Latest TransUnion study examines new-to-credit consumers

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps those new-to-credit consumers — individuals early in their credit journeys — might be some of the best applicants to land in your finance company’s underwriting department.

The main finding from a newly released TransUnion global study showed new-to-credit consumers generally perform as well or better than ones with established credit and similar risk scores.

TransUnion said its study titled, “Empowering Credit Inclusion: A Deeper Perspective on New-to-Credit Consumers,” may give some assurance to finance companies and other lenders in both developed and developing credit markets that they can extend additional credit products to such consumers without incurring materially higher delinquencies.

“A particular focus around the topic of financial inclusion is credit inclusion — the ability of consumers to access traditional lending products, such as credit cards, mortgages and personal loans. These products serve as a means to financial mobility for consumers and can be a gateway to a better quality of life, enabling homeownership, business formation and wealth creation,” said Charlie Wise, co-author of the study and head of global research at TransUnion.

“The more consumers who can participate in credit markets in a region, the greater the opportunities for broad economic inclusion. The data from our study demonstrate that new-to-credit consumers are often good risks who are hungry for credit and will show loyalty to those financial institutions that offer them their first credit accounts,” Wise continued in a news release.

The study included data and insights about millions of consumers in varied global markets, including the United States, Brazil, Canada, Colombia, Dominican Republic, Hong Kong, India, Philippines and South Africa.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion defined a new-to-credit consumer as one with no prior credit history on their credit bureau file who opened their first-ever, traditional credit product such as auto financing, credit card or another loan unique to individual regions.

The study then examined the behaviors and performance of those new-to-credit consumers over the subsequent two years after opening their first credit product.

In the United States, TransUnion indicated 5.8 million consumers opened their first credit product and became new-to-credit (NTC) during 2021. And another 3.0 million became NTC through the first half of 2022.

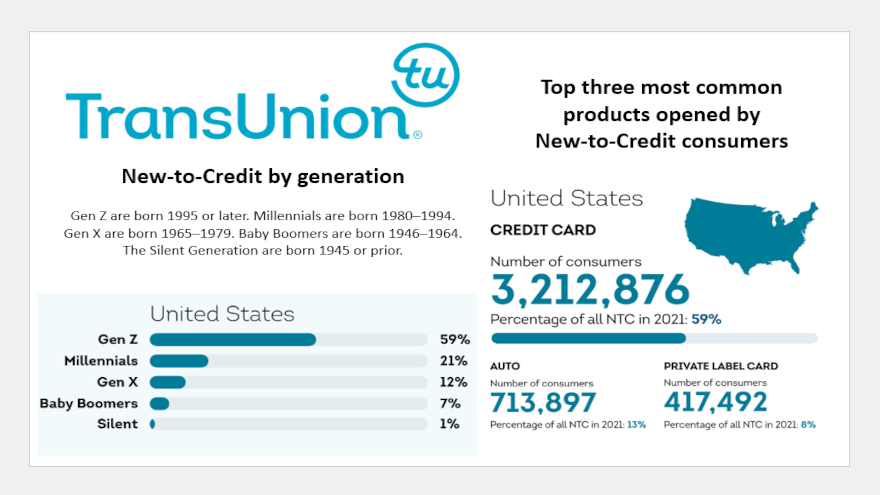

In 2021, TransUnion determined Gen Z made up the largest part of this group with 59%, followed by millennials (21%), Gen X (12%) and Baby Boomers (7%).

One of the main takeaways from the study: NTC consumers around the globe are generally good risks when compared to other established borrowers with similar credit risk profiles. As well, credit cards are generally the first credit product opened by most NTC borrowers in the U.S. as well as many of the other regions studied.

The study found that new expenses were the primary driver for opening a first lending product in nearly all markets, excluding the U.S. and Canada, where having access to a convenient means of spending was the top motivator. This is supported by the choice of first product types, where in the U.S. and Canada the most common first product opened is a credit card.

Furthermore, the study revealed that on average, about six in 10 NTC consumers said their need for credit will increase in the next three to five years. Approximately 52% of American NTC consumers stated their need for credit will rise in this same timeframe.

“It’s clear that new-to-credit borrowers around the globe and in the United States will play a large role in the growth of many lenders’ books of business,” said Michele Raneri, co-author of the study and head of U.S. research at TransUnion. “Banks, credit unions and other financial institutions who use alternative data while providing products, channels and a positive onboarding process, will likely be the ones who succeed in building loyalty with this segment of the population.”

For detailed information about all global markets represented in the study, go to this website.