KBRA spots ‘well-grounded’ metrics from April remittance reports

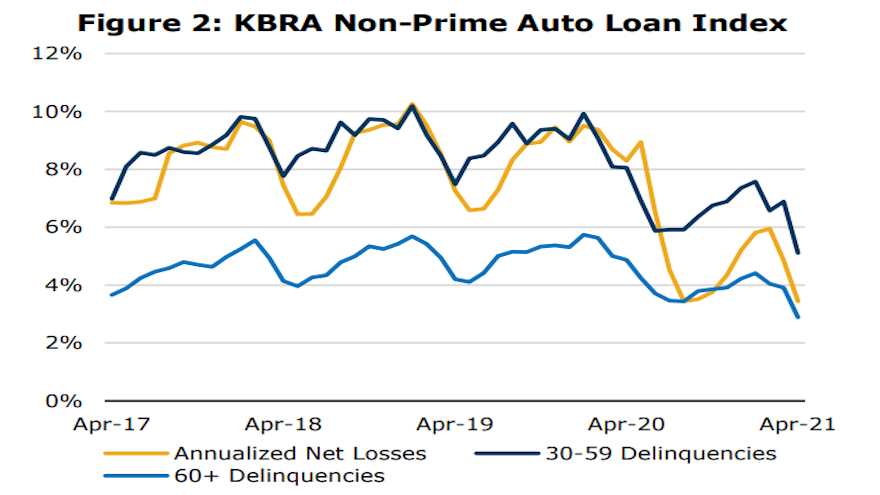

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Kroll Bond Rating Agency (KBRA) used the descriptor “well grounded” when analysts dissected April remittance reports to discover the credit trends that surfaced during the March collection period.

KBRA indicated delinquencies for both non-prime and prime contracts decreased.

Analysts said in their newest report that early stage delinquencies — 30 to 59 days past due — in the KBRA Prime Auto Loan Index fell 23 basis points month-over-month to 0.67%, while late-stage delinquencies — more than 60 days past due — declined 11 basis points to 0.23%.

Meanwhile, the firm said early and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index dropped 177 basis points and 102 basis points, respectively, coming in at 5.11% and 2.89%.

Analysts mentioned annualized net losses also trended lower in both indices during the month, “driven by favorable delinquency metrics and a frothy used-car market caused by strong demand and new vehicle production shortages, which has helped to keep recovery rates at elevated levels in 2021.”

KBRA also highlighted that contract prepayment rates rose sharply in March, mirroring a similar trend that analysts observed in other consumer loan sectors.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The firm determined prime and non-prime prepayments rose to 26.75% and 32.40%, respectively, up 13 percentage points and 11.8 percentage points versus the previous month.

“We expect the rise in prepayment rates to be transitory, as it is likely borrowers used the extra cash received from the third round of stimulus and tax rebates to pay down some of their outstanding debt during the month rather than accumulate savings as uncertainty is reduced and economic activity improves,” analysts said.

Furthermore, there was yet another upbeat metric to report. KBRA noted that its analysis of April’s Reg AB II asset-level disclosures showed improved credit metrics.

Analysts found that the percentage of prime and non-prime contract holders who went from 30 days delinquent to current rose to 47.9% and 44.9%, respectively. That’s up 1,323 basis points in prime pools and 1,634 basis points in non-prime pools versus the previous month.

And KBRA said the percentage of prime contract holders who slid from 60 days or more past due to charge-off dropped to 12.2%, down 77 basis points, while the non-prime roll rate into charge-off declined 357 basis points to 19.1%.