Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

RISC Pro fees waived for new members through rest of 2022

Wednesday, Sep. 7, 2022, 03:05 PM

SubPrime Auto Finance News Staff

Last week, RISC collaborated with MBSi Corp. to deploy VendorConnect, what they called a “revolutionary” compliance management solution that can allow access to a comprehensive list of compliant, vetted third-party vendors in the repossession industry. This week, RISC announced free ... [Read More]

COMMENTARY: How crypto helps lenders cover loan values

Tuesday, Sep. 6, 2022, 02:05 PM

Fred Brothers, Cion Digital

Auto repossessions are on the rise. Subprime repos are up 11% since 2020, according to Jalopnik. Even among prime borrowers with excellent credit scores, repossession rates have doubled from 2% to 4% in the past two years, according to Barron’s. ... [Read More]

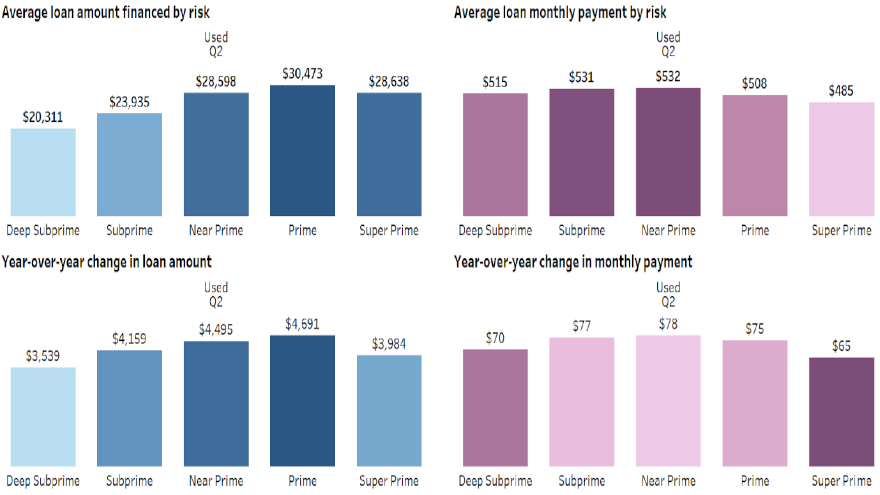

PODCAST: More insight about Experian Q2 auto finance data with Melinda Zabritski

Thursday, Sep. 1, 2022, 01:21 PM

SubPrime Auto Finance News Staff

Experian senior director of automotive financial solutions Melinda Zabritski shared more time for the Auto Remarketing Podcast to discuss which auto finance metrics landed within expectations for the second quarter and which ones did not. Zabritski also touched on how ... [Read More]

MBSi & RISC introduce compliance management solution for repossessions

Wednesday, Aug. 31, 2022, 04:12 PM

SubPrime Auto Finance News Staff

Repossessions are complicated, so MBSi Corp. and RISC are working together to help finance companies find the compliant resources they need. This week, the SaaS provider of repossession assignment software and third-party compliance management company for the auto finance industry ... [Read More]

Carvana adds 4 states covering 16 markets to co-signer program

Wednesday, Aug. 31, 2022, 04:10 PM

SubPrime Auto Finance News Staff

At the beginning of August, Carvana launched the option to add a co-signer during the financing application process for potential buyers in South Carolina with the intention of rolling out the process in more locations before a full nationwide push. ... [Read More]

COMMENTARY: Why aren’t more dealers and lenders leveraging credit-first soft pulls?

Tuesday, Aug. 30, 2022, 02:35 PM

Ken Hill, 700Credit

Shopping for a vehicle comes with all kinds of stressors for a consumer — some of which can affect their relationship with the dealer and lender. The decision to require a shopper to undergo a credit verification can be stressful ... [Read More]

ARA hosting free webinar to explain new-found choice of compliance platform

Friday, Aug. 26, 2022, 03:19 PM

SubPrime Auto Finance News Staff

This week, new American Recovery Association executive director Joel Kennedy shared a development meant to benefit not just organization members, but potentially any repossession agent, too. In an industry letter, Kennedy said “several” of the largest auto finance companies in ... [Read More]

Experian Q2 finance data reinforces shift to used vehicles

Thursday, Aug. 25, 2022, 02:12 PM

SubPrime Auto Finance News Staff

The newest auto finance data from Experian reinforced the theory that consumers are taking delivery of used vehicles more often because of necessity. As the automotive market continues to face inventory shortages, analysts said consumers are shifting back to the ... [Read More]

FTC declines to extend comment period for proposal banning ‘junk fees’

Wednesday, Aug. 24, 2022, 03:52 PM

SubPrime Auto Finance News Staff

The Federal Trade Commission said on Tuesday that the regulator has declined to extend the public comment period for its proposed rule that would ban “junk fees and bait-and-switch advertising tactics that can plague consumers throughout the car-buying experience.” Despite ... [Read More]

Provana welcomes Edmonds, who continues to build advisory portfolio

Wednesday, Aug. 24, 2022, 03:50 PM

SubPrime Auto Finance News Staff

Kelli Edmonds became an advisor to another industry service provider this week after founding her own consulting firm. The former senior vice president of business control and risk management at Santander Consumer USA now is part of the executive advisor ... [Read More]

X