New ValidiFI report reinforces importance of spotting high-risk indicators of ACH transactions

Chart courtesy of ValidiFI .

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Arranging ACH payments for contract holders to stay current on their auto financing used to be as sure a thing as finance companies could have to keep their portfolios healthy.

But like many circumstances, it appears things aren’t quite what they used to be.

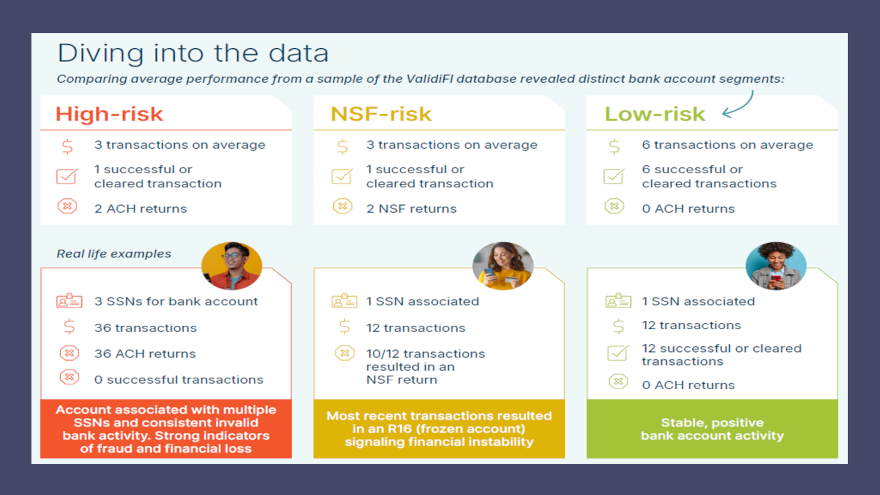

ValidiFI, a provider of predictive bank account and payment intelligence, generated a new report on Wednesday, reinforcing the importance of analyzing bank accounts for low-risk, NSF-risk (non-sufficient funds) and high-risk indicators, as well as other key insights.

Among the major findings:

—High-risk bank accounts show a significantly higher rate of returns. These accounts have experienced 11.5 times more ACH returns than low-risk accounts and subsequent payments result in only 14% being successful.

—NSF risk is a key predictor of future account performance. According to ValidiFI’s findings, there are two NSFs for every successful transaction for this group, leading to a disproportionate risk burden.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—In contrast, low-risk bank accounts in the ValidiFI database demonstrate consistently good payment behavior. Analysts said this allows organizations the ability to streamline and auto-approve these consumers, resulting in significant cost and time savings.

With ACH transactions on the rise and the emergence of pay-by-bank applications, organizations looking to reduce processing fees and streamline payments, ValidiFI said the importance of bank account validation cannot be overstated.

“For high and NSF risk bank accounts, 2/3 of transactions result in a return, such as an R03 (no account/unable to locate) or R04 (invalid account number), representing a substantial operational challenge for companies dealing with high-risk payments. In comparison, low-risk accounts have a 97% success rate,” analysts said in the report.

ValidiFI’s report underscored that choosing the right validation strategy for your finance company’s needs is essential for onboarding customers, detecting bad actors up front and ultimately driving growth by reducing friction and improving financial outcomes.

“These insights from ValidiFI help organizations comply with Nacha regulations along with the tools necessary to assess and manage payment risks more effectively, resulting in a better customer experience,” ValidiFI CEO John Gordon said in a news release.

“By leveraging bank and payment data to identify high-risk accounts, those with NSF risk, and low-risk bank accounts, organizations can tailor their workflows reducing the frequency of failed transactions and improve overall payment operations,” Gordon added.