New way of tracking affordability from Cox Automotive & Moody’s Analytics

Chart courtesy of Cox Automotive and Moody’s Analytics

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

Cox Automotive and Moody’s Analytics are trying to use their collective brainpower to create a new way of analyzing and tracking vehicle affordability.

The companies recently launched what they’re calling the Vehicle Affordability Index, which is designed to quantify price movements in the new-vehicle market in relation to the spending power of the U.S. consumer. The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) will be updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book.

Going forward, experts said this industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.

In the current market, with high unemployment and an economy struggling to recover to pre-pandemic levels, Cox Automotive and Moody’s Analytics acknowledged that understanding the affordability of new vehicles is increasingly important to industry analysts and consumers alike. However, the answer is more complex than simply rising and falling Manufacturer’s Suggested Retail Prices (MSRPs).

To measure true vehicle affordability, Cox Automotive and Moody’s Analytics considered shifting household incomes, incentive spending by the automakers and dealers, and actual finance charges on new-vehicle financing when developing the VAI.

According to Cox Automotive chief economist Jonathan Smoke: “Until now, the industry lacked visibility into consumer spending power and interest rate changes relative to the movement of new vehicle prices. The Cox Automotive/Moody’s Analytics Vehicle Affordability Index is filling this void by providing a comparative way to measure affordability while eliminating guesswork and prognostication.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

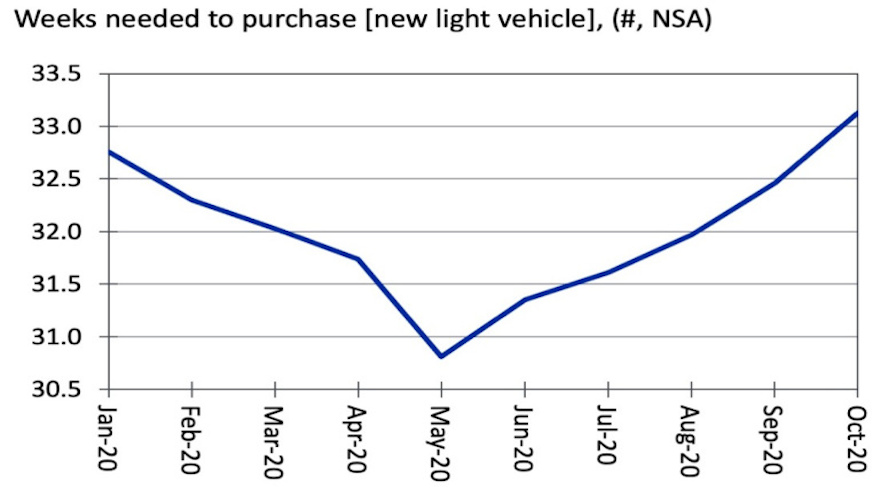

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index for October stood at 33.13, representing the number of weeks of income needed for a median-income household to pay off a new vehicle.

The firms explained that measuring in weeks provides a consistent, straightforward unit that captures the affordability of new vehicles.

In the early stages of the pandemic, Cox Automotive and Moody’s Analytics pointed out that affordability improved as incomes were supported by the CARES Act in the form of stimulus payments and enhanced unemployment benefits, while interest rates declined and incentives peaked in the new-vehicle market.

However, affordability has been declining as average transaction prices continue to rise, and household income has fallen, according to the companies.

“Looking ahead, we expect new vehicle affordability to continue decreasing over the next months without further federal fiscal policy action,” said Michael Brisson, auto economist at Moody’s Analytics.

“The COVID-19 pandemic is intensifying at an alarming rate, dampening consumer demand, putting continued stress on the labor market, and depressing incomes. Despite falling interest rates, dropping incomes may push new vehicles out of reach for the average consumer,” Brisson went on to say.