoning effect: KBRA said it has observed positive consumer score migration through the pandemic as well as fewer originations in the subprime cohort due to lender credit tightening.

“As a result, we expect the total number of borrowers with a credit score below 600 (which is the denominator in the delinquency rate formula) to have fallen meaningfully and may have pushed the TransUnion delinquency rate higher in recent months,” KBRA said.

“Furthermore, as new originations slow, the average seasoning of loans in this cohort increases, and delinquencies as well as losses generally rise as months-on-book increases,” the firm went on to say.

With all of those factors in place, KBRA acknowledged that the auto-finance landscape could change since an analysis of March’s asset-level disclosures showed mixed credit metrics.

Analysts said the percentage of prime and nonprime contract holders who went from 30 days delinquent to current rose to 34.7% and 28.6%, respectively, down 314 basis points in prime pools and 560 basis points in non-prime pools versus the previous month.

But, KBRA discovered the percentage of prime contract holders who rolled from 60 days past due to charge-off dropped to 13.1% — down 8 basis points month-over-month — while the non-prime roll rate into charge-off jumped 228 basis points to 22.7%.

AFSA closed its blog post with this assertion about what reports such as what the Wall Street Journal article can do.

“AFSA member companies have always been there to support consumers through trying times, from a job loss to life-altering natural disasters. It is one of the great differentiators between traditional installment lenders and auto-finance lenders and less reputable payday or vehicle title lenders. It is a good story to tell. We are happy to share it and would hope fact-based reporters would find it compelling. This incident highlights another important component to our industry,” AFSA wrote.

“Trust is a big part of the relationship between a lender and a customer. Trust is earned. It is also diminished … in this case when reporters choose to not do basic due diligence to get the facts right,” AFSA concluded.