Likely interest-rate cut arriving in soft economic environment revealed in AFSA credit index

Charts courtesy of American Financial Services Association.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

An interest-rate cut is widely expected to arrive when the Federal Reserve announces its decision on Wednesday.

But the current environment described by economic experts and research projects from the American Financial Services Association and KeyBank illustrated the significant headwinds credit providers and small businesses now face.

In fact, one respondent who participated in AFSA’s quarterly Consumer Credit (C3) Index survey said, “Toughest environment, equal to 2009. Economy is very bad (in the region in which we operate.)”

AFSA’s quarterly Consumer Credit (C3) Index survey of leading providers of consumer credit, including mortgages, vehicle financing, personal installment loans, and credit cards, provides a look into AFSA member companies’ perceptions of business conditions and key business indicators, including how they see the consumer-lending environment evolving in the coming months.

“The C3 Index offers a unique perspective on the consumer credit industry,” AFSA president and CEO Bill Himpler said in a news release distributed last week along with the index. “Leading into our national elections, this data highlights the ongoing concerns both consumers and credit providers are facing in uncertain economic times.”

AFSA chief economist and vice president for research Tim Gill added: “These results highlight the challenging environment facing consumer lenders in 2024. While it is encouraging to see some signs of optimism reflected in the survey, the headwinds facing consumers and our industry cannot be minimized.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

AFSA’s research highlighted that high interest rates, stubborn inflation, stressed and anxious consumers and a hostile regulatory climate raised headwinds in the second quarter for the consumer finance industry.

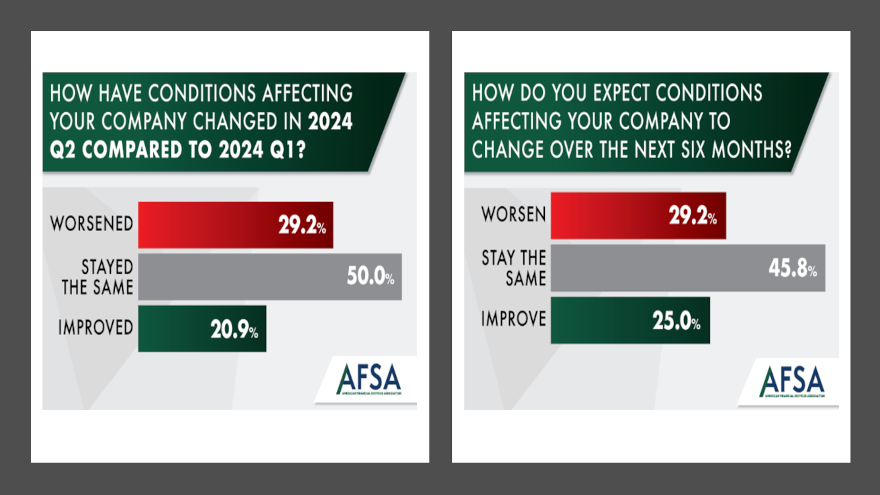

The survey results indicated that the business environment for consumer credit providers deteriorated in the second quarter when compared to the first quarter. The previous survey, in which finance companies and other lenders were asked to compare conditions in the first quarter of 2024 to the fourth quarter of 2023, also showed business conditions had weakened.

AFSA pointed out there is some good news, however: The margin between those reporting overall worsened versus improved business conditions narrowed in the second quarter.

The percentage of respondents reporting conditions improved vs. those who reported worsening conditions was higher than in the previous survey. Of those surveyed, 29.2% reported conditions worsened in Q2, 20.9% said they improved, and half (50%) claimed they were unchanged. In Q1, 38.6% reported conditions worsened, 19.3% said they improved, and 42.1% claimed they were unchanged.

Along with the comment from one participant who described how rough the economy is for that company, AFSA shared more perspectives from other executives, including:

“While we saw a slight increase in demand for the quarter, it is a decrease compared to prior years. We are seeing a hesitancy in borrowing and an increase in delinquency. We are starting to notice the effect of rising prices for our consumers. They aren’t borrowing because they can’t afford to, and they aren’t paying because they are running out of funds after paying for essential items.”

“Cost of capital is more expensive, but stable at this time. Lots of loan demand, but fewer applicants qualify based on budget.”

“Expense control and cost of funds continue to be our main concern and focus.”

“Delinquency is still high.”

“Inflation has caused delinquency to rise to levels unheard of in prior years.”

“Loan demand is not consistent. It’s up and down. Believe it will be that way through year-end until the election is over.”

“Inflation impacting consumer and business’s ability to pay/perform. This coupled with it being an election are creating headwinds.”

“Used vehicle values play a big role in our financials as well. We expect those values to continue to worsen in the second half of the year.”

That last comment from the AFSA research reflected what Satyan Merchant shared, too.

The senior VP/automotive and mortgage business leader at TransUnion — who also is among the experts set to appear during Used Car Week that begins on Nov. 18 in Scottsdale, Ariz. — offered his expectations for what a Fed move might do in auto finance.

“A reduction in interest rates by the Federal Reserve, something that has been signaled previously, will likely be welcome by consumers who are in the market for a new vehicle, and by dealers who finance their vehicle inventory. However, the short-term impact may be muted, and it may take until later in 2024 or even 2025 to see interest rates as well as vehicle prices come down enough for consumer demand to materially increase,” Merchant said.

“In the meantime, those consumers who have an immediate need to acquire a new or used vehicle will likely do so, while those who are able to manage with what they have may continue to wait a little longer,” he added.

Waiting a little bit longer was part of the consensus that small businesses told KeyBank as part of its Fall 2024 Small Business Flash Poll.

KeyBank reported on Tuesday that small business owners say they have faced reduced profit margins (38%), increased borrowing costs (37%), and deferred capital investment (31%) due to high interest rates.

The survey also found that small business owners are anticipating a rate cut, with more than half (56%) expecting interest rate changes to positively impact their business in the next 12 months.

For now, small businesses are adapting to interest rates by increasing cash reserves (43%), reducing reliance on debt (36%), and diversifying funding sources (32%), according to the KeyBank poll.

Despite steadily high interest rates, KeyBank indicated actions small business owners are taking now to adjust may be leading to increased confidence and stability.

Roughly three in four small business owner respondents (72%) are confident that they could fund their operating expenses for a month, up from 64% in March, KeyBank said.

Another sign of stability, the majority of small business owners (75%) told KeyBank that do not foresee hiring cuts over the next year. In fact, one in three (32%) small business owners expect to grow their staff in the next 12 months.

Bottom line: What might the Fed do on Wednesday? Here’s the prediction made on Monday by Comerica Bank chief economist Bill Adams and senior economist Waran Bhahirethan.

“Comerica forecasts for the Fed to lower the federal funds target by a quarter of a percent at Wednesday’s decision and hold the pace of the balance sheet reduction (quantitative tightening) steady. Citing a cooling labor market and a balanced focus on their dual mandate for maximum sustainable employment and price stability, monetary policymakers’ forward guidance and forecasts are anticipated to signal this week’s easing will be the first in a series of cuts through 2025,” Adams and Bhahirethan wrote in an analysis.