LegalShield: Spiking consumer financial stress ‘not a fluke’

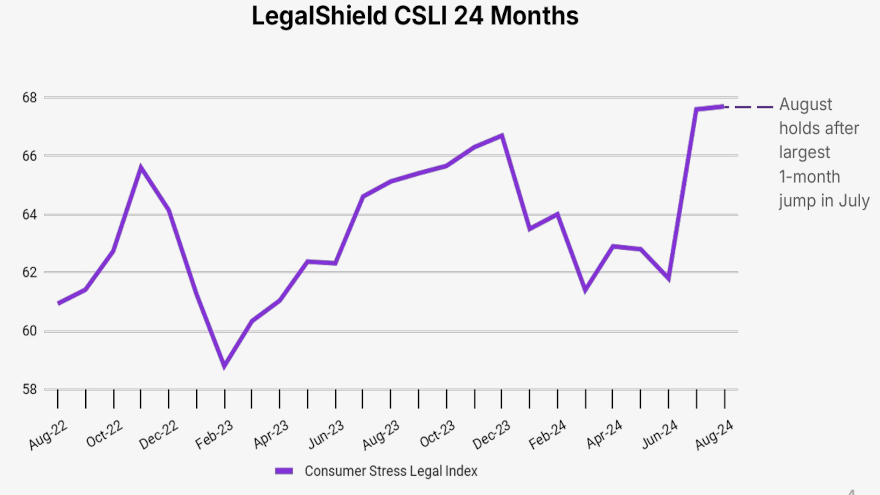

Chart courtesy of LegalShield.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LegalShield said this week when examining consumers’ finances that the “jump in stress is not a fluke.”

Following the steepest surge in the study’s 22-year history, the August reading of the LegalShield Consumer Stress Legal Index (CSLI) ticked up 0.1 to 67.7, making it the highest level recorded since November 2020.

That upward movement came after the index generated its largest single-month jump by rising 5.8 points in July.

LegalShield, which has provided Americans with access to legal advice, counsel, protection, and representation since 1972, compiles the study that tracks about 150,000 calls per month from consumers seeking legal help.

LegalShield’s CSLI is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. The index is built on three sub-indices tracking calls for legal assistance for issues related to bankruptcy, foreclosure and consumer finance.

“The trending in the calls we’re taking suggest an economy where consumers are still stretched thin – they’re looking for legal help to manage their pocketbook challenges,” LegalShield senior vice president of consumer analytics Matt Layton said in a news release. “Based on calls from everyday Americans, our historic results suggest they remain unsettled about the economy.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LegalShield also reported that its bankruptcy subindex dropped 3.3 points in August to 32.3, but it’s up 23.2% year-over-year.

The company added that its consumer finance subindex, which measures inquiries regarding a variety of consumer financial concerns such as billing disputes and loan modifications, was up 1.9 points to 106.0, the highest level since December.

Furthermore, LegalShield’s foreclosure subindex rose 2.8 points to 42.3, its highest level since last August.

“The Federal Reserve Board approved a significant interest rate cut in September which may provide some relief for consumers. However, consumers continue to face increased housing costs, unemployment or underemployment and increased cost of goods which could continue to drive up consumer stress,” LegalShield said in its report that contained the index update.

LegalShield also shared anecdotes from a provider law firm that reinforced the index readings.

“We are talking with people who are unemployed or under employed. They do not have enough income to meet their ordinary expenses, and they are looking for assistance,” said Heidi McGee, supervising attorney at Willinger, Willinger, & Bucci, a LegalShield provider law firm serving Connecticut.

“Mortgage and credit card interest rates are only beginning to ease off their recent highs and everything costs more, especially food and housing. Adult children are moving in with mom and dad and extended family members to share living expenses and to avoid eviction or foreclosure,” McGee continued in a news release.