KBRA’s September indexes point toward upcoming seasonality

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Kroll Bond Rating Agency (KBRA) is seeing the likelihood strengthen that seasonal payment patterns are coming; that some of your contract holders might purchase holiday gifts rather than maintain their monthly vehicle payment.

Analysts delved into the topic when they shared KBRA’s September index readings based on securitizations in both prime and non-prime.

KBRA reported this week that early-stage delinquencies — contracts 30 to 59 days past due — in its Prime Auto Loan Index for September increased 1 basis point month-over-month to 0.82%, while late-stage delinquencies —60 days or more past due — rose 2 bps to 0.29%.

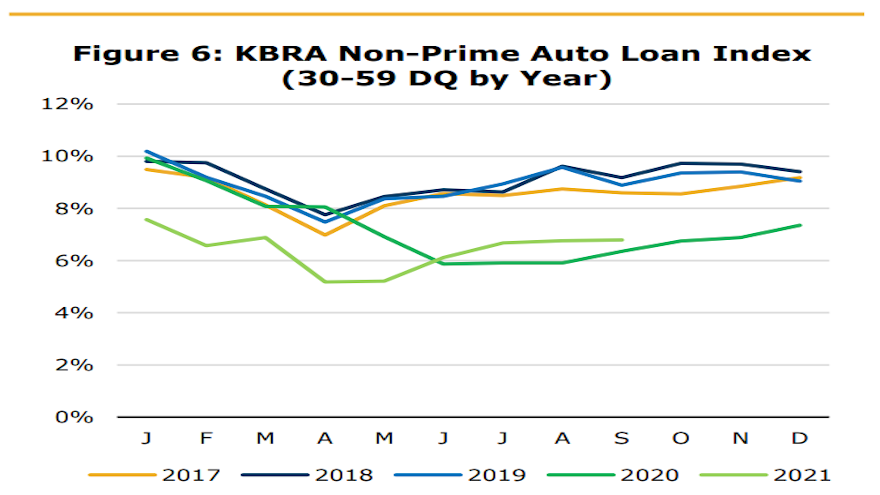

Meanwhile, analysts indicated early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index ticked up month-over-month by 2 basis points and 12 basis points, respectively, to land at 6.79% and 3.65%.

KBRA pointed out that annualized net losses (ANL) also trended higher in both indices versus the previous month but remain below year-ago levels, as the sharp rise in used-vehicle values has helped boost recoveries in 2021.

“We expect credit performance to soften in the coming months, keeping in line with seasonal trends as holiday spending weighs on borrower finances,” analysts said in the newest report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Moreover, the termination of extended federal unemployment benefits in early September, coupled with the phasing out of other COVID-related safety net programs, will likely create additional headwinds to consumer credit performance,” KBRA continued.

KBRA also noted that the percentage of prime and non-prime contract holders who transitioned from current to 30 to 59 days delinquent in September totaled 0.5% and 4.1%, respectively, remaining flat in prime pools and up 29 basis points in non-prime pools versus the previous month.

Analysts added that the percentage of prime customers who rolled from 60 days or more past due to charge-off equaled 14.2%, representing a jump of 218 basis points month-over-month. KBRA said the non-prime roll rate into charge-off increased 52 basis points to 19.5%.