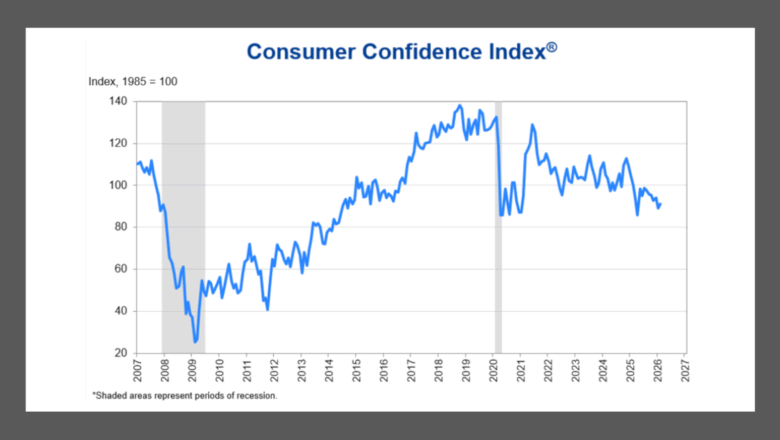

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Latest Stories

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

Auto finance’s digital transformation still ongoing despite pullback in Q4 car sales

Matt Babcock, who oversees digital lending product strategy for Wolters Kluwer, reviewed the Q4 Auto Finance Digital Transformation Index as well as discussed what could happen digitally this year. Listen Here

Wednesday, Mar. 4, 2026, 05:41 PM

PODCAST: Experian’s Michele Bodda on employment & income trends

Wednesday, Jul. 21, 2021, 02:36 PM

SubPrime Auto Finance News Staff

Perhaps one of the most difficult challenges for finance companies to overcome through the pandemic was verifying an applicant’s employment and income. Michele Bodda, president of Experian Mortgage, Employer Services and Verification Solutions, appeared on this episode of the Auto ... [Read More]

UPDATED: Both auto & mortgage defaults now at all-time lows

Tuesday, Jul. 20, 2021, 02:49 PM

Nick Zulovich, Senior Editor

If finance companies based their decisions on how to run and staff their collections and recovery departments based only the metrics included in the S&P/Experian Consumer Credit Default Indices, they truly might be a one-man — or woman — band ... [Read More]

National Auto Care reinforces M&A team to add more to F&I portfolio

Monday, Jul. 19, 2021, 02:47 PM

SubPrime Auto Finance News Staff

National Auto Care (NAC) made four agency acquisitions last year, and the F&I provider wants to be in a position to finalize even more this year. With M&A growth in mind, NAC on Monday announced the addition of Walter Hoffman, ... [Read More]

Senate Banking Committee Republicans want answers from CFPB director nominee

Friday, Jul. 16, 2021, 03:20 PM

SubPrime Auto Finance News Staff

The Senate wrangling over the nominee to be the new director of the Consumer Financial Protection Bureau became even more intense this week. The dozen Republican members of the Senate Banking Committee sent a letter to Rohit Chopra stemming from ... [Read More]

American Recovery Service names Osborne as chief services officer

Friday, Jul. 16, 2021, 03:16 PM

SubPrime Auto Finance News Staff

American Recovery Service (ARS) recently expanded its executive team by promoting Cortney Osborne to be chief services officer. With nearly 20 years of industry experience and moderator of the Women in Auto Finance honoree panels during Used Car Week, ARS ... [Read More]

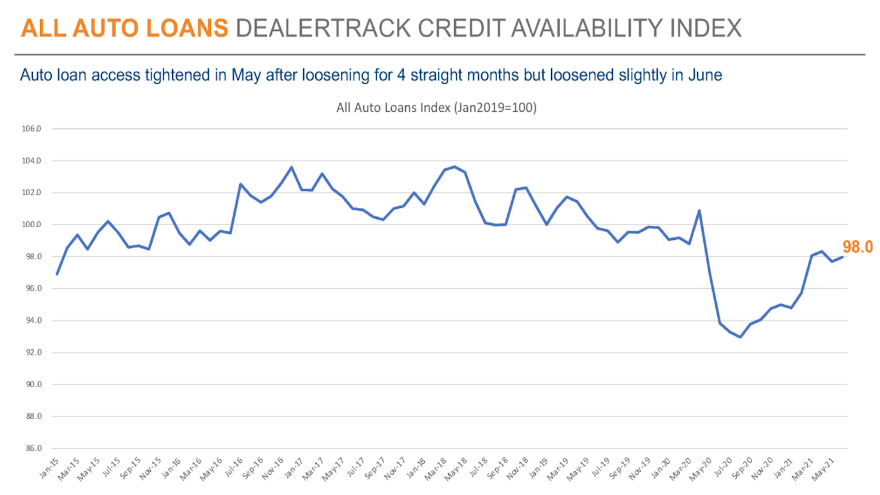

June Dealertrack Auto Credit Availability Index improves

Thursday, Jul. 15, 2021, 02:59 PM

SubPrime Auto Finance News Staff

While consumer confidence might be mixed, Cox Automotive discovered more access to credit last month for potential vehicle buyers who needed it — especially if they had stronger credit backgrounds. According to the newest Dealertrack Auto Credit Availability Index released ... [Read More]

Constant & Alkami partner to enhance back-office processes for banks & credit unions

Wednesday, Jul. 14, 2021, 06:31 PM

SubPrime Auto Finance News Staff

Paper and forms sometimes still are a major part of auto financing, especially in connection with servicing and loss mitigation processes that are normally handled by people in the middle and back office who rely on manual processes and green-screen ... [Read More]

Allied Solutions ‘really moves the needle’ with modeling acquisition

Wednesday, Jul. 14, 2021, 04:37 PM

SubPrime Auto Finance News Staff

Allied Solutions recently expanded its portfolio of partnerships by aligning with Tracers and Illinois Bankers Business Services (IBBS). On Tuesday, the provider of insurance, lending, risk management and data-enabled products to financial institutions broadened its portfolio again, but this time ... [Read More]

RateGenius: Refinancing approvals jump to record high in June

Tuesday, Jul. 13, 2021, 02:24 PM

SubPrime Auto Finance News Staff

Perhaps your finance company is slightly tightening some underwriting strategy when a contract is first originated at the time of vehicle delivery. But some shops evidently are loosening a bit when refinancing contracts, as RateGenius is seeing the highest approval ... [Read More]

Conflict arises as new FTC chair sets investigative priorities for next decade

Monday, Jul. 12, 2021, 03:47 PM

SubPrime Auto Finance News Staff

Less than a month after being confirmed as chair of the Federal Trade Commission, Lina Khan gained approval on a partisan vote for the regulator to proceed via a series of resolutions authorizing investigations into key law enforcement priorities for ... [Read More]

X