Your service drive is filled with loyal customers who trust your dealership and are physically in your store, yet most...

Read More

Edmunds on why appeal of used EVs could surge as gas prices keep rising & affordability remains challenging

Wednesday, Mar. 11, 2026, 10:30 AM

PODCAST: Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tuesday, Mar. 10, 2026, 10:57 AM

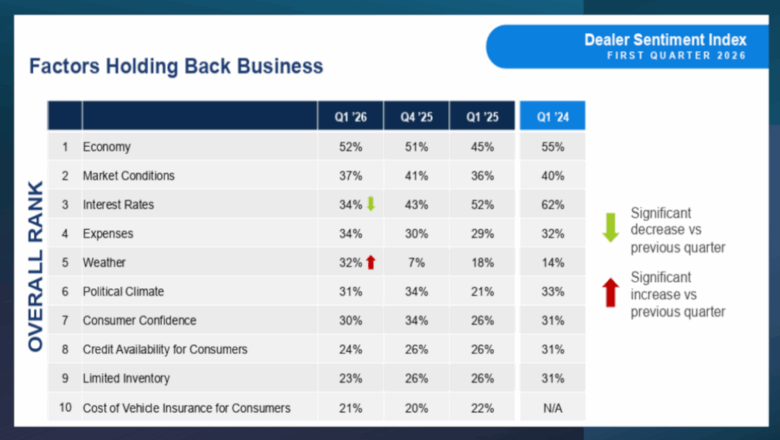

Already the top factor holding back dealership business, potential economic headwinds build

Monday, Mar. 9, 2026, 10:53 AM

Jessica Gonzalez of InformedIQ on growing ‘AI and fraud fatigue’

Jessica Gonzalez, vice president of customer success and general manager of automotive at InformedIQ, appeared again on the Auto Remarketing Podcast to describe growing “AI and fraud fatigue” and other topics connected with auto finance. Listen Here

Wednesday, Mar. 11, 2026, 04:17 PM

Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tim Yalich, who now is vice president of business development for Carleton, returned for an appearance on the Auto Remarketing Podcast. Yalich explained how much more crucial accurate payment information is to today’s car shoppers in an environment with some ... Listen Here

Tuesday, Mar. 10, 2026, 02:48 PM

Widewail CEO Cuyler Owens

Cuyler Owens is CEO of Widewail, a reputation and customer experience platform for the auto industry Cuyler joined Widewail as CEO in December, following nearly three years as chief revenue officer of TrustRadius, and time with Dell, Vmware and Dealerware. ... Listen Here

Monday, Mar. 9, 2026, 08:09 PM

Smith out as Equifax CEO

Tuesday, Sep. 26, 2017, 04:46 PM

SubPrime Auto Finance News Staff

Less than three weeks after revealing a massive cybersecurity data breach, Equifax said that chairman and chief executive officer Richard Smith is retiring from those posts effective today. Current board member Mark Feidler has been appointed non-executive chairman by the ... [Read More]

RoadVantage enhances benefits for lease customers

Monday, Sep. 25, 2017, 02:52 PM

SubPrime Auto Finance News Staff

RoadVantage recently introduced what the F&I program provider called a “powerful and innovative” program for lease customers called Preferred LeaseCare. The company explained this new concept combines the “as you drive” benefits of RoadVantage ancillary products with a lease-end benefit, ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

The Dealer’s Guide to Smarter GPS Tracking

A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

3 more reports question CFPB’s actions and structure

Monday, Sep. 25, 2017, 02:50 PM

SubPrime Auto Finance News Staff

Recent projects completed by the Competitive Enterprise Institute and the Cato Institute again delved into unsatisfactory assessments of the Consumer Financial Protection Bureau. Coinciding with House Republicans chastising the CFPB over its investigation of Wells Fargo, a wide-sweeping survey conducted ... [Read More]

GWC Warranty appoints new chief revenue officer

Friday, Sep. 22, 2017, 03:51 PM

SubPrime Auto Finance News Staff

This week, GWC Warranty, a provider of used-vehicle service contracts sold through dealers, appointed Brian Stach as the company’s new chief revenue officer. In his role, Stach will oversee all of GWC Warranty’s field sales operations, including a nationwide team ... [Read More]

Fed maintains course during latest monetary policy action

Thursday, Sep. 21, 2017, 02:33 PM

SubPrime Auto Finance News Staff

Because of the Federal Reserve’s view of realized and expected labor market conditions and inflation, a unanimous vote of the Federal Open Market Committee decided to maintain the target range for the federal funds rate at 1 percent to 1.25 ... [Read More]

How repossession practices could improve based on latest CFPB report

Wednesday, Sep. 20, 2017, 02:46 PM

Nick Zulovich, Senior Editor

Hudson Cook partner Allen Denson read through the auto-finance portion of the latest Supervisory Highlights shared by the Consumer Financial Protection Bureau and immediately thought of another credit segment. The CFPB’s report described problems bureau representatives found with vehicles being ... [Read More]

Credit Bureau Connection partners with Clarity Services to enhance consumer history analysis

Wednesday, Sep. 20, 2017, 02:43 PM

SubPrime Auto Finance News Staff

Credit Bureau Connection (CBC) and Clarity Services have partnered to provide dealers and finance companies what the service providers say is a first-of-its-kind, comprehensive view of a consumer’s credit history. The companies explained exclusive subprime credit data combined with existing ... [Read More]

New York governor and AG take aggressive actions over Equifax breach

Tuesday, Sep. 19, 2017, 03:26 PM

SubPrime Auto Finance News Staff

Two of the highest ranking officials in New York are using the Equifax security breach to intensify actions within the Empire State, bringing Experian and TransUnion into the matter, too. On Tuesday, Gov. Andrew Cuomo directed the New York Department ... [Read More]

Auto defaults record largest sequential jump in almost 6 years

Tuesday, Sep. 19, 2017, 02:22 PM

SubPrime Auto Finance News Staff

Analysts aren’t panicking, but the auto portion of the S&P/Experian Consumer Credit Default Indices made its largest sequential jump in almost six years. On Tuesday, S&P Dow Jones Indices and Experian released data through August and reported the auto loan ... [Read More]

CitiFinancial Credit to pay DOJ $907K for SCRA violations during repossessions

Monday, Sep. 18, 2017, 07:42 PM

SubPrime Auto Finance News Staff

A suit involving vehicle repossessions and members of the military came to a close Monday. The Justice Department announced that CitiFinancial Credit Co., as successor to CitiFinancial Auto Corp., has agreed to pay $907,000 to resolve allegations that it violated ... [Read More]

X