A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

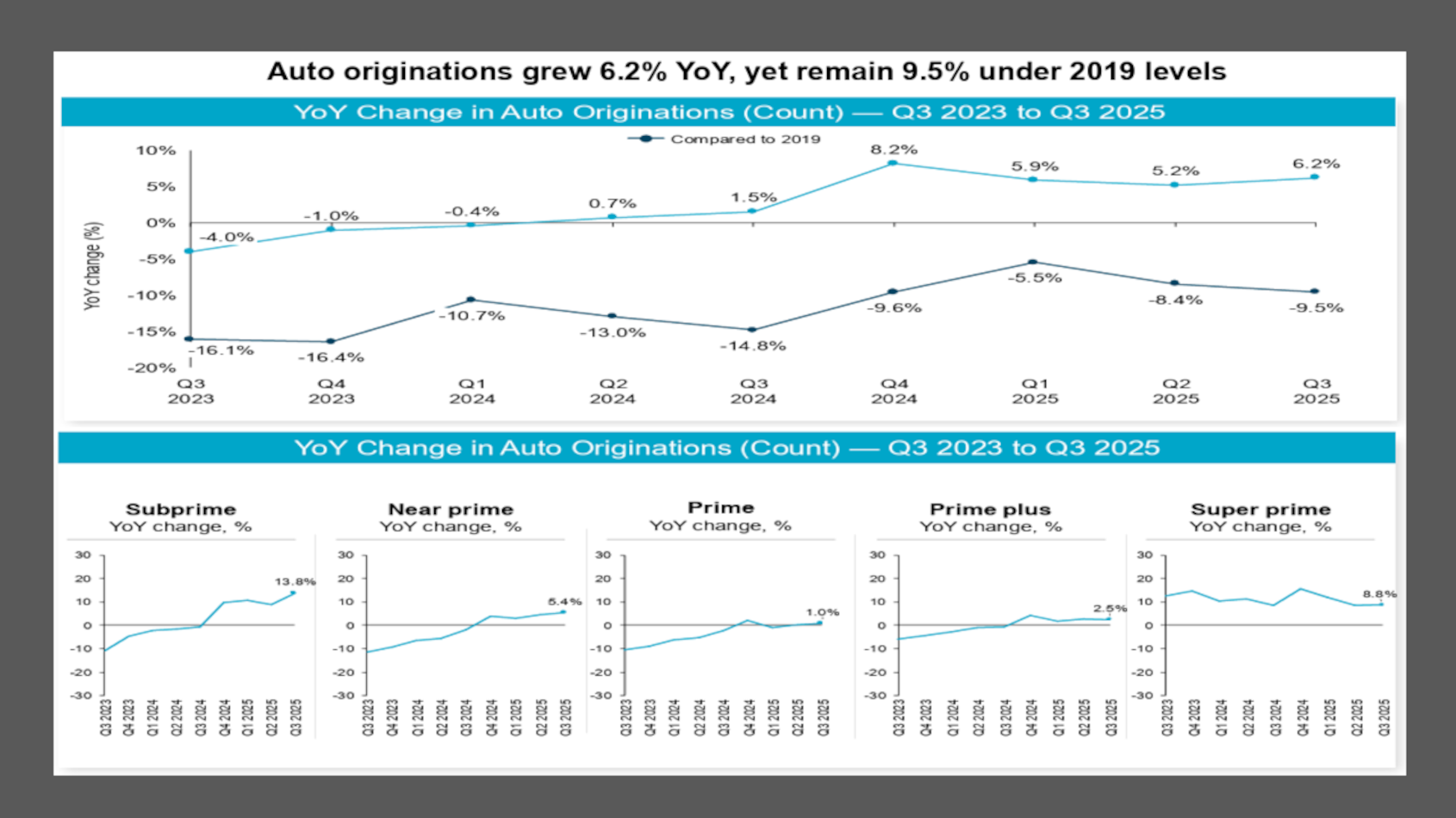

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

SubPrime Auto Finance News Staff

Allegedly not handling vehicles correctly with members of the military on active duty landed CarMax in trouble with the Justice Department to the tune of nearly $500,000. On Monday, Justice Department officials announced that they have reached a settlement with ... [Read More]

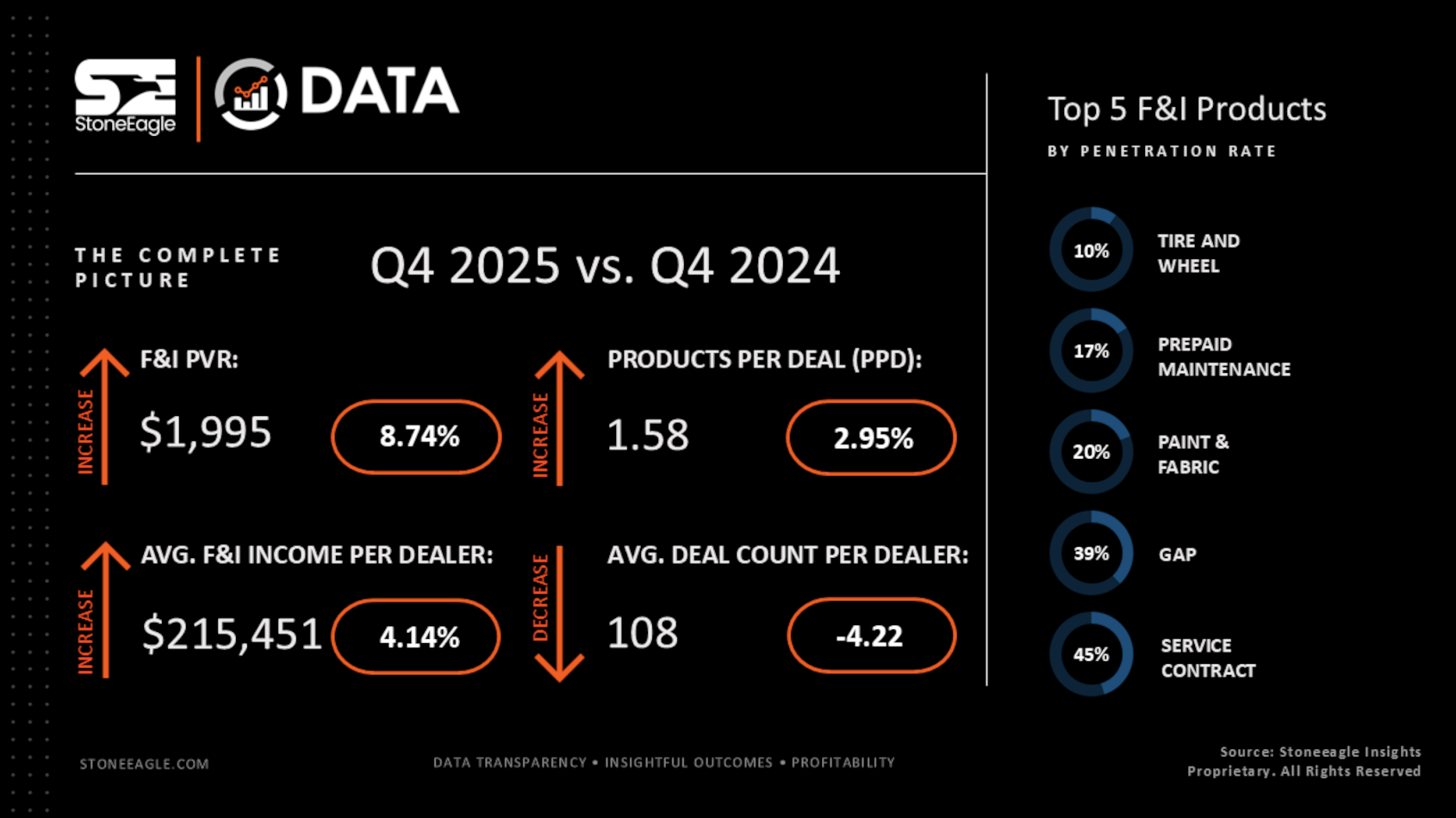

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

SubPrime Auto Finance News Staff

StoneEagle data showed dealerships had a lot to be thankful for, especially in November, when it came to the performance of their F&I departments during the fourth quarter. The newest StoneEagleDATA F&I Benchmark Report indicated that in the fourth quarter, ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

SubPrime Auto Finance News Staff

APCO Holdings recently announced six executive leadership moves and promotions designed to strengthen its support of customers, expand growth across channels, and enhance operational capabilities. The provider of F&I products and dealer solutions began by saying Tony Wanderon has been ... [Read More]

Economic roundup: Recession outlook & explaining Supreme Court decision about tariffs via automotive

Monday, Feb. 23, 2026, 10:54 AM

Nick Zulovich, Senior Editor

Experts from Comerica Bank, Edmunds and S&P Global Ratings tackled a variety of economic topics with connections to automotive, including the chance of a recession in the next 12 months, the Supreme Court’s decision about President Trump’s tariffs, and gross ... [Read More]

Yendo lands $200M funding commitment from i80 Group to continue growth of vehicle-secured credit card

Friday, Feb. 20, 2026, 10:27 AM

SubPrime Auto Finance News Staff

In October, Yendo announced a $50 million Series B funding round to fuel its efforts to grow as a company that claims to be behind the first-ever vehicle-secured credit card. Now at a time when private debt markets remain historically ... [Read More]

TransUnion projects slight dip in auto originations after robust 2025 volume

Thursday, Feb. 19, 2026, 11:22 AM

SubPrime Auto Finance News Staff

Auto finance often moves counter to other segments of the credit market in positive ways, but not this time, according to TransUnion’s 2026 credit originations forecast released on Thursday. Among the five credit market segments specified in the forecast, only ... [Read More]

ARA, AIR, Wheeler, among others seeking to stop ‘serious threat’ to repossessions by local municipalities

Wednesday, Feb. 18, 2026, 02:59 PM

SubPrime Auto Finance News Staff

The American Recovery Association (ARA), the Alliance of Illinois Repossessors (AIR) and DRN|MVTRAC|SCM president Jeremiah Wheeler are all involved in what they see as “a serious threat to the entire repossession industry” that started as a local issue in Illinois ... [Read More]

Experts at Cox Automotive, Conference Board decipher latest credit & job information

Wednesday, Feb. 18, 2026, 10:54 AM

SubPrime Auto Finance News Staff

It’s the puzzle that dealerships and finance companies have had to solve since the start of awarding credit to deliver a vehicle. You likely must have a car to get a job, and you likely have to have a job ... [Read More]

Debt Awareness Week meant to be ‘wake-up call’

Tuesday, Feb. 17, 2026, 10:21 AM

SubPrime Auto Finance News Staff

Perhaps some individuals already in your subprime auto finance portfolio are getting a “wake-up call” this week courtesy of consumer advocates who are orchestrating a financial education program. Debt Awareness Week began on Monday with officials at Debt.com, a resource ... [Read More]

FTC sends letters to 13 data brokers about PADFAA obligations

Monday, Feb. 16, 2026, 10:59 AM

SubPrime Auto Finance News Staff

The Federal Trade Commission said last week that it sent letters to 13 data brokers warning them of their responsibility to comply with the Protecting Americans’ Data from Foreign Adversaries Act of 2024 (PADFAA). Officials recapped that the PADFAA prohibits ... [Read More]

X