A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

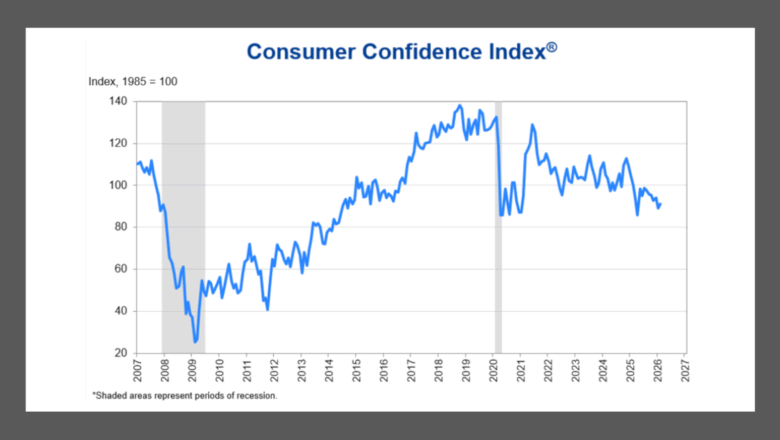

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

PossibleNOW acquires PACE Regulatory Guide

Friday, Apr. 26, 2019, 01:24 PM

SubPrime Auto Finance News Staff

PossibleNOW reinforced its compliance resources this week that could benefit the marketing efforts and dealerships and finance companies. The provider of Do Not Contact direct marketing compliance and enterprise consent and preference management solutions, announced the acquisition of the Professional ... [Read More]

Pennsylvania Honda store settles with state AG over ‘valueless’ warranties

Friday, Apr. 26, 2019, 01:22 PM

SubPrime Auto Finance News Staff

Faulkner Honda recently reached a settlement that includes restitution for consumers for what Pennsylvania attorney general Josh Shapiro described as deceptive and unfair sales of a “valueless” warranty product. According to a news release, an investigation by the attorney general’s ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Industry input prompts CFPB to revise policies involving CIDs

Thursday, Apr. 25, 2019, 02:51 PM

Nick Zulovich, Senior Editor

Perhaps reinforcing an outline shared during the director’s public appearance just a few days earlier, the Consumer Financial Protection Bureau this week announced changes to policies regarding civil investigative demands (CIDs). The regulator said the actions are designed to ensure ... [Read More]

DRN honors 10 agencies as part of 2019 National Affiliate of the Year Awards

Wednesday, Apr. 24, 2019, 03:32 PM

SubPrime Auto Finance News Staff

Along with sharing details about a new affiliate benefit program, Digital Recognition Network (DRN) handed out its annual awards to companies that have demonstrated excellence in the repossession industry. During an appreciation dinner in conjunction with the 2019 North American ... [Read More]

Millennium Capital and Recovery captures another award from Toyota’s captive

Wednesday, Apr. 24, 2019, 03:30 PM

SubPrime Auto Finance News Staff

Toyota Financial Services evidently really likes the results the captive receives from Millennium Capital and Recovery Corp., since the auto-finance provider gave another honor to the forwarding company. TFS recently handed its Recovery Services Excellence Award to Millennium Capital and ... [Read More]

3 mathematics experts create VisionMenu lease payment tool

Wednesday, Apr. 24, 2019, 03:28 PM

SubPrime Auto Finance News Staff

Vision Dealer Solutions went to academia to solve complicated computations finance offices regularly face. The provider that offers VisionMenu, in collaboration with Purdue University Fort Wayne, released a lease payment solver that officials said this week will essentially reverse-engineer the ... [Read More]

ANALYSIS: Lawsuits increase, alleging websites are not compliant with ADA

Tuesday, Apr. 23, 2019, 02:54 PM

Randy Henrick, AutoDealerCompliance.net

A new wave of lawsuits is being filed across the country under the Americans with Disabilities Act (ADA). The ADA is a federal law passed in 1990 requiring “reasonable accommodations” in “any place of public accommodation” to make them accessible ... [Read More]

CFPB director reiterates purpose and strategy involving investigations

Monday, Apr. 22, 2019, 02:42 PM

SubPrime Auto Finance News Staff

During prepared remarks covering an array of topics, Consumer Financial Protection Bureau director Kathleen Kraninger revisited a subject particularly important to auto finance companies — how in-person, onsite examinations might unfold. Kraninger told attendees at an event hosted by the ... [Read More]

First Investors Financial Services installs 2 defi SOLUTIONS tools

Monday, Apr. 22, 2019, 02:38 PM

SubPrime Auto Finance News Staff

First Investors Financial Services (FIFS) is now using a pair of cloud-based loan solutions fueled by defi SOLUTIONS. Officials highlighted the Houston-based subprime auto finance company went live on the defi loan origination and analytics systems (defi LOS and defi ... [Read More]

PODCAST: Latest achievements stemming from Auto Fraud Consortium

Thursday, Apr. 18, 2019, 02:37 PM

SubPrime Auto Finance News Staff

PointPredictive chief fraud strategist Frank McKenna joined Nick for the episode that focused on the achievements of the Auto Fraud Consortium, a wide-ranging collection of finance companies that are collaborating to reduce the volume of fraudulent paper infecting their portfolios. ... [Read More]

X