Latest KBRA report shows more softening in prime & non-prime

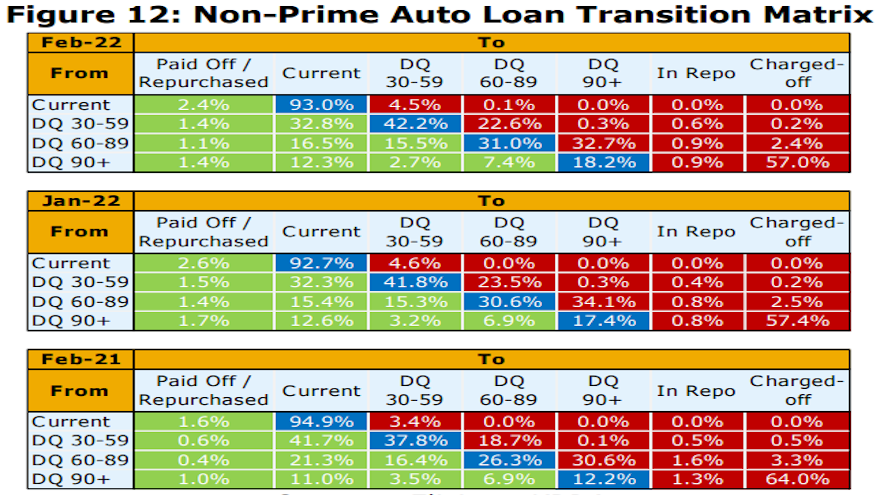

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auto-finance companies looking to gauge collections, delinquencies and defaults continue to get a somewhat murky glimpse of what’s happening in the market.

After the latest update showed a slight dip in defaults, the newest insight from Kroll Bond Rating Agency (KBRA) indicated February remittance reports showed that auto credit performance continued to soften across prime and non-prime securitization pools during the January collection period.

Analysts said annualized net losses in KBRA’s prime auto loan index increased 6 basis points month-over-month to 0.31%, while the percentage of prime contract holders who were 60 days or more past due ticked up a modest 2 basis points to 0.37%.

Meanwhile, analysts found that annualized net losses and 60-day delinquency rates in KBRA’s non-prime index increased at a much faster pace — jumping 83 basis points and 27 basis points, respectively, versus the previous month. The left the readings at 6.27% and 5.15%, respectively.

KBRA reiterated that auto recovery rates rose sharply in 2021, supported by soaring used-vehicle values.

“However, even as both the Manheim Used Vehicle Value Index and J.D. Power Used Vehicle Price Index hit all-time highs in January, prime and non-prime auto loan recovery rates have trended down in recent months,” KBRA analysts said in the latest report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The likely explanation for the divergence between car prices and loan recoveries is that auto loan defaults typically occur in the first year or two following origination,” analysts continued. “As a result, the majority of recent defaults are likely from loans originated after used vehicle values rose sharply in early 2021.”

Will the view of collections, delinquencies and defaults become any clearer later this year? KBRA offered this forecast.

“Broadly, we expect credit performance to continue to weaken in both indices throughout 2022, as inflationary pressures and the lack of further stimulus weigh on consumer balance sheets,” analysts said. “However, tight labor markets, excess savings built up throughout the pandemic, and the approaching tax refund season should help to hamper any sudden or meaningful deterioration in credit.

“It is also probable that auto loan net loss rates will eventually come under increasing pressure as used vehicle values begin to normalize, but this may not occur in 2022,” analysts went on to say.