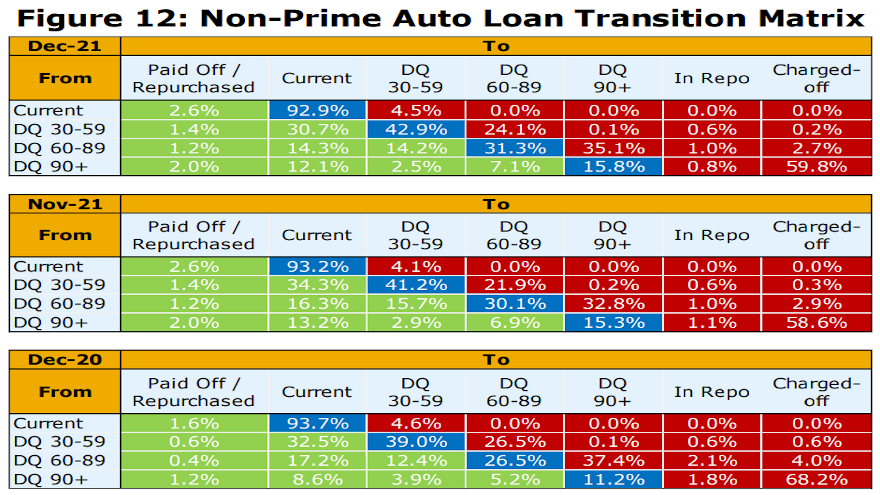

KBRA spots more payment wobbling in December reporting

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

More evidence that consumers maintaining their monthly payments for their vehicles is continuing to wobble arrived this week from Kroll Bond Rating Agency (KBRA).

In its latest analysis looking at the automotive securitization market, KBRA found that December remittance reports showed mixed credit performance across prime and non-prime auto pools during the November collection period.

The firm said annualized net losses in KBRA’s prime auto loan index fell 3 basis points month-over-month and 17 basis points year-over-year to 0.23%, while 60-day delinquencies crept up to 0.35%, an increase of 3 basis versus the previous month.

Meanwhile, analysts discovered annualized net losses in KBRA’s non-prime index came in at 4.53%, dropping 7 basis points month-over-month and 67 basis points compared to December 2020.

However, the percentage of contract holders 60 days or more past due in KBRA’s non-prime index climbed 38 basis points month-over-month and 25 basis points year-over-year to 4.47%.

Furthermore, KBRA added that prime and non-prime auto recovery rates remain elevated but have started to normalize as used-vehicle values have stabilized in recent months. The latest analysis on that topic from Black Book and Cox Automotive can be found in this Cherokee Media Group report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We expect credit performance to gradually deteriorate in the coming months as a combination of inflationary pressures, the remaining wind down of stimulus programs, and the seasonal impact of holiday spending will likely weigh on consumer balance sheets in the months ahead,” KBRA said in its report.

“However, these headwinds will be partly offset by the distribution of tax refunds toward the end of Q1 2022, as well as the impact of tight labor markets, elevated used-car values and excess consumer savings built up throughout the pandemic,” analysts added.