LexisNexis Risk Solutions survey emphasizes alternative data importance in subprime

Charts courtesy of LexisNexis Risk Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

New research from LexisNexis Risk Solutions reinforced how the use alternative data often focuses on deep subprime, subprime and near-prime consumers

Last week, LexisNexis Risk Solutions unveiled the findings of its Alternative Credit Data Impact Report, a nationwide survey assessing the adoption, utilization and impact of alternative credit data for credit portfolio growth and management in consumer and small/mid-sized business (SMB) lending.

The report surveyed those who identify as senior decision makers for marketing, lending and credit risk in U.S. financial institutions such as banks, credit unions, non-bank lenders and fintechs.

LexisNexis Risk Solutions recapped that alternative credit data encompasses a broad range of credit risk insights. Experts said these insights are typically not included in traditional credit reports and scores including life event insights such as professional licenses and asset ownership and modern credit seeking behaviors from markets like online lending and short-term lending, rental data, consented data and more.

When paired with the traditional credit behaviors currently used in conventional credit scores, LexisNexis Risk Solutions explained these non-traditional credit insights can deliver a more comprehensive view into a consumer’s creditworthiness.

LexisNexis Risk Solutions discovered at least two-thirds of financial institutions surveyed use alternative data in their credit risk assessments for underwriting and portfolio management.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In fact, 84% of respondents use alternative credit data in prescreening and credit risk across the customer lifecycle, with credit unions taking the lead in using alternative credit data at 91%.

Three other key findings from the Alternative Credit Data Impact Report include:

1. Adoption of Alternative Credit Data

Alternative credit data usage is becoming more common as financial institutions adopt financial inclusion initiatives.

Of the 37% of self-identified leading adopters of alternative credit data, the survey showed 55% named financial inclusion as their top objective, followed by improving segmentation (37%) and improving the ability to swap in/swap out applicants (24%).

LexisNexis Risk Solutions said financial institutions are most likely to use alternative data in their credit risk assessment of deep subprime, subprime and near-prime consumers.

Leaders of alternative data adoption are also particularly likely to use it when assessing the credit risk of prime consumers, according to the survey.

2. Data as a business driver

LexisNexis Risk Solutions pointed out business drivers for alternative data use include improving pricing strategies, increasing financial inclusion, risk mitigation and gaining a competitive advantage.

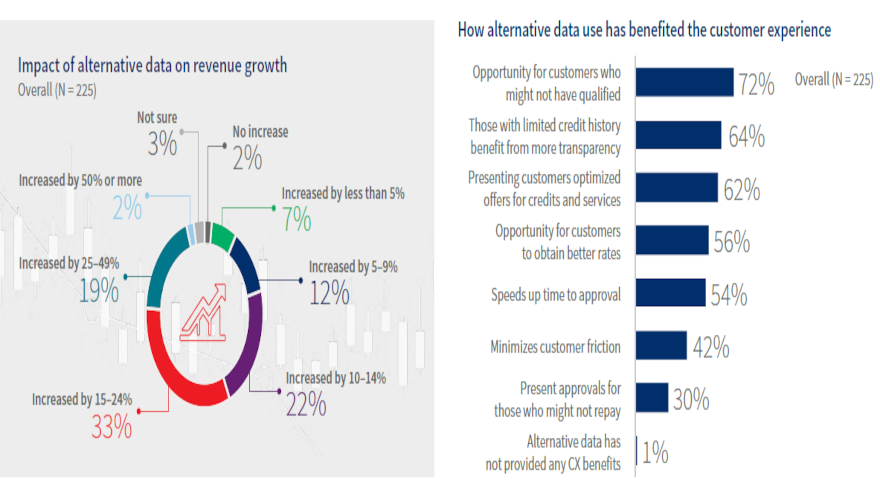

Nearly all financial institutions surveyed indicated that alternative data has increased revenue growth by at least 15% and improved customer experience.

The report also indicated that lack of alternative data usage could lead to lost opportunity, customer friction and limited risk mitigation.

3. Financial institutions satisfied yet challenged

While there is overall satisfaction with alternative data, LexisNexis Risk Solutions acknowledged there are challenges and barriers associated with utilizing alternative credit data for credit risk assessment.

Experts said larger tier 1 banks are significantly more likely than smaller banks to be very satisfied with their data, as a result of having more resources to invest in to obtain alternative types of data.

“The high rate of alternative data adoption across the customer lifecycle reflects how lenders of all sizes are increasingly unsatisfied relying solely on the status quo of traditional credit data to grow and manage their businesses,” said Kevin King, vice president of credit risk and marketing strategy at LexisNexis Risk Solutions.

“The vast majority of institutions are now using alternative data to assess the creditworthiness of subprime consumers and those with limited credit history, while forward-thinking organizations are achieving significant advantages applying these insights in near-prime and prime segments,” King continued in a news release.

“This benefits not only the financial institution but the customer experience, helping to ensure lenders present the most appropriate offers to consumers or SMBs, particularly those who might not appear qualified through the lens of traditional data alone,” he went on to say.

LexisNexis Risk Solutions conducted its first nationwide survey to assess the adoption and utilization of alternative data across different financial institutions for credit portfolio management and growth.

Two phases of research occurred.

The first phase involved quantitative surveys; the second phase involved follow-up qualitative interviews. Data collection was performed online and by phone from July to August with a total of 225 completions in the United States.

Respondents included senior decision makers for lending and credit risk in U.S. financial institutions.

Upon completion of analysis with the quantitative findings, researchers interviewed 10 consumer credit lending decision makers to provide further context around certain survey results.

To download a copy of the Alternative Credit Data Impact Report, go to this website.