A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

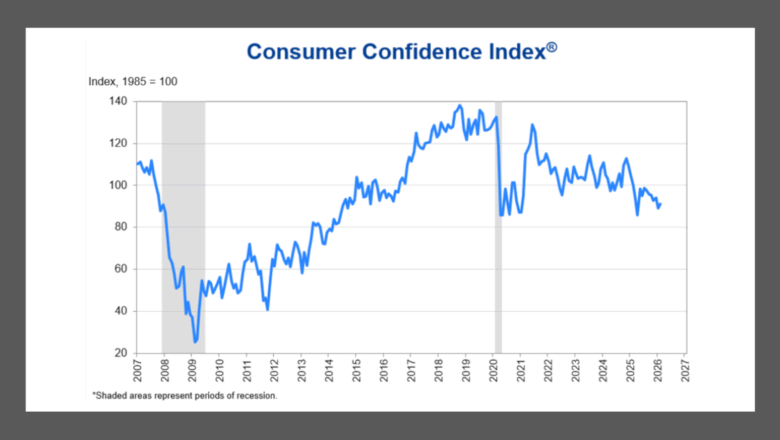

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

CFPB announces advisory committee members

Friday, Sep. 18, 2020, 02:03 PM

SubPrime Auto Finance News Staff

This week, Consumer Financial Protection Bureau director Kathleen Kraninger announced the appointment of members to the Consumer Advisory Board (CAB), Community Bank Advisory Council (CBAC), Credit Union Advisory Council (CUAC) and Academic Research Council (ARC). Officials said these experts advise ... [Read More]

Protective Asset Protection survey shows 5 F&I updates dealers plan in coming months

Friday, Sep. 18, 2020, 02:01 PM

SubPrime Auto Finance News Staff

Protective Asset Protection wanted to get a reading about how COVID-19 impacted dealers and their efforts to quickly implement digital tools and resources available to consumers shopping for vehicles and F&I product options. So, the provider of F&I programs, services ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Auto defaults rise for second consecutive month

Thursday, Sep. 17, 2020, 03:32 PM

SubPrime Auto Finance News Staff

While Kroll Bond Rating Agency (KBRA) described credit performance during the July collection period as “solid,” the data through August released by S&P Dow Jones Indices and Experian earlier this week showed that auto defaults remain on the rise. The ... [Read More]

KBRA spots ‘solid’ credit performance in July

Wednesday, Sep. 16, 2020, 03:07 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) found more evidence that federal assistance helped the auto-finance industry since August remittance reports showed what analysts called “solid” credit performance during the July collection period. The firm’s newest report dissecting information from the auto ... [Read More]

Florida repossession company settles with DOJ over alleged SCRA violations

Wednesday, Sep. 16, 2020, 02:47 PM

SubPrime Auto Finance News Staff

The Servicemembers Civil Relief Act (SCRA) created another action by federal enforcers. Last week, the Justice Department reached an agreement with ASAP Towing & Storage Co. (ASAP) in Jacksonville, Fla., to resolve allegations that ASAP violated a federal law and ... [Read More]

6 repossession and recovery operations merging into 1 company

Tuesday, Sep. 15, 2020, 02:39 PM

SubPrime Auto Finance News Staff

Consolidation that the repossession and recovery industries have rarely seen — if ever — came to light on Tuesday. According to a news release, Camping Companies and Paramount Recovery Service are merging, and four other repossession companies are involved, too, as ... [Read More]

New Jersey AG files fraud charges involving $1.3M worth of inventory

Monday, Sep. 14, 2020, 02:10 PM

SubPrime Auto Finance News Staff

Alleged fraudsters tried to cultivate quite a scheme in the Garden State during a two-year timeframe. Last week, New Jersey attorney general Gurbir Grewal announced that nine individuals have been charged with conspiring to use stolen identities to obtain New ... [Read More]

Webinar poll shows majority of finance companies only ‘somewhat prepared’ for federal exams

Friday, Sep. 11, 2020, 02:58 PM

SubPrime Auto Finance News Staff

Perhaps a primary reason recently Wolters Kluwer Lien Solutions hosted an informational webinar appeared through a participant survey conducted during the session. Nearly 60% of the live webinar audience polled about portfolio management for auto financing responded that they felt ... [Read More]

As down payments climb, likelihood of another federal stimulus dims on Capitol Hill

Friday, Sep. 11, 2020, 02:41 PM

Nick Zulovich, Senior Editor

Edmunds shared data with SubPrime Auto Finance News that average down payments in August climbed by more than $400 on new-car deals and by nearly $700 on used-vehicle transactions. Experts and surveys both pointed to how previous federal government stimulus ... [Read More]

Free ZipDeal eBook gives strategy to increase F&I profits, improve cash flow, boosts CSI

Wednesday, Sep. 9, 2020, 03:36 PM

SubPrime Auto Finance News Staff

Less than a month after launching its F&I solution, ZipDeal this week unveiled a free eBook the company said was created to help dealers combat the erosion of front-end profits on new and used vehicles with a customer-driven, digital vehicle ... [Read More]

X