A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

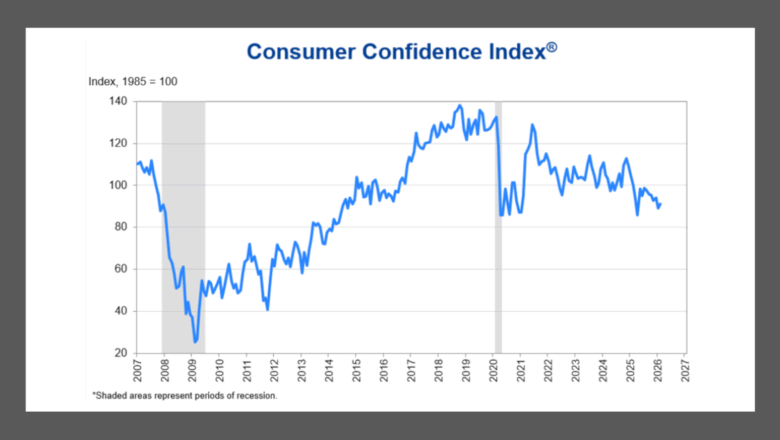

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Merchant Partners and Acima Credit join forces for repair option for subprime customers

Wednesday, Aug. 22, 2018, 03:50 PM

SubPrime Auto Finance News Staff

For consumers who needed a subprime auto finance company to accept their application because of a soft credit profile, Merchant Partners and Acima Credit are collaborating to assist those same individuals who encounter financial hardship stemming from vehicle repair. The ... [Read More]

PointPredictive fraud tools now available to all defi SOLUTIONS customers

Wednesday, Aug. 22, 2018, 03:49 PM

SubPrime Auto Finance News Staff

Finance companies that use the defi SOLUTIONS platform now have additional tools to combat fraud. PointPredictive, a leading provider of machine learning fraud and misrepresentation solutions, announced on Wednesday that its Auto Fraud Manager 2.0 and DealerTrace 2.0 solutions are ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

July auto defaults maintain seasonal pattern

Tuesday, Aug. 21, 2018, 02:25 PM

SubPrime Auto Finance News Staff

The seasonal upturn in auto defaults typically seen during the middle month of summer surfaced again based on the latest information from S&P Dow Jones Indices and Experian. According to data through July for the S&P/Experian Consumer Credit Default Indices ... [Read More]

9 Hudson Cook attorneys named among America’s best

Friday, Aug. 17, 2018, 02:19 PM

SubPrime Auto Finance News Staff

Nine Hudson Cook attorneys were recently selected for inclusion in the 2019 edition of The Best Lawyers in America, up from five recognized a year ago. Attorneys named to The Best Lawyers in America were recognized by their peers in ... [Read More]

Millennium Capital describes 2 products stemming from VendorRisk partnership

Friday, Aug. 17, 2018, 02:18 PM

SubPrime Auto Finance News Staff

Millennium Capital and Recovery Corp. sees its latest partnership as the combination of “intelligent automation and human ingenuity.” The provider of nationwide recovery management and related services as well as the lead sponsor of Repo Con at Used Car Week ... [Read More]

PAR North America honors 15 recovery agents, generates money for RABF

Thursday, Aug. 16, 2018, 01:52 PM

SubPrime Auto Finance News Staff

PAR North America recently held an event to honor 15 of the best repossession operations in the country and generated funds to help agents who sustain negative consequences that sometimes come with the job. The business unit of KAR Auction ... [Read More]

Today’s hot repo topic: personal property and redemption fees

Wednesday, Aug. 15, 2018, 08:10 PM

Mike Levison, ALS Resolvion

Over the past year, the handling of personal property and redemption fees has become one of the hottest compliance topics in the industry. It is on the radar screen of virtually every auto finance company in the country, as well ... [Read More]

BillingTree elevates Hiland to VP of sales and business development

Wednesday, Aug. 15, 2018, 01:36 PM

SubPrime Auto Finance News Staff

Payment technology provider BillingTree recently announced Jason Hiland has been appointed vice president of sales and business development for ARM and financial services. In this newly created position, Hiland oversees sales operations and initiatives to expand electronic payment and technology ... [Read More]

COMMENTARY: Discussion about CFPB’s structure about to get more interesting

Tuesday, Aug. 14, 2018, 02:10 PM

Blair Evans, Baker Donelson

Senior U.S. District Judge for the Southern District of New York Loretta Preska issued an opinion on June 21 that has set the consumer finance world atwitter, sparking discussions of a potential review by the Supreme Court. In her opinion, ... [Read More]

TransUnion examines trio of trends involving refinancing

Monday, Aug. 13, 2018, 03:31 PM

Nick Zulovich, Senior Editor

Here is some new TransUnion data that could help managers within finance company underwriting departments when looking at an application attached to a vehicle that just rolled over the curb. According to the recent TransUnion study of 1.5 million refinanced ... [Read More]

X