New TransUnion research highlights broad interest in refinancing

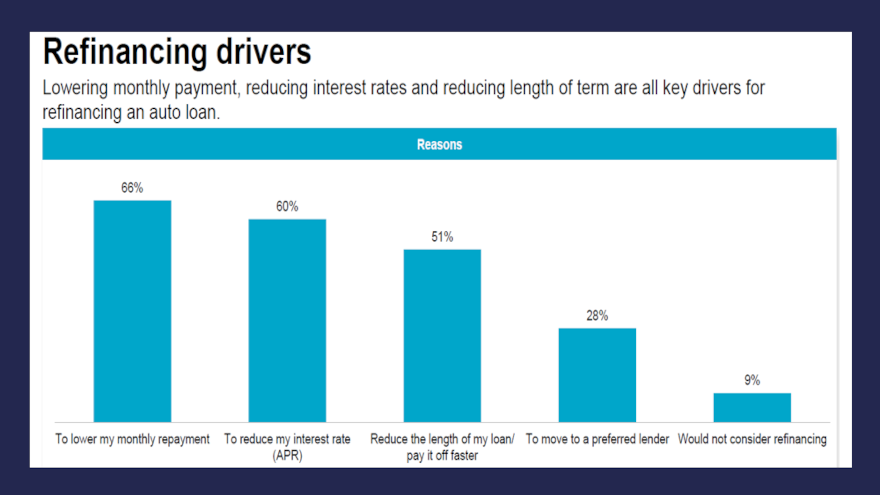

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The customer who took delivery at your dealership a year or more ago might still like the vehicle but not the monthly payment.

With the rates appearing to be on a downward path, TransUnion wanted to gauge consumer interest in refinancing, conducting research that examined both the auto and mortgage markets.

“We surveyed consumers to better understand the drivers of refinance for both mortgages and auto loans,” said Jason Laky, executive vice president and head of financial services at TransUnion. “Millions of people financed homes and autos during this period of high interest rates, and many will look to refinance as interest rates decline.”

The survey also examined consumer sentiment towards their existing auto loans, payments and interest rates along with future plans regarding refinancing.

TransUnion reported on Wednesday that results indicated that there was a similar eagerness to refinance when interest rates eventually fall, and a similar response among consumers when asked if they feel that their current auto-finance payments represent a strain on their household finances.

When asked the extent to which they agree that their current auto payment represented a strain on their personal finances, 65% of respondents indicated that they agree or strongly agree with this statement as opposed to 20% who disagree or strongly disagree.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Nearly the same percentage of respondents — 63% — indicated that they were likely or very likely to refinance their existing installment contract if it could save them money on their monthly payments.

TransUnion found that 52% of respondents indicated they would consider refinancing if it would save them between $50 and $149 monthly.

The research also explored the sentiment of consumers who have already refinanced despite the relatively high interest rates. Many of these consumers derived lower payments through longer terms, according to TransUnion.

From this standpoint, TransUnion data showed that credit unions continue to lead the way with 67% of the refinance share in 2023. Banks had the second largest share, at 20%.

Researchers determined these figures have remained relatively stable in recent years and underscore consumers’ favorable perception of credit unions when they begin exploring refinancing opportunities.

“Credit unions may be able to offer their members rates and service that larger more traditional banks cannot,” said Sean Flynn, senior director of community financial institutions at TransUnion. “Credit unions should lean into this fact and leverage available tools such as trended data and advanced analytics to seek out those consumers who may be able to refinance.”

The surveys of current auto-finance customers and those consumers who have taken out a mortgage in the last 24 months were conducted between Sept. 18 and 27. TransUnion said they resulted in responses from 1,002 and 1,025 auto and mortgage customers, respectively.

Looking at the mortgage research, TransUnion asked participants about the biggest factor that would ultimately drive them to pull the trigger on a refinancing decision,

Researchers found that 70% said that a more favorable loan term would be a key driver for them. However, a nearly identical percentage said that better interest rates (67%) and a cash-out refinance (61%) would also be significant drivers, reflecting broad economic interest.

“For many consumers, their mortgage payment is their largest single payment each month and the one that seemingly strains their budget the most,” said Satyan Merchant, senior vice president and mortgage and auto business leader for TransUnion.

“The upside is that it is a payment that can be refinanced if the economic climate allows for it, and with interest rates at long last beginning to fall, consumers should begin exploring this option. Conversely, lenders should be actively marketing to these refinance candidates, regardless of what their primary motivation to refinance may be,” added Merchant, who also is among the experts set to appear during Used Car Week, which begins on Nov. 18 in Scottsdale, Ariz.

More details about this research project from TransUnion can be found via this website.