Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

MBSi partners with Loanbridge to expand vehicle data offerings

Wednesday, Sep. 10, 2025, 11:59 AM

SubPrime Auto Finance News Staff

Soon after gaining a new client relationship in the credit union market, MBSi landed a partnership to drive vehicle recoveries and efficiency via what the company called near-time data. On Wednesday, MBSi and Loanbridge announced a new partnership to integrate ... [Read More]

Protective Asset Protection unveils newest F&I training program fueled by AI

Wednesday, Sep. 10, 2025, 11:57 AM

SubPrime Auto Finance News Staff

Protective Asset Protection announced the expansion of its auto, RV, powersport, and marine training program, introducing new resources designed to equip F&I managers with the skills needed for success in a competitive market. The company highlighted that the enhanced program, ... [Read More]

Informativ introduces Verified Stips powered by TurboPass

Wednesday, Sep. 10, 2025, 11:56 AM

SubPrime Auto Finance News Staff

Informativ on Tuesday introduced a new feature to instantly verify “stips” — the additional documents or information required to finalize a contract — for businesses including auto dealers and financing companies The provider of fraud prevention, compliance and credit technology ... [Read More]

Agora moves recently hired Pratt to be head of its Financial Institutions Group

Tuesday, Sep. 9, 2025, 10:19 AM

SubPrime Auto Finance News Staff

Agora Data hired Wendy Pratt less than a month ago to be its vice president of sales strategy. Then on Monday, the fintech innovator of advanced capital solutions in subprime and non-prime consumer finance announced the appointment of Pratt to ... [Read More]

North State Acceptance acquires portfolio from ‘premier’ specialty finance company

Monday, Sep. 8, 2025, 10:47 AM

SubPrime Auto Finance News Staff

A regional subprime auto finance company in the Southeast became a little bigger last week. North State Acceptance, a portfolio company of Fourshore Partners, announced a portfolio acquisition from an unnamed lender but one classified as a “premier” specialty finance ... [Read More]

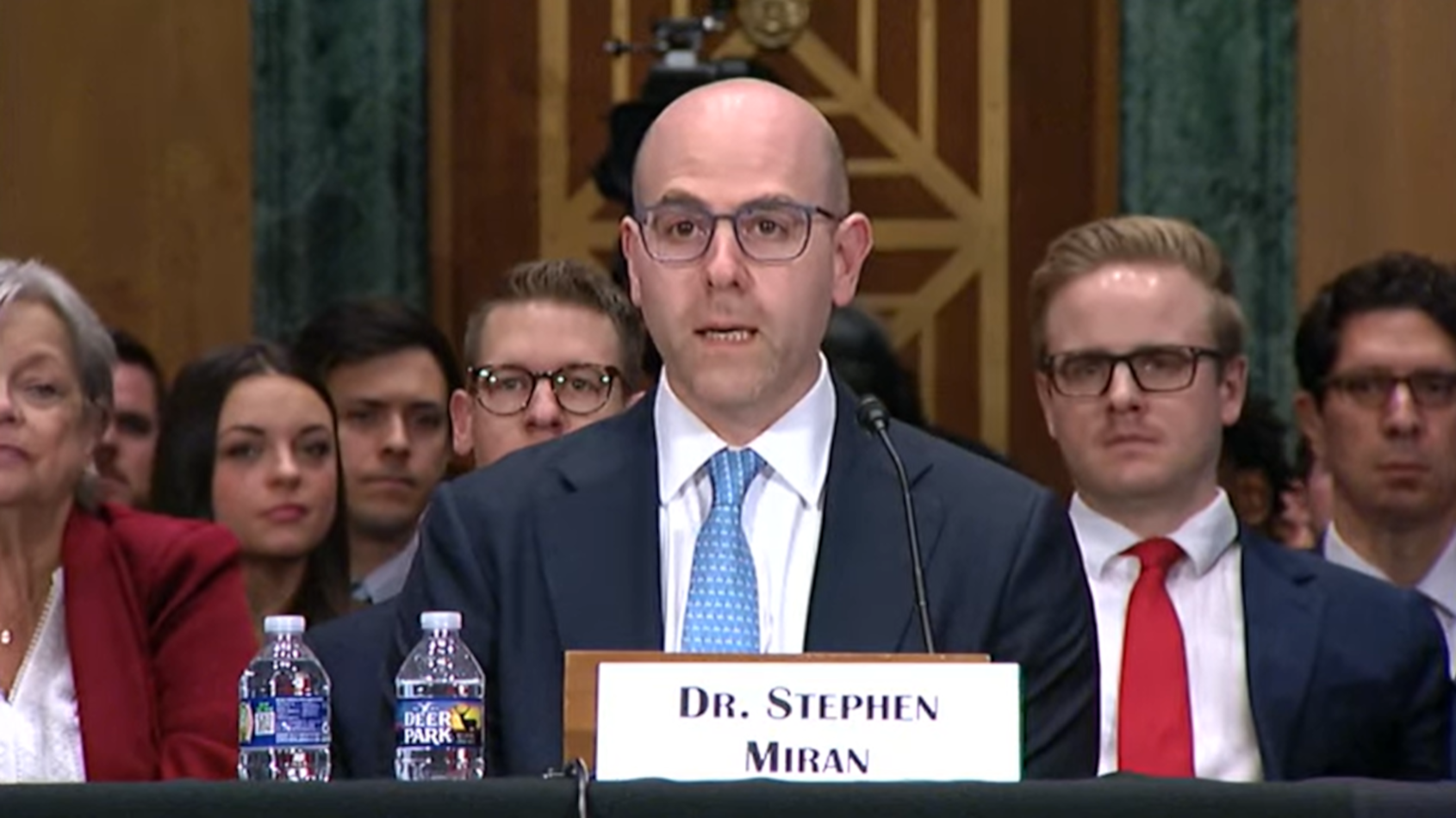

AFSA looking for stability as Senate considers Fed governor nomination

Monday, Sep. 8, 2025, 10:47 AM

SubPrime Auto Finance News Staff

The American Financial Services Association is hoping the latest round of bluster on Capitol Hill quells soon, so the Federal Reserve can stay focused on its purpose of setting interest rates. AFSA shared its views in a blog post last ... [Read More]

Jericho Information Technology names Beard as chief revenue officer

Friday, Sep. 5, 2025, 10:08 AM

SubPrime Auto Finance News Staff

Brice Beard has worked inside finance companies as well as industry vendors. And now Beard is bringing three decades of experience within those segments to Jericho Information Technology, which named him chief revenue officer. During the first half of his ... [Read More]

TurboPass now offers 90-day banking report option for users

Friday, Sep. 5, 2025, 10:05 AM

SubPrime Auto Finance News Staff

TurboPass acknowledged some dealerships and auto-finance companies prefer to examine stipulations and other underwriting documents through the prism of a 90-day window. So this week, the financial technology software company that provides automation, SaaS, and cloud-based solutions for automotive dealerships, ... [Read More]

Carleton survey shows depth of loan calculation errors, compliance strains & resource burdens

Thursday, Sep. 4, 2025, 10:40 AM

SubPrime Auto Finance News Staff

Sarah Milovich, who is general counsel and vice president of compliance with Carleton, recently cautioned lenders that when loan calculators do not function properly “they are ticking time bombs of compliance risk.” Carleton followed up on Milovich’s assertions in her ... [Read More]

Desert Financial Credit Union chooses MBSi for case management

Wednesday, Sep. 3, 2025, 01:11 PM

SubPrime Auto Finance News Staff

MBSi announced this week that Desert Financial Credit Union has selected MBSi’s RecoveryConnect platform as its exclusive case management system. With this partnership, MBSi said Desert Financial gains a modern, flexible, user-friendly platform, as well as a trusted partner dedicated ... [Read More]

X