AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

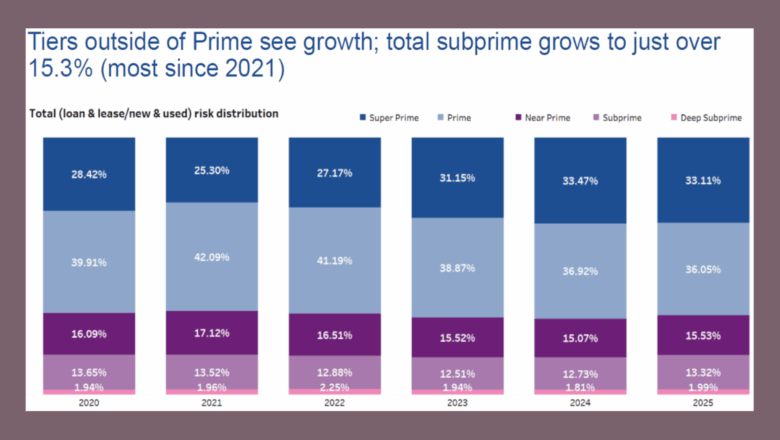

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Latest Stories

Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tim Yalich, who now is vice president of business development for Carleton, returned for an appearance on the Auto Remarketing Podcast. Yalich explained how much more crucial accurate payment information is to today’s car shoppers in an environment with some ... Listen Here

Tuesday, Mar. 10, 2026, 02:48 PM

Widewail CEO Cuyler Owens

Cuyler Owens is CEO of Widewail, a reputation and customer experience platform for the auto industry Cuyler joined Widewail as CEO in December, following nearly three years as chief revenue officer of TrustRadius, and time with Dell, Vmware and Dealerware. ... Listen Here

Monday, Mar. 9, 2026, 08:09 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Industry input prompts CFPB to revise policies involving CIDs

Thursday, Apr. 25, 2019, 02:51 PM

Nick Zulovich, Senior Editor

Perhaps reinforcing an outline shared during the director’s public appearance just a few days earlier, the Consumer Financial Protection Bureau this week announced changes to policies regarding civil investigative demands (CIDs). The regulator said the actions are designed to ensure ... [Read More]

DRN honors 10 agencies as part of 2019 National Affiliate of the Year Awards

Wednesday, Apr. 24, 2019, 03:32 PM

SubPrime Auto Finance News Staff

Along with sharing details about a new affiliate benefit program, Digital Recognition Network (DRN) handed out its annual awards to companies that have demonstrated excellence in the repossession industry. During an appreciation dinner in conjunction with the 2019 North American ... [Read More]

Millennium Capital and Recovery captures another award from Toyota’s captive

Wednesday, Apr. 24, 2019, 03:30 PM

SubPrime Auto Finance News Staff

Toyota Financial Services evidently really likes the results the captive receives from Millennium Capital and Recovery Corp., since the auto-finance provider gave another honor to the forwarding company. TFS recently handed its Recovery Services Excellence Award to Millennium Capital and ... [Read More]

3 mathematics experts create VisionMenu lease payment tool

Wednesday, Apr. 24, 2019, 03:28 PM

SubPrime Auto Finance News Staff

Vision Dealer Solutions went to academia to solve complicated computations finance offices regularly face. The provider that offers VisionMenu, in collaboration with Purdue University Fort Wayne, released a lease payment solver that officials said this week will essentially reverse-engineer the ... [Read More]

ANALYSIS: Lawsuits increase, alleging websites are not compliant with ADA

Tuesday, Apr. 23, 2019, 02:54 PM

Randy Henrick, AutoDealerCompliance.net

A new wave of lawsuits is being filed across the country under the Americans with Disabilities Act (ADA). The ADA is a federal law passed in 1990 requiring “reasonable accommodations” in “any place of public accommodation” to make them accessible ... [Read More]

CFPB director reiterates purpose and strategy involving investigations

Monday, Apr. 22, 2019, 02:42 PM

SubPrime Auto Finance News Staff

During prepared remarks covering an array of topics, Consumer Financial Protection Bureau director Kathleen Kraninger revisited a subject particularly important to auto finance companies — how in-person, onsite examinations might unfold. Kraninger told attendees at an event hosted by the ... [Read More]

First Investors Financial Services installs 2 defi SOLUTIONS tools

Monday, Apr. 22, 2019, 02:38 PM

SubPrime Auto Finance News Staff

First Investors Financial Services (FIFS) is now using a pair of cloud-based loan solutions fueled by defi SOLUTIONS. Officials highlighted the Houston-based subprime auto finance company went live on the defi loan origination and analytics systems (defi LOS and defi ... [Read More]

PODCAST: Latest achievements stemming from Auto Fraud Consortium

Thursday, Apr. 18, 2019, 02:37 PM

SubPrime Auto Finance News Staff

PointPredictive chief fraud strategist Frank McKenna joined Nick for the episode that focused on the achievements of the Auto Fraud Consortium, a wide-ranging collection of finance companies that are collaborating to reduce the volume of fraudulent paper infecting their portfolios. ... [Read More]

Indiana AG files civil suit over special-finance promotions sent to 2.1M state residents

Wednesday, Apr. 17, 2019, 01:43 PM

SubPrime Auto Finance News Staff

Indiana attorney general Curtis Hill is pursuing legal action against another dealership promotions company over allegations of deceptive advertising that included thousands of dollars in prizes and promotions of special financing connected with monthly payments of less than $100. In ... [Read More]

3 elements of CARS Program update from RISC and Hudson Cook

Wednesday, Apr. 17, 2019, 01:41 PM

SubPrime Auto Finance News Staff

For the second time leading into this week’s North American Repossessors Summit (NARS), Recovery Industry Services Co. (RISC) is bolstering its offerings. Through its relationship with Hudson Cook, RISC announced it has completed a significant update to the Certified Asset ... [Read More]

X