Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

FTC gets federal court involved in complaint against debt-relief operation

Wednesday, Jul. 23, 2025, 10:42 AM

SubPrime Auto Finance News Staff

The Federal Trade Commission is continuing to police operations that bill themselves as offering consumer debt relief. According to a news release, a federal court at the FTC’s request has temporarily halted an alleged debt relief services scheme that targeted ... [Read More]

Cox Automotive & FICO tackle complexities of subprime auto finance amid increasing student-loan delinquency

Tuesday, Jul. 22, 2025, 09:53 AM

SubPrime Auto Finance News Staff

TransUnion previously reported that consumers who have recently gone delinquent on their federal student loans because of policy changes have seen their credit scores drop by 60 points on average. That decrease might shift those individuals into the subprime credit ... [Read More]

COMMENTARY: New frontier of used-vehicle acquisition and F&I’s pivotal role

Monday, Jul. 21, 2025, 09:20 AM

Paul McCarthy, Protective Asset Protection

The method in which auto dealers acquire used inventory is rapidly changing. Historically reliant on auctions and trade-ins, a surging demand for pre-owned vehicles and persistent market scarcity are compelling dealers to aggressively purchase directly from consumers at an unprecedented ... [Read More]

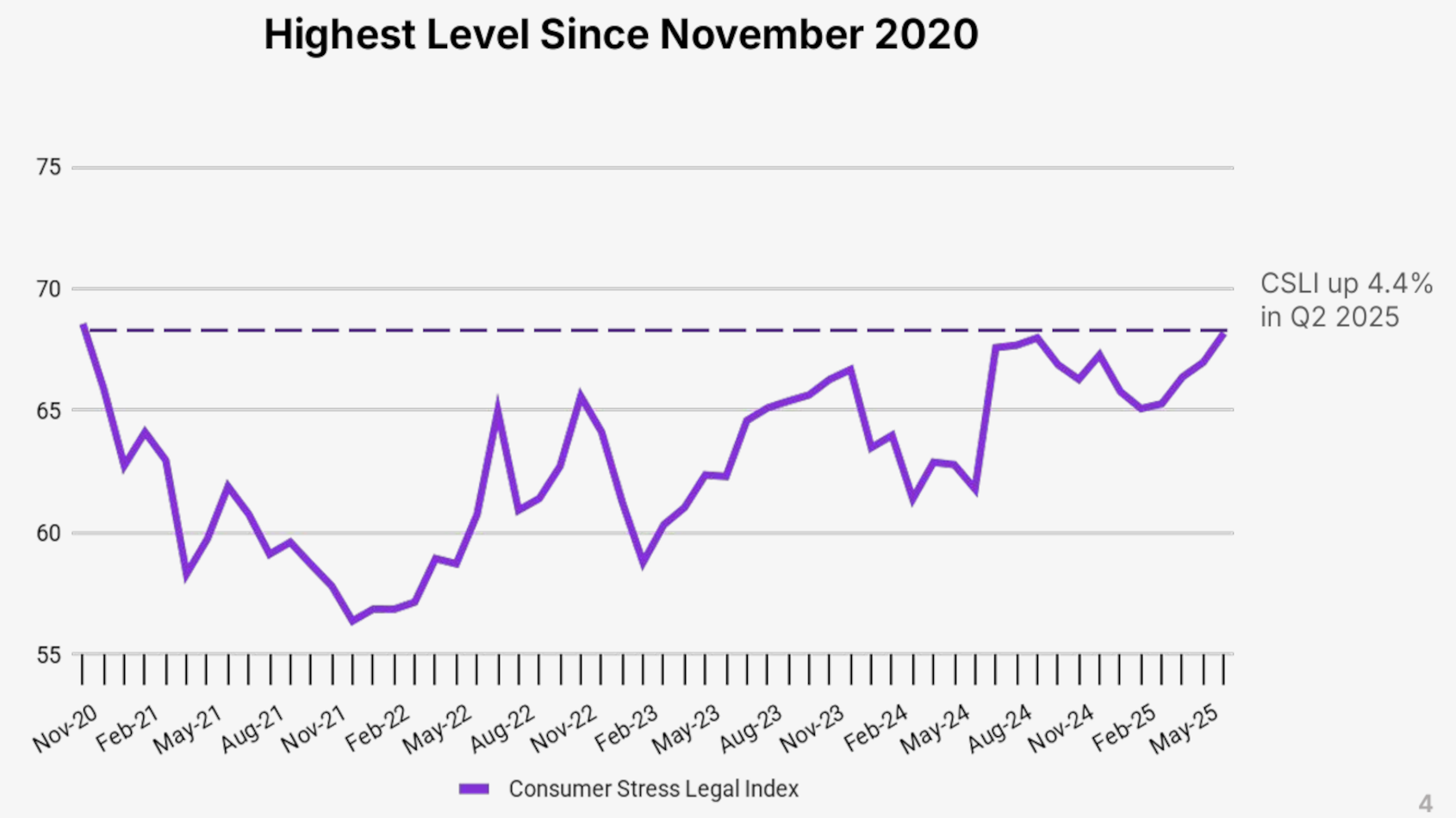

LegalShield’s Consumer Stress Legal Index at highest point in more than 5 years

Thursday, Jul. 17, 2025, 11:56 AM

SubPrime Auto Finance News Staff

LegalShield’s Consumer Stress Legal Index (CSLI) climbed from March to June, and the company said it was driven by surging foreclosure and consumer finance legal inquiries, all rooted in increased debt. Analysts indicated the CSLI surged to 68.2, which is ... [Read More]

Weltman, Weinberg & Reis tackles challenges of subrogation & bankruptcy

Wednesday, Jul. 16, 2025, 12:55 PM

SubPrime Auto Finance News Staff

Two legal experts from Weltman, Weinberg & Reis tackled one of the most complex situations that auto finance companies and insurance providers might ever face. That’s when subrogation recovery intersects with a bankruptcy case, triggering even more questions that need ... [Read More]

Buoyed in part by job market, Fed might not cut interest rates until year end

Wednesday, Jul. 16, 2025, 11:16 AM

SubPrime Auto Finance News Staff

If you’re hoping the Federal Reserve cuts interest rates this month, you might be disappointed. Comerica Bank predicted policymakers might not make a move until it’s time to celebrate Christmas, Hannukah and Kwanzaa. The Federal Open Market Committee will announce ... [Read More]

Cox Automotive spots 6 troubling trends from June auto-finance performance

Tuesday, Jul. 15, 2025, 09:48 AM

SubPrime Auto Finance News Staff

Being a music aficionado and chief economist, Cox Automotive’s Jonathan Smoke could have included some woeful blues tracks when he highlighted six points about the current performance of auto financing in his Auto Market Weekly Summary. While not mentioning songs ... [Read More]

Auto credit availability improves again in June

Thursday, Jul. 10, 2025, 02:46 PM

SubPrime Auto Finance News Staff

Both summertime temperatures and the Dealertrack Credit Availability Index are on upward trajectories. Cox Automotive reported on Thursday that the June index reflected a second consecutive month of improved credit access, rising to 97.3. That’s up from 96.5 in May. ... [Read More]

TransUnion: Credit scores dropping by 60 points on average because of delinquent federal student loans

Thursday, Jul. 10, 2025, 10:27 AM

SubPrime Auto Finance News Staff

The pool of consumers potentially falling into the subprime credit tier might grow by nearly 6 million individuals based on the trends connected with student loans recently highlighted by TransUnion. New research from TransUnion revealed that the number of consumers ... [Read More]

ARA highlights 4 primary compliance features of new 50-State Solution

Wednesday, Jul. 9, 2025, 01:21 PM

SubPrime Auto Finance News Staff

For agents, 50 states can mean as many as 50 different sets of regulations to follow when repossessing vehicles. To help them handle those potential complexities, the American Recovery Association launched what it called a “groundbreaking” resource on Wednesday. Called ... [Read More]

X