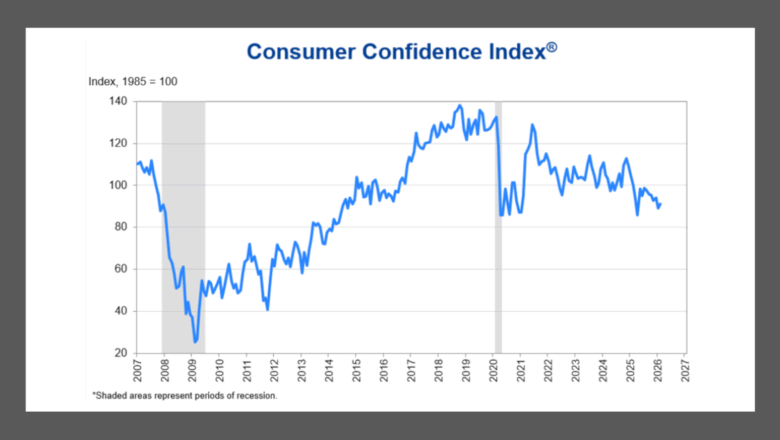

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Indiana AG files civil suit over special-finance promotions sent to 2.1M state residents

Wednesday, Apr. 17, 2019, 01:43 PM

SubPrime Auto Finance News Staff

Indiana attorney general Curtis Hill is pursuing legal action against another dealership promotions company over allegations of deceptive advertising that included thousands of dollars in prizes and promotions of special financing connected with monthly payments of less than $100. In ... [Read More]

3 elements of CARS Program update from RISC and Hudson Cook

Wednesday, Apr. 17, 2019, 01:41 PM

SubPrime Auto Finance News Staff

For the second time leading into this week’s North American Repossessors Summit (NARS), Recovery Industry Services Co. (RISC) is bolstering its offerings. Through its relationship with Hudson Cook, RISC announced it has completed a significant update to the Certified Asset ... [Read More]

Survey reinforces compliance-knowledge gap over securing consumer consent

Wednesday, Apr. 17, 2019, 01:39 PM

SubPrime Auto Finance News Staff

Collections and other customer-service communications certainly can be a complicated endeavor, and a survey conducted by PossibleNOW revealed how some firms still might not have a firm grip on all compliance matters associated with getting past-due payments and more. The ... [Read More]

March auto default rate shows more stability

Tuesday, Apr. 16, 2019, 03:16 PM

SubPrime Auto Finance News Staff

Maybe now that both the first quarter and Tax Day are both in the rear-view mirror, perhaps the handwringing over the delinquency rate spotted at the end of 2018 can be completely squashed based on the newest default data shared ... [Read More]

Consumers push for affordable vehicle payments even as rates rise

Monday, Apr. 15, 2019, 03:14 PM

SubPrime Auto Finance News Staff

Consumer survey results discovered by PenFed Credit Union reinforced the importance vehicle buyers place on securing a monthly payment that fits their budgets. The findings arrived as the newest Cox Automotive analysis showed purchasing both new and used vehicles is ... [Read More]

Equifax and Credit Bureau Connection collaborate on soft inquiries

Friday, Apr. 12, 2019, 03:50 PM

SubPrime Auto Finance News Staff

Here’s another collaborative effort to present information to consumers who want to know if the vehicle in your inventory might fit within the potential terms the finance company could provide — especially in the subprime segment. Equifax and Credit Bureau ... [Read More]

7 findings and more from depreciation and ABS forecast by Black Book and Fitch

Thursday, Apr. 11, 2019, 01:45 PM

SubPrime Auto Finance News Staff

Black Book and Fitch Ratings delivered seven key findings along with other projections as a part of its latest joint U.S. vehicle depreciation and auto asset backed securities (ABS) report released on Thursday. Black Book is forecasting an annual depreciation ... [Read More]

RISC taps DRN’s ‘Skip Guru’ for updated training program

Wednesday, Apr. 10, 2019, 04:03 PM

SubPrime Auto Finance News Staff

Repossession agents and other recovery industry professionals looking to sharpen their skip-training efforts have another resource on the horizon. Recovery Industry Services Co. (RISC), a provider of compliance education and training services, announced on Tuesday that it will be releasing ... [Read More]

KBRA refutes tax-refund fears when releasing March ABS indexes

Wednesday, Apr. 10, 2019, 03:57 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) looked to calm concerns that tax refunds and other possible turbulence would trigger significant disturbances within the auto asset backed securities market. Neither of KBRA’s indexes tracking at prime and non-prime ABS shifted substantially, as ... [Read More]

Dent Wizard rebrands F&I division

Wednesday, Apr. 10, 2019, 03:54 PM

SubPrime Auto Finance News Staff

Dent Wizard International rebranded one of its divisions this week in an effort to sharpen its image with dealerships, finance companies and fleet operators. The provider of automotive reconditioning services and vehicle protection products introduced Evolution, Vehicle Protection by Dent ... [Read More]

X