A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

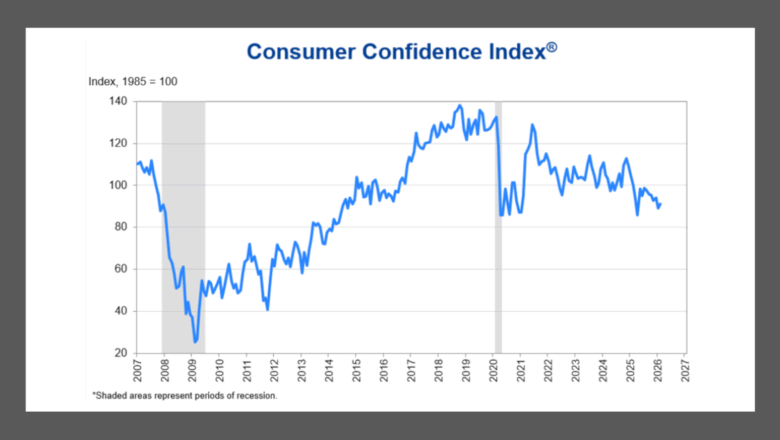

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

TagRail integrates with Market Scan and F&I Express to enhance mobile shopping

Monday, Feb. 12, 2018, 04:55 PM

SubPrime Auto Finance News Staff

TagRail recently finalized the integration of Market Scan and F&I Express services into its new digital retail platform. Now TagRail’s platform can provide shoppers a transactional-specific, penny-accurate vehicle finance and aftermarket product check-out and delivery experience from their living room ... [Read More]

Nominations now welcomed for The CEO Issue 2018

Monday, Feb. 12, 2018, 04:17 PM

SubPrime Auto Finance News Staff

It’s time again when SubPrime Auto Finance News engages with the industry for one of our most successful annual projects — "The CEO Issue." In an ongoing effort to recognize the chief executive officers who are flourishing in today’s competitive ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

BB&T Dealer Financial Services to abandon flat fees

Friday, Feb. 9, 2018, 05:12 PM

Nick Zulovich, Senior Editor

With regulators such as the Consumer Financial Protection Bureau issuing official requests for information about the implications of rules, investigations and enforcement actions, a sterling example might have arrived from BB&T Dealer Financial Services. In a direct message to SubPrime ... [Read More]

Expecting growth, Westlake tops $1B with latest securitization

Friday, Feb. 9, 2018, 03:18 PM

SubPrime Auto Finance News Staff

After approaching the $1 billion securitization threshold last summer, Westlake Financial Services surpassed the mark, according to an announcement shared earlier this week. Westlake issued its largest asset-backed securitization (ABS) of $1 billion backed by approximately $1.1 billion of automotive ... [Read More]

BillingTree makes 7 executive moves

Friday, Feb. 9, 2018, 03:16 PM

SubPrime Auto Finance News Staff

Payment technology provider BillingTree looked to strengthen its company leadership to serve clients within five crucial markets, including auto financing. This week, the company announced the extension of its C-level team and made five key senior vertical industry appointments as ... [Read More]

Now CFPB wants feedback on enforcement process

Thursday, Feb. 8, 2018, 03:50 PM

SubPrime Auto Finance News Staff

Along with naming a chief of staff who formerly served the chair of the House Financial Services Committee, Consumer Financial Protection Bureau acting director Mick Mulvaney is continuing to put his stamp on how the regulator operates. The CFPB issued ... [Read More]

NARS 2018 to include special repo agency owner forum

Wednesday, Feb. 7, 2018, 07:53 PM

SubPrime Auto Finance News Staff

It is likely agents discuss their successes and challenges during the networking times and other activities associated with North American Repossessors Summit (NARS) that’s now been conducted for a decade. But now organizers of the industry event hosted by the ... [Read More]

Dissecting how inflation could ripple into automotive space

Wednesday, Feb. 7, 2018, 03:56 PM

Nick Zulovich, Senior Editor

Cox Automotive senior economist Charlie Chesbrough explained the challenge facing the Federal Open Market Committee (FOMC) at the Federal Reserve. Chesbrough articulated how the implications might not impact dealership turns and finance company originations immediately, but he cautioned that trends ... [Read More]

AUL Corp. surpasses 2M contracts and adds to sales team

Wednesday, Feb. 7, 2018, 03:51 PM

SubPrime Auto Finance News Staff

It took AUL Corp. 21 years to reach 1 million vehicle services contracts. According to a new release shared this week, the VSC provider doubled that figure seven years later. AUL president and chief executive officer Jimmy Atkinson announced the ... [Read More]

2 ways longer terms impacted Credit Acceptance in Q4

Monday, Feb. 5, 2018, 04:25 PM

Nick Zulovich, Senior Editor

Stretching terms forced Credit Acceptance to adjust its expectations for future cash flows. But increasing contract length to the longest average in company history perhaps helped the finance provider turn around a string of declines in the number originations from ... [Read More]

X