A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

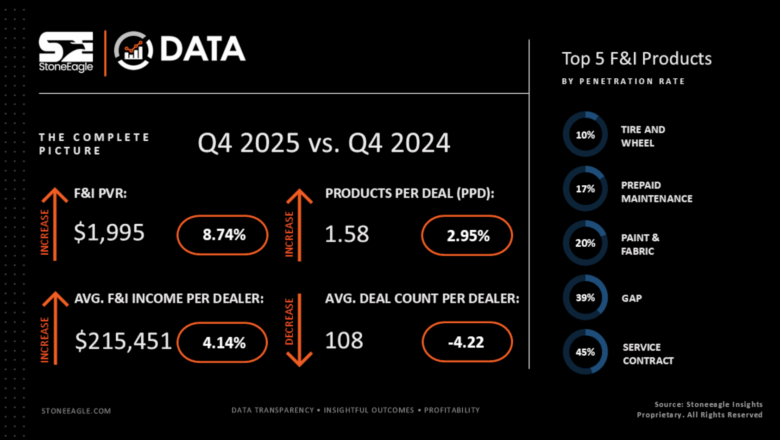

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

Latest Stories

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Spireon claims another honor for customer service

Monday, Sep. 11, 2017, 03:22 PM

SubPrime Auto Finance News Staff

Spireon gets to add another honor to its mantle. The company recently received the prestigious Gold award for customer service in the 2017 Golden Bridge Awards; a program that encompasses the world’s best in organizational performance, innovations, products and services. ... [Read More]

Darwin Automotive now working with 2,000 dealers

Monday, Sep. 11, 2017, 03:21 PM

SubPrime Auto Finance News Staff

F&I software provider Darwin Automotive announced on Monday that it has reached a significant milestone — enrolling its 2,000th dealership nationwide. Since launching just 19 months ago, Darwin Automotive has achieved significant growth across the U.S., securing endorsements with the ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Early fallout of Equifax breach that might impact 143 million consumers

Friday, Sep. 8, 2017, 03:54 PM

Nick Zulovich, Senior Editor

From lawmakers to law firms, Equifax now is in the middle of a financial hurricane as the credit bureau announced late on Thursday that a cybersecurity incident potentially impacted approximately 143 million U.S. consumers. In its announcement, Equifax said criminals exploited ... [Read More]

AUL promotes 2 executives to new positions

Friday, Sep. 8, 2017, 02:26 PM

SubPrime Auto Finance News Staff

This week, vehicle service contracts administrator AUL Corp. announced the executive promotions today of Bryan Nieves to vice president of national accounts and Henry Paoli to national sales manager. According to Jason Garner, AUL’s senior vice president of sales and ... [Read More]

Cordray sticks with CFPB message during Labor Day speech in Ohio

Wednesday, Sep. 6, 2017, 02:29 PM

SubPrime Auto Finance News Staff

If Richard Cordray wanted to make a triumphant announcement that he was running for governor in Ohio, the Consumer Financial Protection Bureau director passed on the opportunity when he gave a speech on Monday during the Cincinnati AFL-CIO Labor Day ... [Read More]

RateGenius hits new milestone, aims for 400,000 refinanced contracts

Wednesday, Sep. 6, 2017, 02:27 PM

SubPrime Auto Finance News Staff

RateGenius, an online auto refinancing platform, recently reached a milestone by refinancing more than 334,738 installment contracts, saving customers an estimated $350.5 million since its inception in 1999. “It’s gratifying to know that we've helped so many people save such ... [Read More]

FCC to examine 11 recommendations for blocking phone calls

Wednesday, Sep. 6, 2017, 02:25 PM

SubPrime Auto Finance News Staff

How collections departments can make contact with customers via phone might be impacted by what the Federal Communications Commission is currently reviewing. The agency’s consumer advisory committee is expected to consider a recommendation from its robocalls working group on blocking unwanted ... [Read More]

Edmunds notices down payments keep rising for used and new financing

Tuesday, Sep. 5, 2017, 02:52 PM

SubPrime Auto Finance News Staff

While many of the August auto finance metrics Edmunds compiled and shared remained stable on a year-over-year basis, analysts did spot one rise that should be pleasing to finance companies. Edmunds noticed increases in down payments in August for both ... [Read More]

FIS and Equifax launch solution to prevent financial fraud and identity theft

Friday, Sep. 1, 2017, 01:46 PM

SubPrime Auto Finance News Staff

Your thumbprint isn’t just for your iPhone any longer. FIS and Equifax recently teamed up to improve consumer experiences by bringing new levels of convenience and security to consumers challenged with maintaining multiple usernames and passwords to protect themselves from ... [Read More]

FactorTrust partners with Enova Decisions to bolster consumer credit availability

Friday, Sep. 1, 2017, 01:44 PM

SubPrime Auto Finance News Staff

This week, alternative credit data provider FactorTrust announced a partnership with predictive analytics and digital decisioning company, Enova Decisions, to integrate FactorTrust’s proprietary data into its Colossus digital decisioning platform. Executives highlighted the integration will strengthen Enova Decisions’ platform with ... [Read More]

X