Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Fed’s Bowman maintains stance for rate cut

Tuesday, Aug. 12, 2025, 10:23 AM

SubPrime Auto Finance News Staff

Michelle Bowman, who is the Federal Reserve’s vice chair for supervision, was one of two members of the Federal Open Market Committee who dissented from the majority vote that kept interest rates unchanged when policymakers made their decision at the ... [Read More]

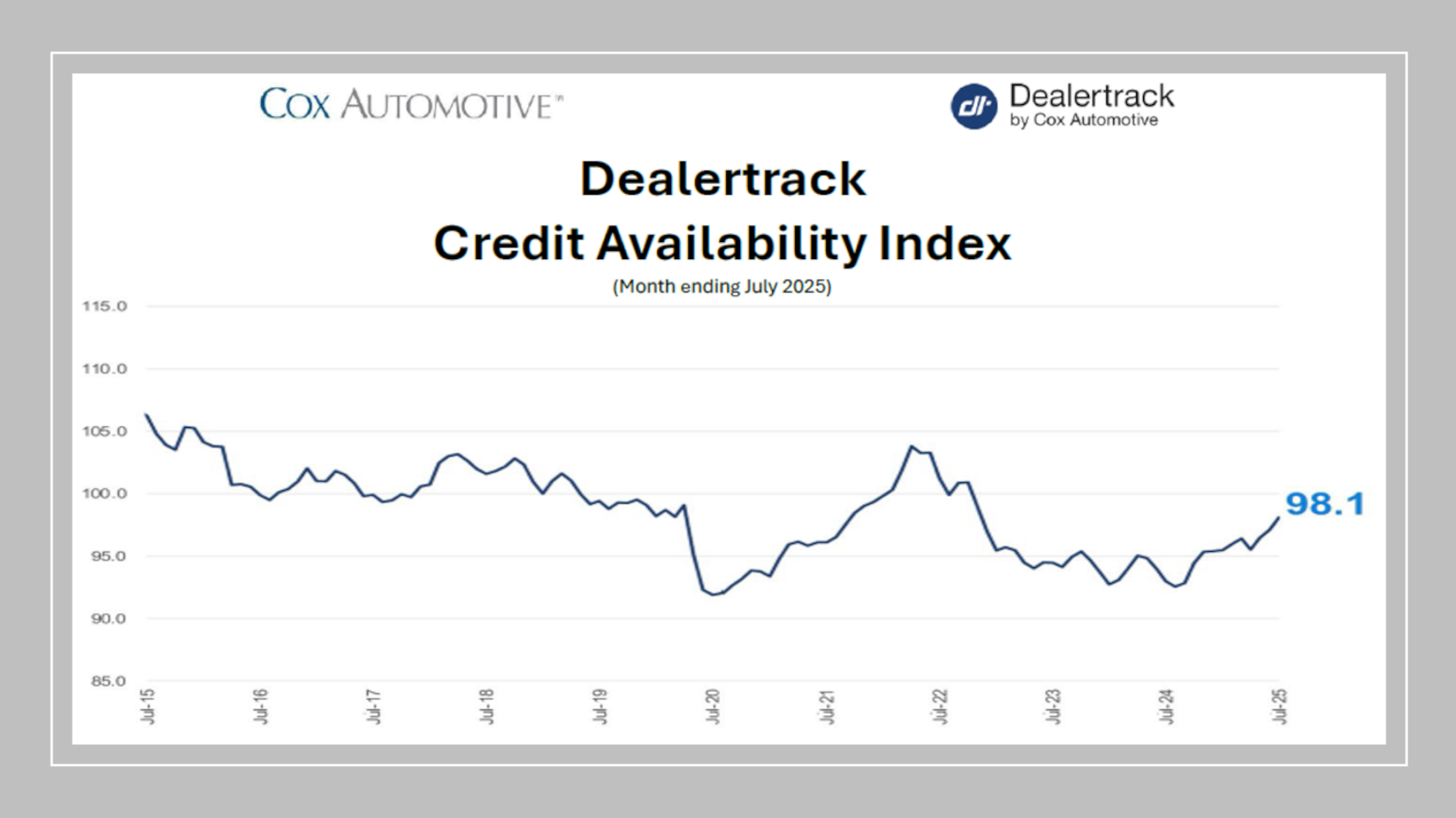

Only momentary tariff bump interrupts ongoing expansion of auto credit access

Monday, Aug. 11, 2025, 10:39 AM

SubPrime Auto Finance News Staff

It appears only talk about tariffs disrupted the upward trajectory of expanded auto credit access since last summer. Cox Automotive reported the Dealertrack Credit Availability Index improved again in July, marking the third consecutive month of enhanced credit access. The ... [Read More]

CFPB seeks input about changing Automobile Financing Larger Participant Rule

Friday, Aug. 8, 2025, 10:24 AM

SubPrime Auto Finance News Staff

A decade ago, the Consumer Financial Protection Bureau established the Automobile Financing Larger Participant Rule, which created regulatory oversight over providers that originated 10,000 contracts or more annually. That threshold might be changing since the regulator now operates with half ... [Read More]

New Open Lending CFO starts on Aug. 18

Friday, Aug. 8, 2025, 09:52 AM

SubPrime Auto Finance News Staff

Open Lending Corp. will have a new chief financial officer in place on Aug. 18. The provider of automotive lending and risk analytics solutions for financial institutions recently appointed Massimo Monaco as its incoming CFO, an executive who will bring ... [Read More]

ACC pauses originations but not ‘a closure of business’

Friday, Aug. 8, 2025, 09:11 AM

SubPrime Auto Finance News Staff

One of the longest-tenured finance companies in the subprime space has paused originations but said, “This is not a closure of business.” Automotive Credit Corp. (ACC) said late Thursday afternoon it will continue to fund all complete contract packages that ... [Read More]

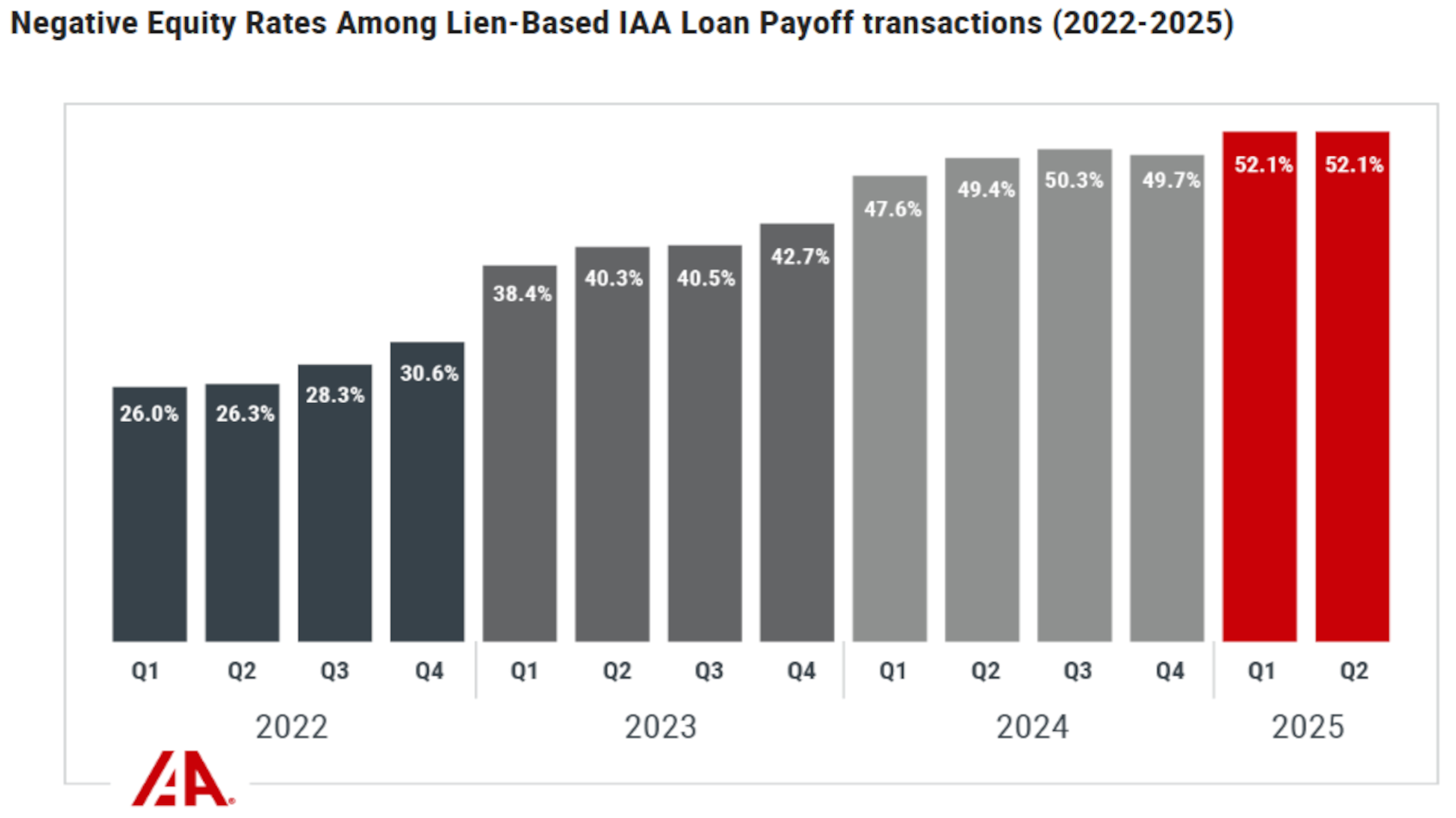

IAA sees salvage transactions with negative equity remain at 3-year high in Q2

Wednesday, Aug. 6, 2025, 02:07 PM

SubPrime Auto Finance News Staff

Negative equity can be significant hurdle to clear when dealerships handle trades, as Edmunds recently reported 7.7% of trade-ins toward a new-vehicle purchase during the second quarter were upside down by more than $15,000. Negative equity can be a conundrum ... [Read More]

Vola CreditMap aimed at helping consumers handle debt & increase credit scores

Wednesday, Aug. 6, 2025, 10:32 AM

SubPrime Auto Finance News Staff

Coinciding with the Federal Reserve Bank of New York tabulating that total consumer debt surpassed $18 trillion during the second quarter, personal financial management platform Vola Finance rolled out a new loan management dashboard designed to help consumers take control ... [Read More]

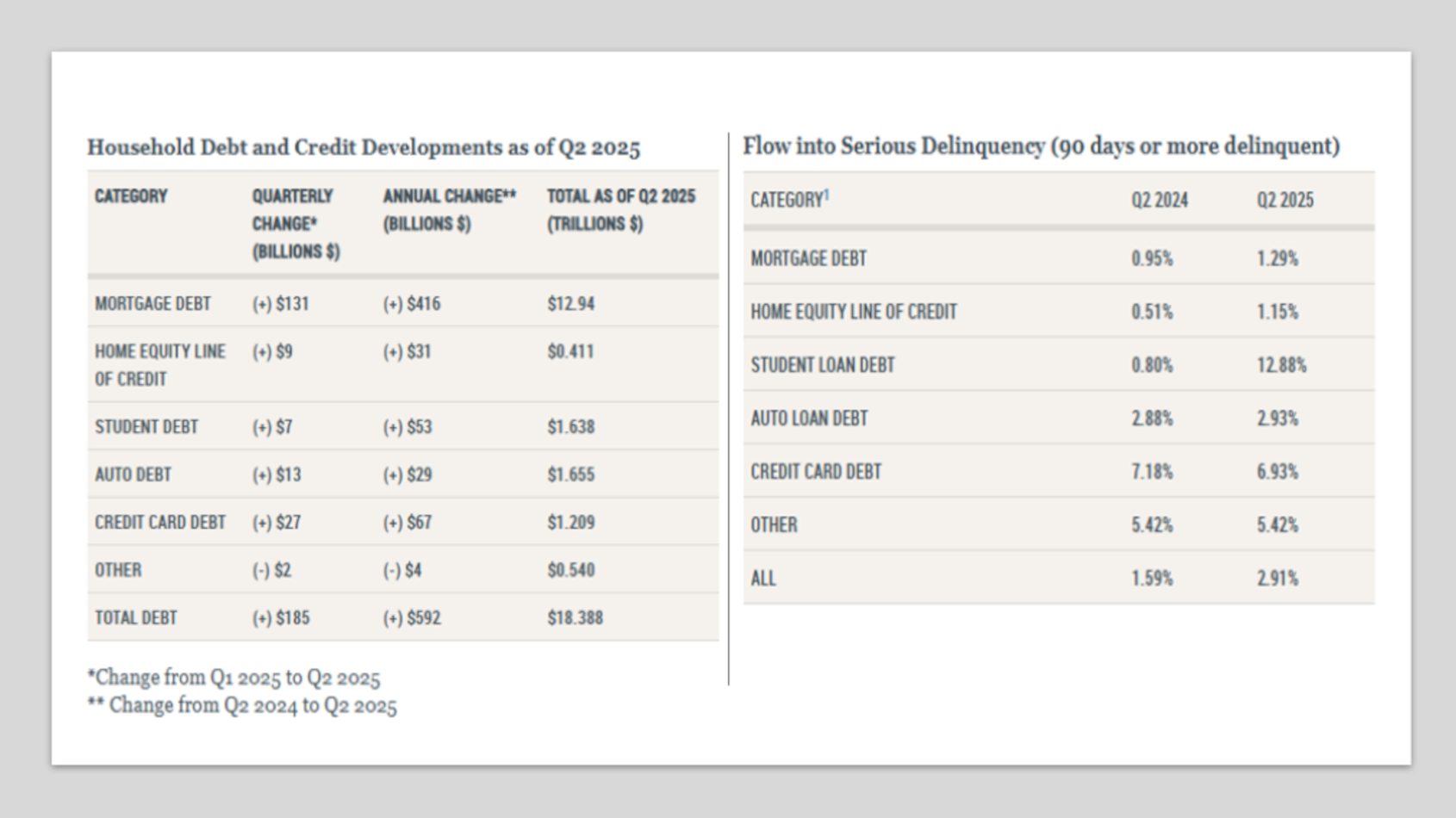

New York Fed sees stability in auto-finance sector but turbulence involving student loans

Wednesday, Aug. 6, 2025, 10:30 AM

SubPrime Auto Finance News Staff

While student-loan metrics are deteriorating because of changes in federal policies, auto-loan trends are staying stable. That’s two of the primary findings from the Quarterly Report on Household Debt and Credit released on Tuesday by the Federal Reserve Bank of ... [Read More]

Wolters Kluwer: ‘Enforcement pullback exceeds even the most aggressive predictions’

Tuesday, Aug. 5, 2025, 10:05 AM

SubPrime Auto Finance News Staff

New information from Wolters Kluwer about how much the regulatory landscape has changed since President Trump started his second term prompted experts to say, “this enforcement pullback exceeds even the most aggressive predictions.” According to new data from Wolters Kluwer ... [Read More]

Western Funding executes first securitization

Monday, Aug. 4, 2025, 11:08 AM

SubPrime Auto Finance News Staff

Western Funding is now in the securitization business, too. Late on Friday, the subsidiary company of Westlake Technology Holdings announced the successful closing of its inaugural asset-backed securitization (ABS), WEFUN 2025-1, totaling $400 million. Management said this transaction marks Western ... [Read More]

X