KBRA spots continued seasonal improvement

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Amazing what federal income tax refunds can do for the health of your portfolio, huh?

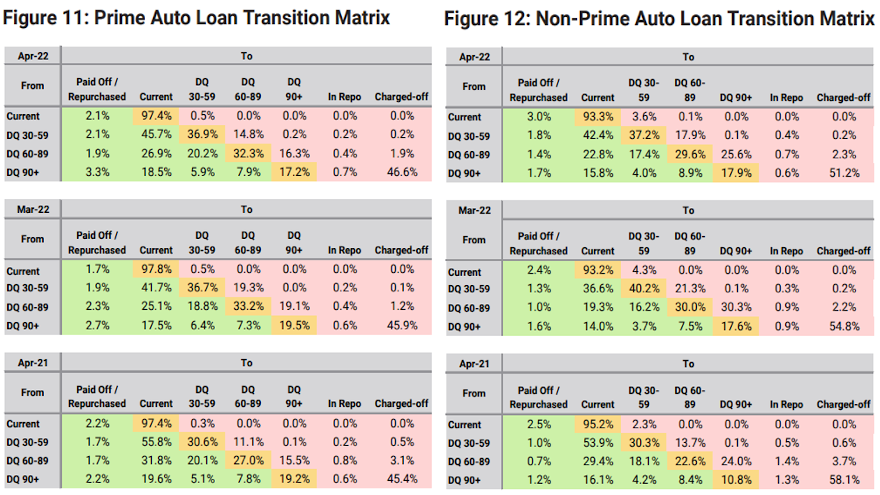

Kroll Bond Rating Agency (KBRA) said April remittance reports showed auto finance credit performance improved for the second consecutive month across both prime and non-prime securitized pools.

According to the firm’s report, annualized net losses in KBRA’s prime auto index fell 4 basis points month-over-month to 0.17%, while the percentage of prime contract holders who were 60 days or more past due declined a “modest” 7 basis points to 0.28%.

Meanwhile, analysts determined annualized net losses and 60-day delinquency rates in KBRA’s non-prime index improved at a much faster pace, falling 122 basis points month-over-month to 3.99% and 56 basis points month-over-month to 4.06%, respectively.

“The month-over-month improvement in both indices is consistent with typical seasonal trends as borrowers receive tax refunds, providing an additional source of cash to catch up on past due loan payments,” KBRA said in the report. “These seasonal tailwinds will likely dissipate in the next month or two, placing some upward pressure on loss and delinquency rates as we enter the summer months.

“Outside of the typical seasonality seen in auto loan credit performance, we continue to expect inflationary pressures and the lack of further stimulus to create additional performance headwinds through the remainder of 2022,” analysts continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The firm went on to mention recovery rates in KBRA’s prime and non-prime auto indices rose sharply for the second consecutive month and remain elevated versus pre-pandemic levels.

“Despite the recent increase in loan recoveries, we generally expect recovery rates to trend down toward pre-pandemic levels as the strong used-vehicle market enters its 23rd month, as defaults occurring now are more heavily weighted toward loans originated after used vehicle values rose sharply in early 2021,” analysts said.

“Furthermore, it is probable that auto loan recovery rates will eventually come under increasing pressure as rising interest rates and a slowing economy cause used-vehicle values to move toward more normalized levels,” they added.