KBRA offers update on securitization performance & US Auto Sales status

Charts courtesy of KBRA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

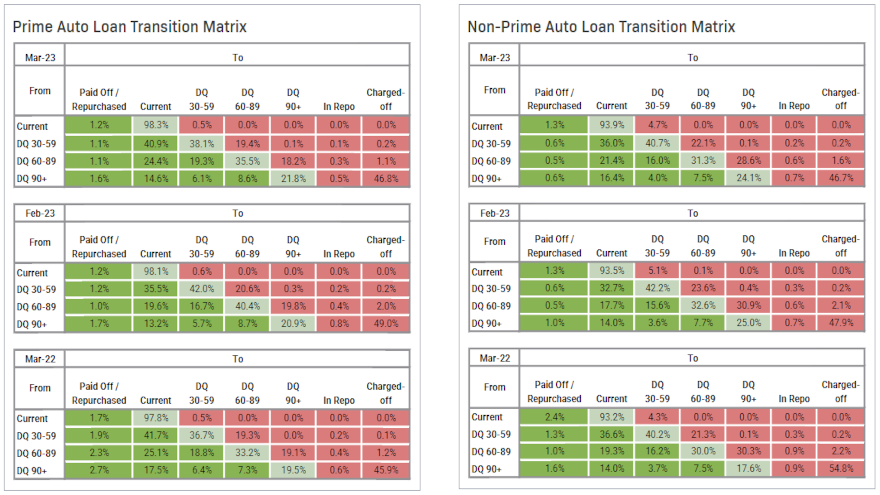

Along with giving an update on its views of securitizations by U.S. Auto Sales, which is going through some operational turmoil, KBRA highlighted March remittance reports showed further seasonal improvement in credit performance across prime and non-prime pools during the February collection period.

Analysts cited the seasonal improvement stemmed from contract holders continuing to receive their tax refunds.

The firm said in a report released last week that annualized net losses in KBRA’s prime index for March dropped 11 basis points month-over-month to 0.36%, while the percentage of prime contract holders at least 60 days past due came in at 0.38%, down 7 basis points month-over-month.

Meanwhile showing that seasonality, analysts determined annualized net losses and 60-day delinquency rates in KBRA’s non-prime index improved 157 basis points month-over-month to 6.95% and 61 basis points month-over-month to 5.13%, respectively.

Following a nine-month streak of decline, KBRA said recovery rates rose sharply in both indices.

Analysts explained this reversal was largely due to theme of this update — seasonal trends — as well as increasing used vehicle values as measured by the Manheim Used Vehicle Value Index, which logged its third consecutive month-over-month increase in 2023. The index rose 4.3% in February and 1.5% in March.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

KBRA pointed out recovery rates rose 6 percentage points month-over-month to 53.26% in its prime index and 8 percentage points month-over-month to 46.56% in its non-prime index.

“The month-over-month improvement across KBRA’s prime and non-prime auto loan indices is consistent with recurring annual trends, as annualized net losses, delinquencies, and recovery rates typically improve first half of theyear until tax-related seasonal tailwinds begin dissipating around May or April,” analysts said in their update.

Considering seasonal tailwinds, we expect positive index readings in the next two months. However, improvements in credit performance may be limited, as borrowers face inflationary pressures, depleting savings, and lower tax refunds, resulting from expired stimulus-related tax breaks and reduced tax credits,” analysts went on to say.

Views of U.S. Auto Sales

In a separate news release, KBRA addressed the situation involving U.S. Auto Sales, whose 39 dealerships located in Georgia, South Carolina, North Carolina, Florida, Tennessee and Alabama remained temporarily closed as of Monday.

However, the dealership network’s affiliated servicing company, USASF Servicing, is still open, servicing accounts and accepting monthly payments, according to store’s website.

“According to various news articles, a letter from the chief executive officer Bob Anderson was sent to employees that claimed the company is working with shareholders to arrive at a solution that allows it to re-open its dealership locations,” KBRA said in its news release. “As of April 19, 2023, U.S. Auto representatives have yet to respond to KBRA inquiries regarding the details of these events including, but not limited to, the reason for the temporary closure of its dealerships and the ongoing operations of U.S. Auto and its affiliates.”

KBRA recapped that U.S. Auto Sales is majority owned by Milestone Partners, a private equity firm founded in 1995. KBRA noted U.S. Auto Sales has historically funded its originations via warehouse facilities and term asset-backed security (ABS) transactions and its vehicle inventory via a floorplan facility with Ally Financial.

On April 14, KBRA said it has placed its ratings on eight classes of notes on watch developing and two classes of notes on watch downgrade issued from three U.S. Auto Funding Trust (USAUT) transactions, owing to a reporting error by USASF Servicing resulting in cumulative gross and cumulative net losses to be understated for a period of six months.

Concurrently, KBRA said it has maintained its watch downgrade status on one class of notes issued from USAUT 2022-1 where it was placed on Feb. 28, due to deteriorating credit performance which has resulted in declining overcollateralization.

U.S. Auto Sales operates a direct financing model in which it originates 100% of contracts through its company-owned stores, according to KBRA.

KBRA went on to mention the USAUT transactions have several servicer replacement events that would trigger the back-up servicer to become the successor servicer to USASF Servicing. Computershare Trust Co., serves as the back-up servicer for the USAUT transactions.

“Should a servicer replacement event occur, Computershare could choose to service the receivables or appoint another entity that is qualified under the documents as sub-servicer. Servicer replacement events include events of bankruptcy, insolvency, receivership, or liquidation,” KBRA said. “The closure of the dealerships may have a negative impact on the company’s financial condition, which may lead to a possible servicer replacement event.

“While a servicing transfer under such circumstances may benefit the ABS transactions, it poses risks of cash flow interruption while such transfer occurs, particularly given the subprime credit profile of the underlying borrowers and that many of the loans in the subject securitizations pay bi-monthly,” KBRA continued.

“KBRA will continue to monitor the developments and implications of U.S. Auto’s temporary dealership closures, as well as performance of the U.S. Auto outstanding ABS transactions,” KBRA added.