October auto defaults make second-highest rise of 2022

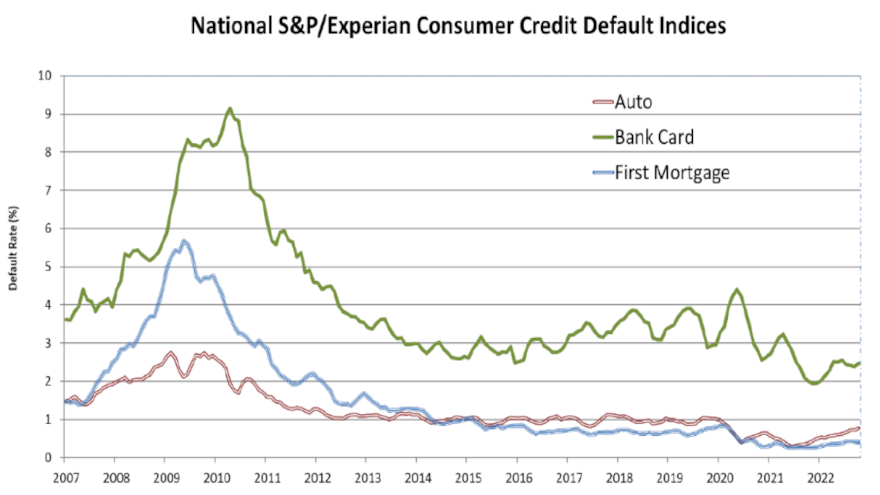

Chart courtesy of S&P Dow Jones Indices and Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auto defaults made the second-highest sequential jump so far this year in October, according to the S&P/Experian Consumer Credit Default Indices.

S&P Dow Jones Indices and Experian reported that data through October showed the auto reading at 0.77%, which was 5 basis points higher than September.

The only increase more than the latest one in the auto segment came in August, when analysts pegged the default rate at 0.72% and noted a rise of 6 basis points.

Despite the auto movement, S&P Dow Jones Indices and Experian determined the composite rate — a comprehensive measure of changes in consumer credit defaults — remained unchanged in October at 0.57%.

While the first mortgage default rate fell 1 basis point to 0.41%, the bank card default rate rose 8 basis points higher at 2.46%, according to the October data from S&P Dow Jones Indices and Experian.

Analysts added two of the five major metropolitan areas they track monthly posted higher default rates in October compared to the previous month.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The data indicated New York generated the largest increase, rising 3 basis points to 0.60%, while Chicago ticked up 2 basis points to 0.63%

While Dallas was unchanged at 0.64%, Los Angeles edged 2 basis points lower to 0.36%.

Most notably, analysts spotted that Miami’s default fell by 18 basis points in October to 0.81%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.