A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

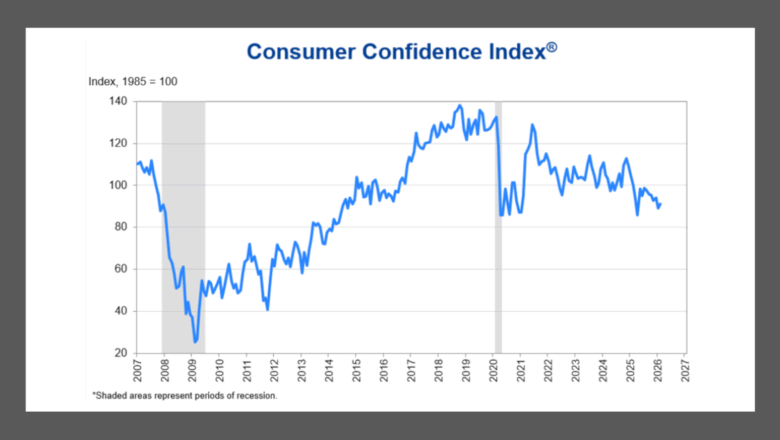

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Creative Business Decisions partners with LAUNCHER.SOLUTIONS to improve risk management

Wednesday, Nov. 9, 2022, 04:49 PM

SubPrime Auto Finance News Staff

This week, LAUNCHER.SOLUTIONS and Creative Business Decisions (CBD) finalized their full integration to help mutual clients make better underwriting decisions by incorporating generic or custom-developed scorecards created by CBD within Launcher’s appTRAKER Loan Origination System (LOS). The company reiterated appTRAKER ... [Read More]

TransUnion: Soft vehicle inventory continues to drag originations

Tuesday, Nov. 8, 2022, 04:24 PM

SubPrime Auto Finance News Staff

Reinforcing what Cox Automotive and other experts are seeing from a retail perspective, TransUnion’s Q3 2022 Quarterly Credit Industry Insights Report (CIIR) showed how much auto finance originations are slowing. According to the report released on Tuesday, TransUnion said originations ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

3 Chicago men charged with odometer & title fraud

Friday, Nov. 4, 2022, 02:36 PM

SubPrime Auto Finance News Staff

The Justice Department described another notable fraud incident this week that could have permeated through the wholesale, retail and finance spaces. A federal grand jury in Chicago returned an indictment, which was unsealed on Wednesday, charging three Illinois men with ... [Read More]

Latest Fed move could push auto interest rates to levels not seen in 21 years

Thursday, Nov. 3, 2022, 02:39 PM

Nick Zulovich, Senior Editor

Edmunds executive director of insights Jessica Caldwell and Cox Automotive chief economist Jonathan Smoke made comments before and after the Federal Reserve pushed interest rates higher again on Wednesday. The latest 75-point rise pushed the year-to-date increase in the target ... [Read More]

Top 20 cities where millennials have highest auto balance

Wednesday, Nov. 2, 2022, 01:46 PM

SubPrime Auto Finance News Staff

LendingTree recently reported that millennials owe a median of $15,281 in auto debt across the 100 largest metros in the U.S. Researchers used an anonymized sample of credit reports from the first and second quarters of this from more than ... [Read More]

Credit Acceptance welcomes Mohan as CTO

Tuesday, Nov. 1, 2022, 02:51 PM

SubPrime Auto Finance News Staff

Just before Halloween night, Credit Acceptance announced an addition to its senior leadership team. Ravi Mohan joined the subprime auto finance company as chief technology officer as of Oct. 24. In his role, Credit Acceptance said Mohan will be responsible ... [Read More]

All-digital provider enters warranty space for dealers

Friday, Oct. 28, 2022, 02:10 PM

SubPrime Auto Finance News Staff

Another warranty and service contract provider now is in the market to serve franchised and independent dealerships. This week, Titan Warranty Administration publicly launched its all-digital platform, specializing in manufacturing and administering customized service contracts and limited warranty programs. Titan ... [Read More]

After previously examining ‘junk fees,’ CFPB now focuses on ‘junk data’

Thursday, Oct. 27, 2022, 03:31 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau started the year by launching an initiative in connection with what the federal regulator called “exploitative junk fees.” Last week, the CFPB turned its attention to what it’s calling “junk data.” The bureau issued guidance ... [Read More]

Seeking knowledge leads Gage to be Repossession Executive of the Year

Wednesday, Oct. 26, 2022, 04:18 PM

Nick Zulovich, Senior Editor

Dion Gage said he learns something new about the repossession and recovery business every day. His knowledge-gaining approach is part of the reason why Gage was named this year’s Repossession Executive of the Year, an accolade presented by Primeritus Financial ... [Read More]

Informed.IQ and F&I Sentinel partner to broaden compliance offerings

Wednesday, Oct. 26, 2022, 03:01 PM

SubPrime Auto Finance News Staff

After Informed.IQ recently made inroads in subprime with Consumer Portfolio Services and DriveTime, this week the provider of artificial intelligence-based software for financial institutions finalized a partnership with F&I Sentinel, leading compliance and regulatory risk mitigation solutions provider. According to ... [Read More]

X