KBRA spots notable non-prime credit deterioration

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The newest data and analysis from Kroll Bond Rating Agency (KBRA) might be reinforcing the observations and comments made by finance company executives and repossession agents during the North American Repossessors Summit a little less than a month ago.

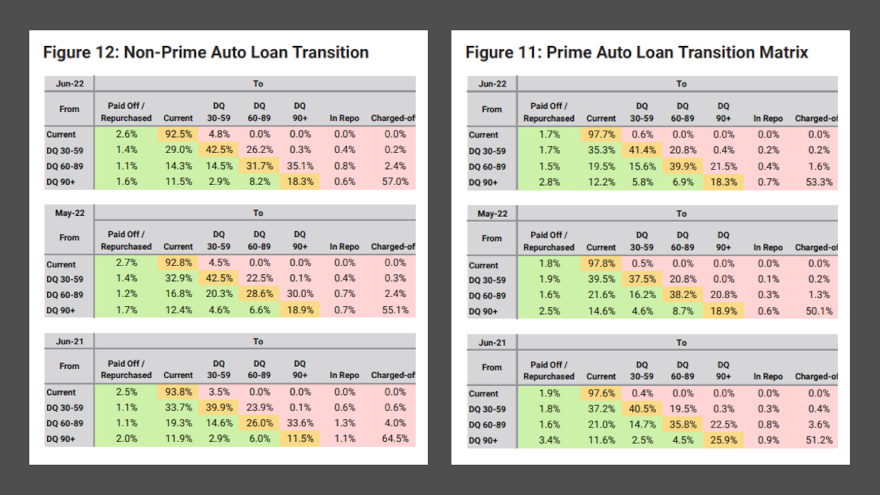

KBRA reported that June remittance reports showed softening credit performance across securitized prime and non-prime auto securitization pools during the May collection period, especially in the non-prime segment.

Analysts indicated annualized net losses in KBRA’s prime auto index rose 2 basis points month-over-month and 11 basis points year-over-year to 0.12%, while the percentage of prime contract holders 60 days or more past due increased to 0.32%, which is up 2 basis points versus the previous month and 9 basis points came to a year ago.

Meanwhile, analysts noticed annualized net losses and 60-day delinquency rates in KBRA’s non-prime index rose at a much faster pace.

In non-prime, KBRA said annualized net losses increased 25 basis points month-over-month to 3.90%, which computed to a whopping 212 basis-points spike year-over-year. And the firm determined 60-day delinquency rates rose 62 basis points month-over-month to 4.56%, which represented a significant 156 basis-points leap year-over-year.

KBRA elaborated about what the latest trends might mean in its latest report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We note that while non-prime delinquency rates have risen back to pre-pandemic levels, non-prime loss rates have not moved up in tandem,” analysts said. “We believe the divergence between delinquencies and losses has been driven by two main factors: lofty used vehicle prices, which continue to boost recovery rates, and elevated delinquency churning, as a higher percentage of delinquent borrowers have avoided repossession by making at least a portion of their monthly payments.

“This month’s weaker index readings do not come as a surprise, as we expected seasonal tailwinds from tax refunds in the first few months of the year to dissipate, and for inflationary pressures and rising rates to weigh on credit performance as we enter the summer months,” analysts continued.

“It seems likely that auto loan credit performance will continue to generally weaken in both indices through the remainder of the year as consumers struggle with rising prices and depleting savings,” KBRA went on to say.