Edmunds on why appeal of used EVs could surge as gas prices keep rising & affordability remains challenging

Wednesday, Mar. 11, 2026, 10:30 AM

PODCAST: Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tuesday, Mar. 10, 2026, 10:57 AM

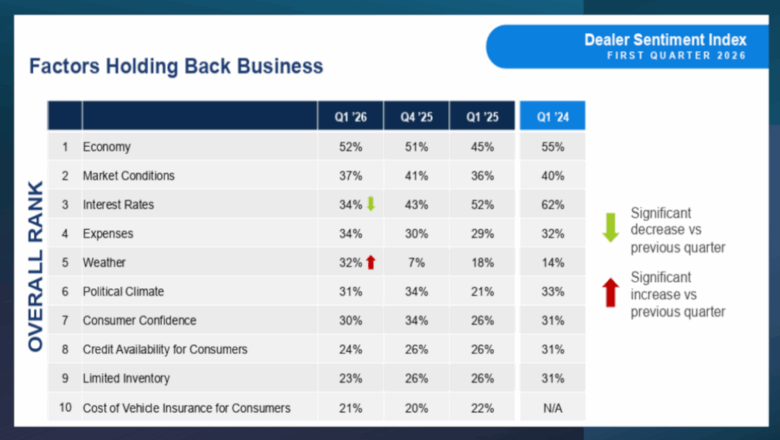

Already the top factor holding back dealership business, potential economic headwinds build

Monday, Mar. 9, 2026, 10:53 AM

Jessica Gonzalez of InformedIQ on growing ‘AI and fraud fatigue’

Jessica Gonzalez, vice president of customer success and general manager of automotive at InformedIQ, appeared again on the Auto Remarketing Podcast to describe growing “AI and fraud fatigue” and other topics connected with auto finance. Listen Here

Wednesday, Mar. 11, 2026, 04:17 PM

Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tim Yalich, who now is vice president of business development for Carleton, returned for an appearance on the Auto Remarketing Podcast. Yalich explained how much more crucial accurate payment information is to today’s car shoppers in an environment with some ... Listen Here

Tuesday, Mar. 10, 2026, 02:48 PM

Widewail CEO Cuyler Owens

Cuyler Owens is CEO of Widewail, a reputation and customer experience platform for the auto industry Cuyler joined Widewail as CEO in December, following nearly three years as chief revenue officer of TrustRadius, and time with Dell, Vmware and Dealerware. ... Listen Here

Monday, Mar. 9, 2026, 08:09 PM

Republicans out to stop CFPB arbitration rule

Friday, Jul. 21, 2017, 02:51 PM

Nick Zulovich, Senior Editor

House and Senate lawmakers wasted little time in using Congressional Review Act (CRA) authority to start an effort to stop the Consumer Financial Protection Bureau’s final rule prohibiting the use of class action waivers in arbitration clauses. The CRA permits ... [Read More]

Great Recession repeat not expected as payment performance likely softens

Friday, Jul. 21, 2017, 02:43 PM

Nick Zulovich, Senior Editor

As experts and policymakers shared a variety of economic trend updates and observations, Fitch Ratings summarized that record-setting payment performance isn’t likely to simply last forever. But at the same time, Fitch reiterated that deterioration of auto finance performance — ... [Read More]

Survey shows strong support for ‘futuristic’ payment technologies

Thursday, Jul. 20, 2017, 01:52 PM

SubPrime Auto Finance News Staff

How contract holders in your auto finance portfolio make future payments continues to be an evolving topic, as a recent survey conducted by Viewpost showed. Viewpost, a network for invoicing, payments and cash management, produced a survey of American consumers ... [Read More]

New arbitration rule now on path to be in effect in September

Wednesday, Jul. 19, 2017, 03:10 PM

Nick Zulovich, Senior Editor

Well, the clock now is officially running with regard to the Consumer Financial Protection Bureau’s final rule prohibiting the use of class action waivers in arbitration clauses. The rule appeared in the Federal Register on Wednesday, meaning that barring a ... [Read More]

4 more enhancements to GWC Warranty’s Dealer Portal

Wednesday, Jul. 19, 2017, 03:05 PM

SubPrime Auto Finance News Staff

Used-vehicle service contract and related finance and insurance product provider GWC Warranty has released Dealer Portal 2.1 — the latest batch of enhancements to GWC’s online dealer resource center. The company highlighted Dealer Portal 2.1 contains a series of new ... [Read More]

ACA International elects 2017-2018 board of directors and officers

Wednesday, Jul. 19, 2017, 03:04 PM

SubPrime Auto Finance News Staff

ACA International elected its new 2017-2018 board of directors and officers this past week as part of the 2017 Convention & Expo in Seattle. New members joining the board for three-year terms are: • Albert Cadena, president and chief executive ... [Read More]

June auto default rate sets 10-year low

Tuesday, Jul. 18, 2017, 03:25 PM

SubPrime Auto Finance News Staff

Perhaps the auto loan component of the S&P/Experian Consumer Credit Default Indices is becoming a game of “how low can you go?” A month after the rate tied a 10-year low, S&P Dow Jones Indices and Experian released data through ... [Read More]

5 reforms when FTC issues civil investigative demands

Monday, Jul. 17, 2017, 08:12 PM

Nick Zulovich, Senior Editor

If a federal investigation into your dealership or finance company ever happens, perhaps here is some good news regarding how it might unfold. Federal Trade Commission acting chairman Maureen Ohlhausen on Monday announced several internal process reforms in the agency’s ... [Read More]

Former Exeter, Capital One exec joins defi SOLUTIONS

Friday, Jul. 14, 2017, 06:37 PM

SubPrime Auto Finance News Staff

An experienced technology expert whose previous career stops included stints with Exeter Finance and Capital One is now bringing his talents to defi SOLUTIONS. The loan origination software and lending technology platform provider announced Keven Sticher has joined the team ... [Read More]

Revamped FNI platform can handle 100K applications per hour

Friday, Jul. 14, 2017, 06:35 PM

SubPrime Auto Finance News Staff

Financial Network Inc. (FNI) said it is launching a new loan origination system platform in August. Among the new features, FNI highlighted the solution boasts additional data services, workbench screens and overall functionality. The company also pointed out the platform ... [Read More]

X