New survey says half of Americans feel ‘trapped’ in their financial situation

Screenshot courtesy of Self Financial.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps the sentiments held by the contract holders in your finance company’s portfolio aren’t quite as sullen as some of the recent consumer studies that have surfaced in the past month.

With debt-free aspirations sagging and a majority of individuals and families living paycheck to paycheck, Self Financial offered details on Wednesday from a new third-party survey that indicated half of Americans are feeling “trapped” in their financial situations.

The fintech company that looks to make building credit and savings more accessible said its survey also showed 83% of Americans with bad credit feel at least somewhat “trapped” in their financial situation and 62% have at least some degree of uncertainty that they’ll be able to afford their house or apartment over the next 12 months.

The survey was conducted by Wakefield Research and consisted of 1,000 nationally representative U.S. adults ages 18 and older, including oversamples of 500 respondents for Black Americans, Hispanic Americans and Asian Americans.

While 50% of Americans feel “trapped,” the survey revealed millennials, mothers, and Hispanic and Black respondents are feeling “trapped” more than their counterparts.

• Millennials (67%) are more likely to feel at least somewhat “trapped in their financial situation than Boomers (31%).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

• 66% of mothers feel at least somewhat “trapped,” compared to 53% of non-mothers.

• 59% of Hispanic and 54% of Black Americans report feeling at least a little or somewhat trapped in their financial situations, compared to 49% of whites.

Self said survey participants who have credit challenges report feeling more financial strain.

More than four out of five Americans (83%) with self-reported bad credit feel at least somewhat “trapped” in their financial situation, compared to those with OK credit (68%), good credit (50%) and excellent credit (24%).

And more than half of Black Americans (53% versus 34% of whites) report having bad or just OK credit. More than a quarter (27%) of those with bad credit are still reeling from the financial impact of losing their job as a result of the pandemic.

On top of that, Self mentioned more than half of respondents (51%) indicated their monthly utilities cost has gone up.

Self noted a few other additional key findings from the survey:

• Hanging on until payday: Nearly half (46%) of Hispanics and (46%) Black Americans report living paycheck to paycheck, compared to 38% of whites. The vast majority of respondents with bad credit (76%) are living paycheck to paycheck, compared to those with OK credit (56%), good credit (39%), and excellent credit (13%).

• Nightmare situation: The majority of Americans (58%) are losing sleep over finances. Their top concerns are: paying next month's mortgage/rent (20%), having credit card debt of $5,000 or more (20%), maintaining their relationship with their partner through money stress (16%), and putting food on the table each night (15%).

• Parental problems: More than three in f parents (62% versus 43% of non-parents) feel at least somewhat “trapped” in their current financial situation, while two in three mothers (66% versus 53% non-mothers) feel at least somewhat “trapped.” More than half of those mothers (54% versus 42% of non-mothers) also report they are living paycheck to paycheck.

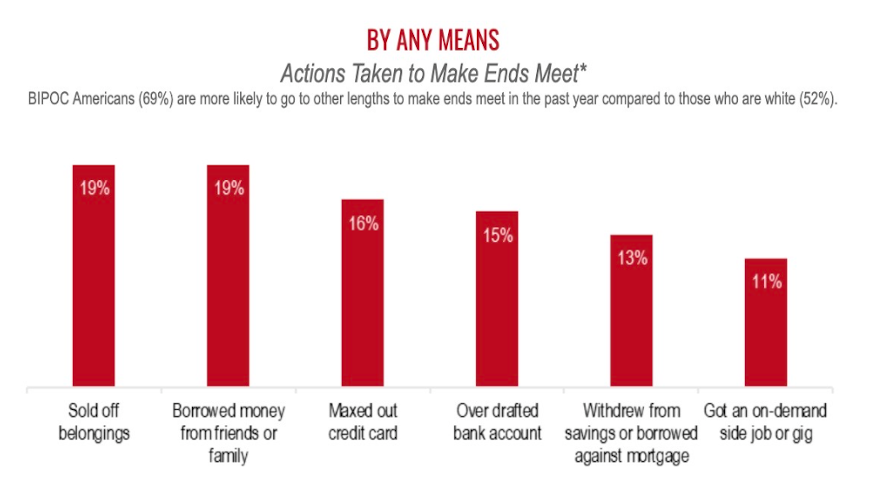

• Boxed in: In the past year, more than half (55%) of Americans have taken action to make ends meet. BIPOC Americans (69%) are more likely than whites (52%) to have taken some action, such as selling off belongings (19%) or borrowing money from friends or family (19%).

“As a financial educator, I’m hearing how people are feeling the strain from inflation, the pandemic and just monthly bills while living paycheck to paycheck,” said Sharita Humphrey, a former Self customer, paid Self spokesperson and an award-winning certified financial education instructor.

“The survey data gives insight into the financial challenges people are facing right now, which can be amplified for BIPOC communities,” Humphrey continued in a news release. “I know from first-hand experience that money problems can be overwhelming, especially when you aren’t sure what steps to take to get out of the hole.

“But I always say access to credit and emergency savings are the building blocks of a strong financial foundation because they give you options when you are in a tight spot,” Humphrey went on to say.

The entire survey report can be found via this website.