A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

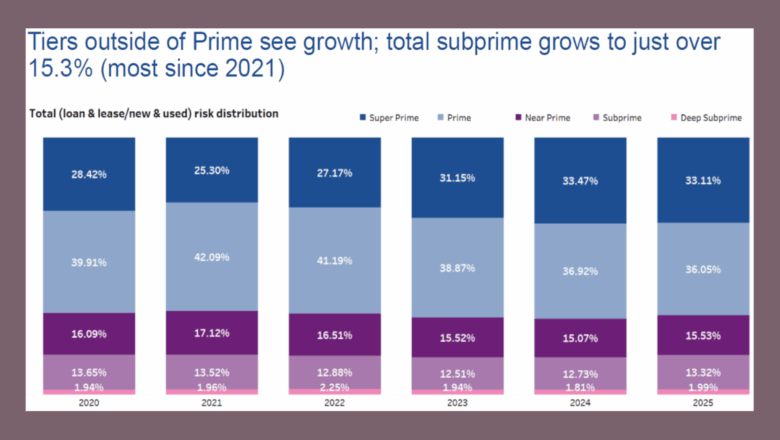

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

Auto finance’s digital transformation still ongoing despite pullback in Q4 car sales

Matt Babcock, who oversees digital lending product strategy for Wolters Kluwer, reviewed the Q4 Auto Finance Digital Transformation Index as well as discussed what could happen digitally this year. Listen Here

Wednesday, Mar. 4, 2026, 05:41 PM

PODCAST: Used Car Week Hall of Famer Becky Igo of Allied Solutions

Tuesday, Nov. 11, 2025, 10:48 AM

SubPrime Auto Finance News Staff

Becky Igo remembers the first few business trips she made going to industry conferences at a time when things like pay phones and fax machines were critical business-development tools. Now more than four decades later, the regional vice president for ... [Read More]

AutoPayPlus highlights series of technology, compliance & organizational advancements

Monday, Nov. 10, 2025, 11:42 AM

SubPrime Auto Finance News Staff

AutoPayPlus by US Equity Advantage, an automated financial concierge service, announced that it has achieved a series of technology, compliance, and organizational advancements designed to deliver greater efficiency, accuracy and security for its dealer partners. First, the company said it ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Open Lending unveils ApexOne Auto so lenders can review deeper pool of potential customers

Monday, Nov. 10, 2025, 11:34 AM

SubPrime Auto Finance News Staff

Last week, Open Lending Corp. announced the launch of ApexOne Auto, an advanced decisioning platform that expands the company’s capabilities to serve the full spectrum of auto-finance customers. The provider of automotive lending enablement and risk analytics solutions for financial ... [Read More]

Vitu bookends 2025 with acquisitions; this time of DDI Technology

Friday, Nov. 7, 2025, 09:59 AM

SubPrime Auto Finance News Staff

Vitu began the year by successfully closing its acquisition of the Dealertrack registration and titling businesses from Cox Automotive. And the innovator in vehicle-to-government (V2Gov) technology is rounding out the year with another acquisition. Vitu announced on Friday that it ... [Read More]

LCT’s Refund Control now aligns with new industry standards set by 3 associations

Friday, Nov. 7, 2025, 09:58 AM

SubPrime Auto Finance News Staff

Lender Compliance Technologies (LCT) said Thursday it secured “an important milestone for the industry” in connection with its Refund Control platform. The provider of a tool for managing voluntary protection product (VPP) cancellations and refunds announced that its platform fully ... [Read More]

2025 Repossession Agent of the Year: Phil Hanks of Connect 1 Recovery

Thursday, Nov. 6, 2025, 10:34 AM

Nick Zulovich, Senior Editor

Phil Hanks spent more than 17 years in corporate positions associated with the recovery industry. Much of that time was with Manheim, but Hanks also held leadership positions with Primeritus Financial Services and MBSi. Then in April 2013, Hanks established ... [Read More]

2025 Loss Mitigation Executive of the Year: Craig Paterson of GM Financial

Wednesday, Nov. 5, 2025, 02:23 PM

Nick Zulovich, Senior Editor

Auto loans and retail installment contracts are often referred to by industry executives as paper. When Craig Paterson began his career in automotive, many of the tasks he had to complete were done on paper, too. Much has changed in ... [Read More]

Lender executives & industry experts distill current status of subprime auto finance

Wednesday, Nov. 5, 2025, 10:48 AM

Nick Zulovich, Senior Editor

Suspicions are intensifying about the current health of auto finance, especially within the subprime space stemming from the bankruptcy filings of Tricolor Holdings and PrimaLend. For example, the first question from an investment analyst during Carvana’s quarterly conference call last ... [Read More]

How Protective plans to leverage past F&I acquisitions to make most of upcoming Portfolio addition

Tuesday, Nov. 4, 2025, 10:39 AM

Nick Zulovich, Senior Editor

Rick Kurtz, senior vice president and chief distribution officer for Protective Asset Protection, spent a few minutes with Cherokee Media Group on Thursday after the company entered into an agreement to acquire Portfolio Holding and its subsidiaries from Abry Partners. ... [Read More]

White Label Holding acquires National Auto Lenders

Monday, Nov. 3, 2025, 04:08 PM

SubPrime Auto Finance News Staff

Another auto-finance company specializing in the subprime space now has new ownership. White Label Holding, a U.S.-based financial group specializing in integrated automotive lending solutions, on Monday announced the full acquisition of National Auto Lenders, which is a non-prime auto ... [Read More]

X