KBRA spots some seasonal movement in newest ABS indices

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Kroll Bond Rating Agency (KBRA) released its auto finance ABS indices for July, as analysts used a description that might make many executives and managers a little more confident about how the entire market is behaving.

While defaults still near the all-time low, KBRA said July remittance reports showed softening credit performance across most securitized auto finance pools during the June collection period, prompting analysts to say they were “in line with typical seasonal trends.”

The firm indicated that early-stage delinquencies — contracts 30 to 59 days past due — in KBRA’s Prime Auto Loan Index increased 3 basis points month-over-month to 0.77%, while late-stage delinquencies — contracts 60 days or more past due — rose 2 basis points to 0.26%.

Meanwhile, analysts determined that early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index jumped 56 basis points and 42 basis points respectively, coming in at 6.68% and 3.43%.

“Annualized net loss rates ticked up slightly in both indices versus the previous month but continue to trend well below year-ago levels, due to favorable delinquency metrics in early 2021, as well as a strong used-car market which has boosted recovery rates on defaulted loans,” KBRA said in its newest report.

“We expect credit performance to generally soften in both indices through the remainder of the year as the benefits of stimulus dissipate and summer travel and holiday spending weigh on borrower finances in the coming months,” analysts continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Additionally, recovery rates may begin to normalize as the supply and demand imbalances in the used car market begin to abate, which may place upward pressure on net loss rates,” they added.

KBRA closed its latest update by mentioning the percentage of prime and non-prime contract holders in June who went from current to 30 days delinquent came to 0.4% and 3.8%, respectively. That’s 1 basis point higher in prime pools and 21 basis points higher in non-prime pools versus the previous month.

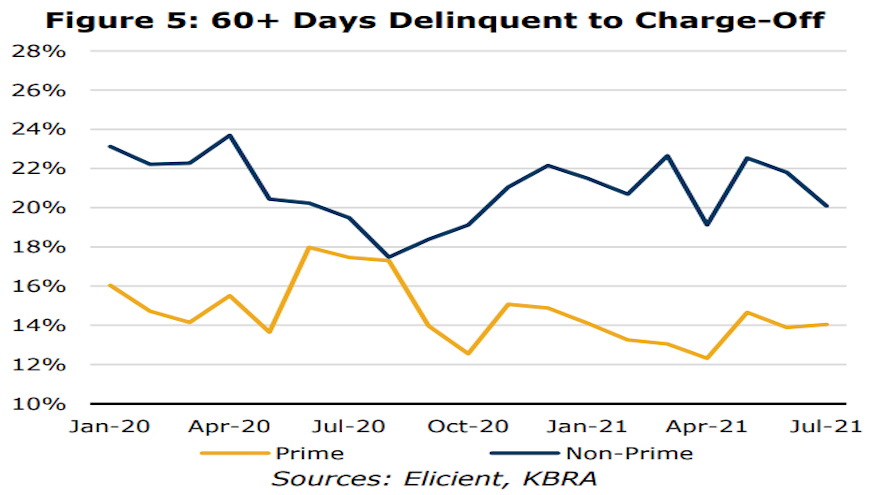

Meanwhile, the firm said the percentage of prime borrowers who rolled from 60 days or more past due to charge-off came in at 14%, up 17 basis points month-over-month, while the non-prime roll rate into charge-off decreased 171 basis points to 20.1%.