A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

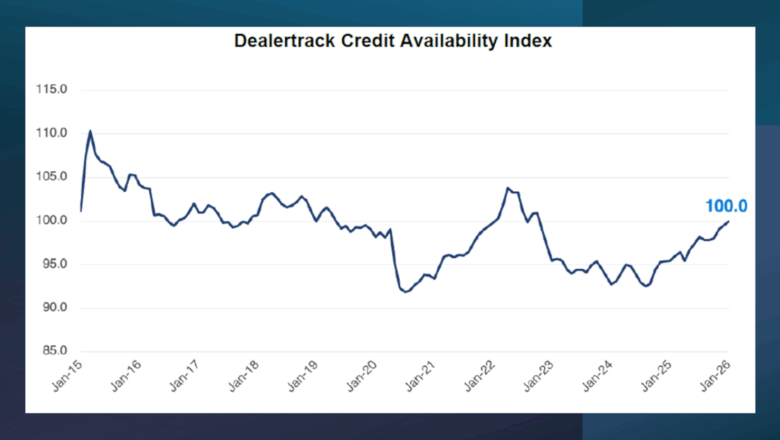

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

Voting closes on President’s Day for 10 industry awards to be given at NARS 2026

Wednesday, Feb. 11, 2026, 01:00 PM

Labor scene still murky, creating potential headwind for automotive

Wednesday, Feb. 11, 2026, 10:38 AM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

2025 Women in Remarketing honorees describe their careers, industry changes & more

One of the foundational parts of Used Car Week each year is the lively conversation among the Women in Remarketing honorees. Moderated again by Brenda Rios of award program sponsor, Ally, hear the valuable perspectives and wisdom from some of ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

Alistair Weaver on Edmunds Top Rated Awards

Edmunds editor-in-chief Alistair Weaver joins the Auto Remarketing Podcast from the NADA Show 2026 expo hall, where he talks with Cherokee Media Group senior editor Joe Overby about the Edmunds Top Rated finalists at the convention, how dealers can use ... Listen Here

Thursday, Feb. 12, 2026, 05:41 PM

13 finance companies assemble to talk fraud

Tuesday, May. 2, 2017, 11:53 PM

SubPrime Auto Finance News Staff

Machine learning and fraud solutions provider PointPredictive recently orchestrated a gathering of six of the nation’s Top 10 and nine of the nation’s Top 20 aimed at tackling the problem of auto finance fraud through collaboration. As a part of ... [Read More]

Compliance diary post No. 3: Enjoying a successful journey

Tuesday, May. 2, 2017, 11:51 PM

Nick Zulovich, Senior Editor

It’s been a little while since I’ve made an entry into my diary about navigating through the rigors of the National Automotive Finance Association’s Consumer Credit Compliance Certification Program. I’m happy to report I can see the certification summit. While ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

7 components when hiring terrific candidates

Monday, May. 1, 2017, 06:45 PM

Don Jasensky, Automotive Personnel

Over the past 28 years in executive search and several years as a general manager at a dealership prior, I have found seven components common to all terrific hires. We focus on these components when we are evaluating candidates and ... [Read More]

FICO answers 5 typical questions to enhance collections

Monday, May. 1, 2017, 02:23 PM

SubPrime Auto Finance News Staff

With delinquencies an ongoing concern, FICO said it has crafted a way to prioritize the account holders with the highest likelihood of paying. FICO discussed the process in its latest white paper, delving into the topic by discussing five questions ... [Read More]

How Q1 GDP figure might frame next rate discussion

Monday, May. 1, 2017, 02:22 PM

SubPrime Auto Finance News Staff

The Federal Open Market Committee within the Federal Reserve is set to conduct its next regularly scheduled meeting on Tuesday and Wednesday. It appears the policymakers have much to discuss since first-quarter gross domestic product figures arrived this past Friday. ... [Read More]

March auto defaults dip 5 basis points

Friday, Apr. 28, 2017, 01:36 PM

SubPrime Auto Finance News Staff

The auto finance component of the S&P/Experian Consumer Credit Default Indices showed contract defaults improved in March both on a year-over-year and sequential basis. According to data released by S&P Dow Jones Indices and Experian, auto loan defaults came in ... [Read More]

Carleton successfully completes SOC 2 audit

Friday, Apr. 28, 2017, 01:35 PM

SubPrime Auto Finance News Staff

Carleton, a provider of compliant financing calculation and document generation solutions, recently announced that it has successfully completed its 2016 SOC 2 compliance audit, conducted by Crowe Horwath. The company highlighted SOC 2 compliance has quickly become a hot topic ... [Read More]

UPDATED: CFPB hits SNAAC with another $1.25M penalty

Thursday, Apr. 27, 2017, 01:45 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau said on Wednesday that Security National Automotive Acceptance Company (SNAAC) violated a consent order from 2015, demanding that the finance company make good on the redress it owes to consumers and pay an additional $1.25 ... [Read More]

White paper tackles 8 common problems during F&I cancellation process

Wednesday, Apr. 26, 2017, 02:46 PM

SubPrime Auto Finance News Staff

F&I Express insisted the F&I product cancellation process currently lacks standardization, automation, transparency and efficiency. F&I Express continued by stating these challenges not only have a negative impact on the day-to-day operations of a product provider or finance company, but ... [Read More]

Recapping crucial debt collection case before Supreme Court

Wednesday, Apr. 26, 2017, 02:45 PM

Nick Zulovich, Senior Editor

Hudson Cook associate Anastasia Caton observed last week’s oral arguments during a crucial debt collection case in front of the Supreme Court that might make third-party efforts within auto finance significantly more difficult depending which way the nine justices rule. ... [Read More]

X