A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

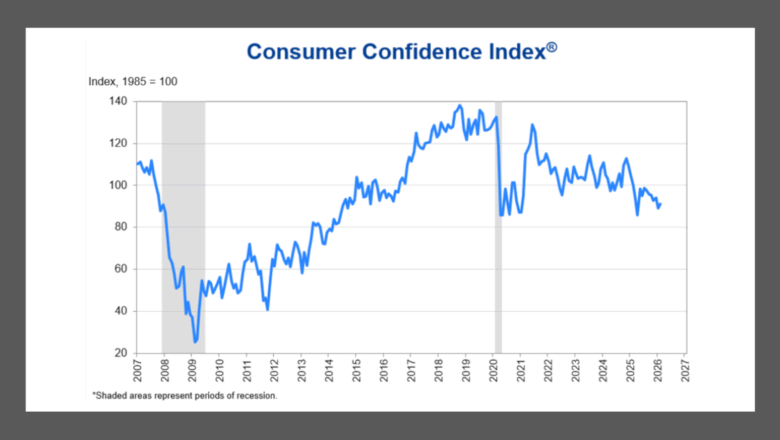

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Desert Financial Credit Union chooses MBSi for case management

Wednesday, Sep. 3, 2025, 01:11 PM

SubPrime Auto Finance News Staff

MBSi announced this week that Desert Financial Credit Union has selected MBSi’s RecoveryConnect platform as its exclusive case management system. With this partnership, MBSi said Desert Financial gains a modern, flexible, user-friendly platform, as well as a trusted partner dedicated ... [Read More]

Lobel Financial hires Holgate as president

Wednesday, Sep. 3, 2025, 11:48 AM

SubPrime Auto Finance News Staff

Bringing 25 years of industry experience, Lobel Financial announced via social media on Tuesday that Tom Holgate is now president of the finance company founded in 1977. While Holgate’s professional career doesn’t date back quite that far, his profile on ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

NextGear Capital reaches multiple milestones associated with audit transformation

Wednesday, Sep. 3, 2025, 11:48 AM

SubPrime Auto Finance News Staff

Saying “it’s by no means the finish line,” NextGear Capital recently hit notable numbers in its service as an inventory finance company for independent dealers. On Tuesday, the company said it surpassed 50% adoption of its self-audit feature in its ... [Read More]

Car-purchasing plans rise in August amid Fed turmoil & slightly sagging consumer confidence

Tuesday, Sep. 2, 2025, 10:42 AM

Nick Zulovich, Senior Editor

With turmoil at the Federal Reserve getting as intense as ever, perhaps dealerships and finance companies can focus on one part of the newest Consumer Confidence Index from the Conference Board. While the overall reading and other parts of the ... [Read More]

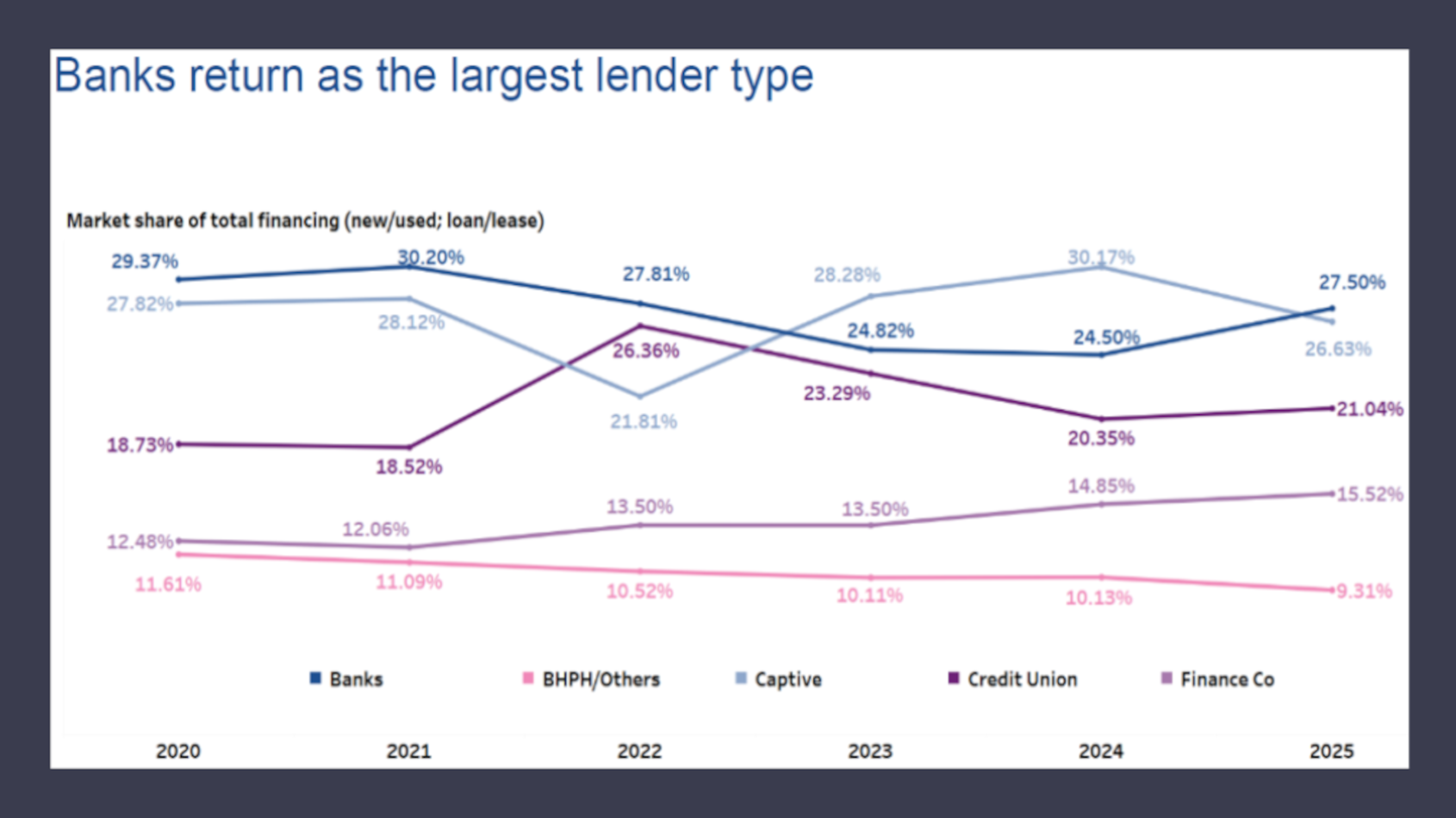

Experian watches banks recapture top auto-finance market share spot in Q2

Thursday, Aug. 28, 2025, 10:52 AM

SubPrime Auto Finance News Staff

Experian’s State of the Automotive Finance Market Report: Q2 2025 showed that perhaps banks not making many underwriting adjustments in the auto-finance department during the second quarter was shrewd strategy. Experian reported banks returned as the largest lender for total ... [Read More]

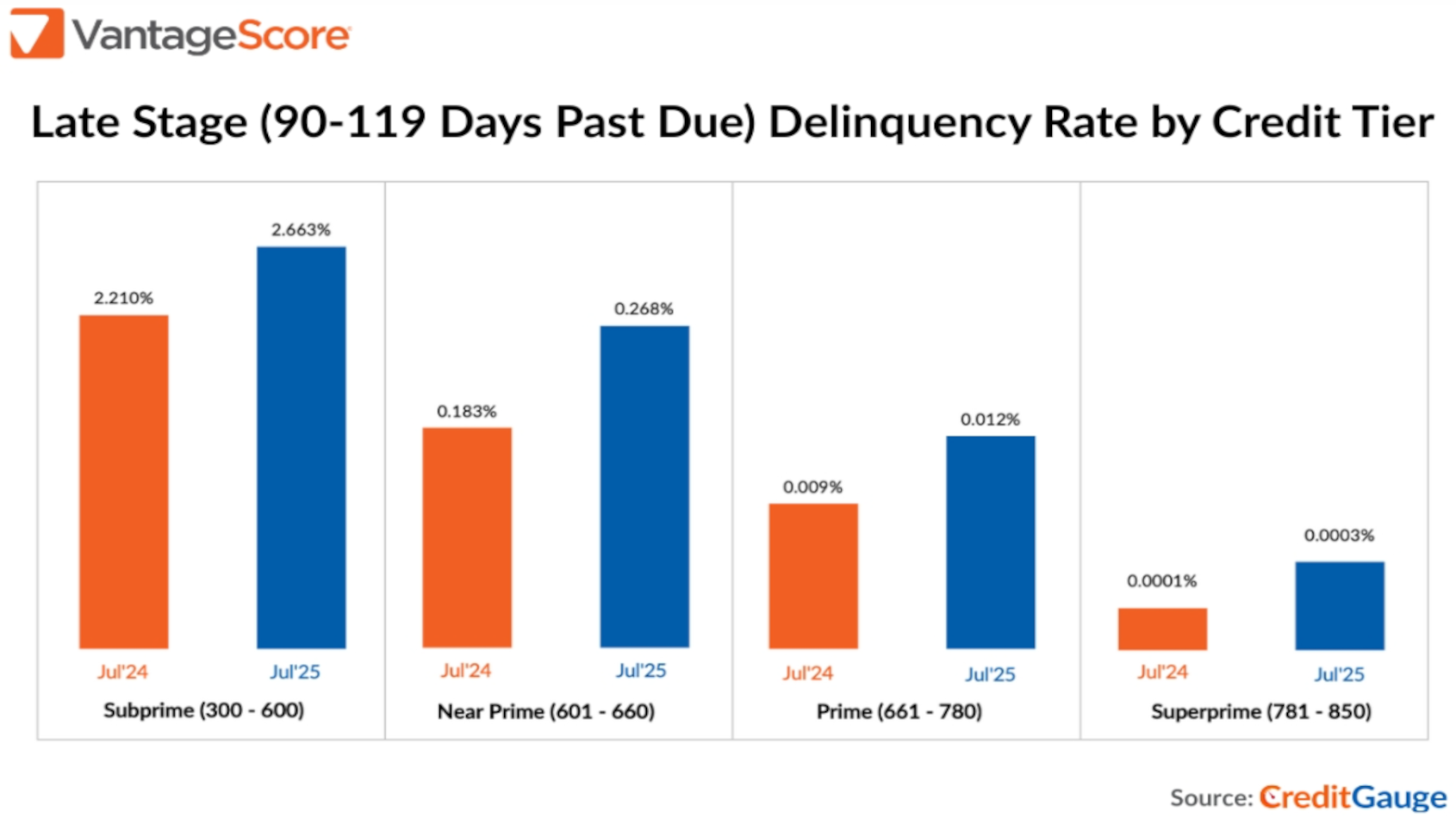

VantageScore spots notable auto-delinquency jump in July

Wednesday, Aug. 27, 2025, 11:57 AM

SubPrime Auto Finance News Staff

The July edition of CreditGauge published this week by VantageScore showed that auto is one of the credit segments showing the most performance deterioration. VantageScore reported mortgage and auto loan credit delinquencies saw the largest year-over-year uptick in the early-stage ... [Read More]

Glenview Finance to add 20 new sales reps to bolster nationwide expansion

Wednesday, Aug. 27, 2025, 11:11 AM

SubPrime Auto Finance News Staff

While one company in the subprime space recently halted originations, another operation is in growth mode. Late last week, Glenview Auto Loan Fund announced the nationwide expansion of its Credit Builder Program and will hire 20 new sales representatives. Glenview’s ... [Read More]

FinBe USA now using Point Predictive’s tools to grow & improve subprime portfolio

Wednesday, Aug. 27, 2025, 11:11 AM

SubPrime Auto Finance News Staff

FinBe USA on Tuesday announced its adoption of Point Predictive’s AutoPass FCRA solution. According to a news release, the implementation enables FinBe USA to leverage Point Predictive’s proprietary data repository and artificial intelligence to accelerate growth, automate fraud detection, reduce ... [Read More]

COMMENTARY: The compliance mirage & why not all payment calculators are created equal

Tuesday, Aug. 26, 2025, 10:33 AM

Sarah Milovich, Carleton

A payment calculator seems like it is technology offered and used by everyone today. Plug in a few numbers, and out pops a monthly payment. Simple, right? Unfortunately, this illusion of simplicity is costing auto lenders and dealers significantly. What ... [Read More]

Agora Data hires Pratt as VP of sales strategy

Monday, Aug. 25, 2025, 10:30 AM

SubPrime Auto Finance News Staff

Agora Data said through a post on LinkedIn that the fintech innovator of advanced capital solutions in subprime and non-prime consumer finance has hired Wendy Pratt as its new vice president of sales strategy. “Wendy is an experienced and recognized ... [Read More]

X