Your service drive is filled with loyal customers who trust your dealership and are physically in your store, yet most...

Read More

AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

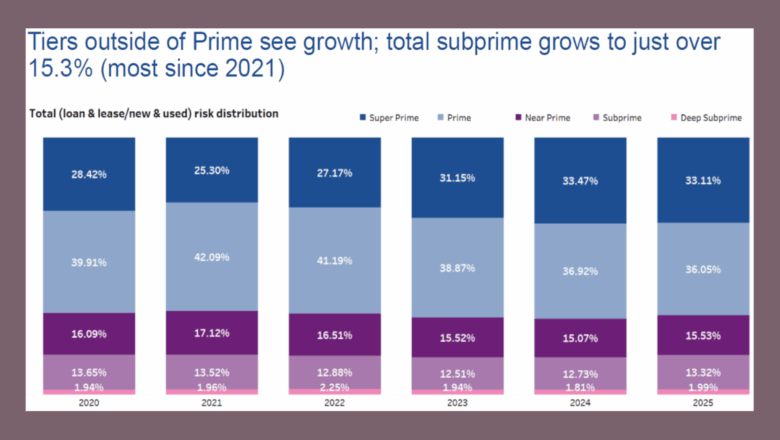

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Widewail CEO Cuyler Owens

Cuyler Owens is CEO of Widewail, a reputation and customer experience platform for the auto industry Cuyler joined Widewail as CEO in December, following nearly three years as chief revenue officer of TrustRadius, and time with Dell, Vmware and Dealerware. ... Listen Here

Monday, Mar. 9, 2026, 08:09 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

White Clarke Group adds Slyman to bolster North American team

Wednesday, Jan. 17, 2018, 04:42 PM

SubPrime Auto Finance News Staff

White Clarke Group recently bolstered its North American workforce. The global provider of full lifecycle loan origination, servicing, collections and floorplan finance technology announced Heather Slyman has joined the firm as vice president of business development for North America. Executives ... [Read More]

LAUNCHER.SOLUTIONS integrates with Equifax Workforce Solutions

Wednesday, Jan. 17, 2018, 04:36 PM

SubPrime Auto Finance News Staff

An important component in subprime auto finance underwriting is gauging the potential contract holder’s ability to make installment payments. LAUNCHER.SOLUTIONS and Equifax are teaming up to help finance companies with that stipulation. This week Equifax and LAUNCHER.SOLUTIONS, a technology provider ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

The Dealer’s Guide to Smarter GPS Tracking

A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Auto defaults close 2017 on stable track

Tuesday, Jan. 16, 2018, 04:55 PM

SubPrime Auto Finance News Staff

For the fourth time in the past seven years, the auto portion of the S&P/Experian Consumer Credit Default Indices closed the calendar with the default rate holding steady or ticking a bit lower on a sequential basis. S&P Dow Jones ... [Read More]

FICO hosting free webinar to share best practices in using automated communications

Monday, Jan. 15, 2018, 03:24 PM

SubPrime Auto Finance News Staff

It’s a new year, and FICO is hopeful 2018 will be filled with new customers coming into company portfolios. In an effort to help institutions communicate with this new batch of contract holders, FICO is hosting a free educational webinar ... [Read More]

3 suggestions for companies with underperforming employees

Monday, Jan. 15, 2018, 03:22 PM

SubPrime Auto Finance News Staff

Automotive Personnel chief executive officer Don Jasensky offered three options when dealership and auto finance company management teams are faced with the decision of making manpower changes based on performance. Jasensky leveraged his nearly 30 years of experience, acknowledging that, ... [Read More]

RouteOne adds Fidelity Bank to eContracting footprint

Friday, Jan. 12, 2018, 03:45 PM

SubPrime Auto Finance News Staff

This week, RouteOne announced the addition of Fidelity Bank as an available eContracting finance source for dealers utilizing the RouteOne platform. Fidelity Bank’s financing services are available to dealers throughout the South. David Buchanan, executive vice president of indirect lending ... [Read More]

Dundon’s newest endeavor: professional hockey and the Stanley Cup

Friday, Jan. 12, 2018, 03:38 PM

Nick Zulovich, Senior Editor

From subprime paper to slap shots, Thomas Dundon is making the transition from managing auto finance underwriting and securitizations to overseeing a professional hockey franchise that’s looking to hoist the Stanley Cup once again. Dundon, who built the subprime financing ... [Read More]

Survey reinforces value of online auto financing applications

Thursday, Jan. 11, 2018, 03:44 PM

SubPrime Auto Finance News Staff

Eddie Castillo, general sales manager for the subprime division for Pine Belt Cadillac in Toms River, N.J., described how much a customer who has completed financing online prior to coming to the dealership improves the entire delivery experience — especially ... [Read More]

Top 10 states for 60-day delinquencies in Q3

Wednesday, Jan. 10, 2018, 08:19 PM

SubPrime Auto Finance News Staff

Recovery professionals often see the greatest saturation of 60-day delinquencies within states near or along the Gulf of Mexico. While a pair of those states constituted two of the top three as tracked by Experian Automotive, the state that registered ... [Read More]

CARite secures $45M in funding to boost lease portfolio

Wednesday, Jan. 10, 2018, 05:29 PM

SubPrime Auto Finance News Staff

CARite received an injection of funds to expand its leasing portfolio from a finance provider that has an understanding of what the company is trying to accomplish within the subprime market. On Wednesday, Crystal Financial announced the completion of a ... [Read More]

X