A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

PODCAST: 3 lender executives on affordability & more in auto finance

Tuesday, Jan. 20, 2026, 12:12 PM

SubPrime Auto Finance News Staff

Used Car Week 2025 featured a panel focused on the state of auto finance. Led by Jennifer Martin of the NAF Association, Christopher Mitcham of Santander Consumer USA, Mary Leigh Phillips of Bridgecrest Acceptance and Amy Brooks of Chase Auto ... [Read More]

Former Virginia independent dealer receives 6-year prison sentence for running fraud scheme impacting two dozen lenders

Monday, Jan. 19, 2026, 11:07 AM

SubPrime Auto Finance News Staff

A dealer is being punished for committing fraud that prosecutors said had involved more than two dozen auto-finance providers, resulting in more than $2 million losses. Officials from the U.S. Attorney’s Office for the Eastern District of Virginia said last ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

NCC sees Consumer Document Exchange potentially savings stores more than $100K annually

Monday, Jan. 19, 2026, 11:07 AM

SubPrime Auto Finance News Staff

NCC, a leading provider of integrated credit, compliance, desking, and fraud prevention solutions for automotive retailing, announced the launch of Consumer Document Exchange. Along with a claim of potentially saving a store more than $100,000 annually, the company highlighted the ... [Read More]

COMMENTARY: Cut auto-loan servicing costs by tackling your largest preventable expense

Friday, Jan. 16, 2026, 10:03 AM

Dawn Fretwell, PayNearMe

Most auto lenders know their transaction fees down to the penny. Far fewer can tell you what a failed payment actually costs. Why? Because the expenses hide behind the manual workarounds required to resolve payment-blocking issues. Payment friction is often ... [Read More]

PODCAST: Auto-finance leaders on growth, risk & recovery

Thursday, Jan. 15, 2026, 10:29 AM

SubPrime Auto Finance News Staff

It’s a question any business must answer, but it’s especially important in auto finance. How do you balance growth and risk? A trio of industry executives — Mike Goins of TD Bank, Jeff Marsh of Millennium Capital and Recovery and ... [Read More]

PODCAST: Expectations for repossessions in the US & Canada with Purr’s Chris Schellenberger

Wednesday, Jan. 14, 2026, 03:06 PM

SubPrime Auto Finance News Staff

Purr founder and CEO Chris Schellenberger opened Used Car Week 2025 on the Live Stage presented by SYCN Auto Logistics. Schellenberger, whose unique business model offers a retail consignment platform for repossessed vehicles, discussed what the repo industry could be ... [Read More]

Westlake Financial completes $100M ‘landmark transaction’ with HFC Acceptance

Wednesday, Jan. 14, 2026, 11:02 AM

Nick Zulovich

Instead of booking subprime auto paper, Westlake Financial sold approximately $100 million of subprime auto loans in what it called a “landmark transaction.” Westlake on Tuesday announced the successful sale to HFC Acceptance that included what the companies dubbed a ... [Read More]

Allied Solutions hires former PAR North America COO

Wednesday, Jan. 14, 2026, 09:55 AM

SubPrime Auto Finance News Staff

One of the honorees among the 2023 Women in Collections and Recoveries has a new executive position. Allied Solutions posted on social media this week that Jessie Herdrich Irwin joined the company as its vice president of recovery operations. The ... [Read More]

McGlinchey Stafford to wind down law firm after more than 50 years

Tuesday, Jan. 13, 2026, 10:00 AM

SubPrime Auto Finance News Staff

Here’s an example of how dramatically situations can change for even well-established service providers connected with auto finance. On Dec. 15, McGlinchey Stafford announced the hire of four associates who previously clerked or worked at the law firm across three ... [Read More]

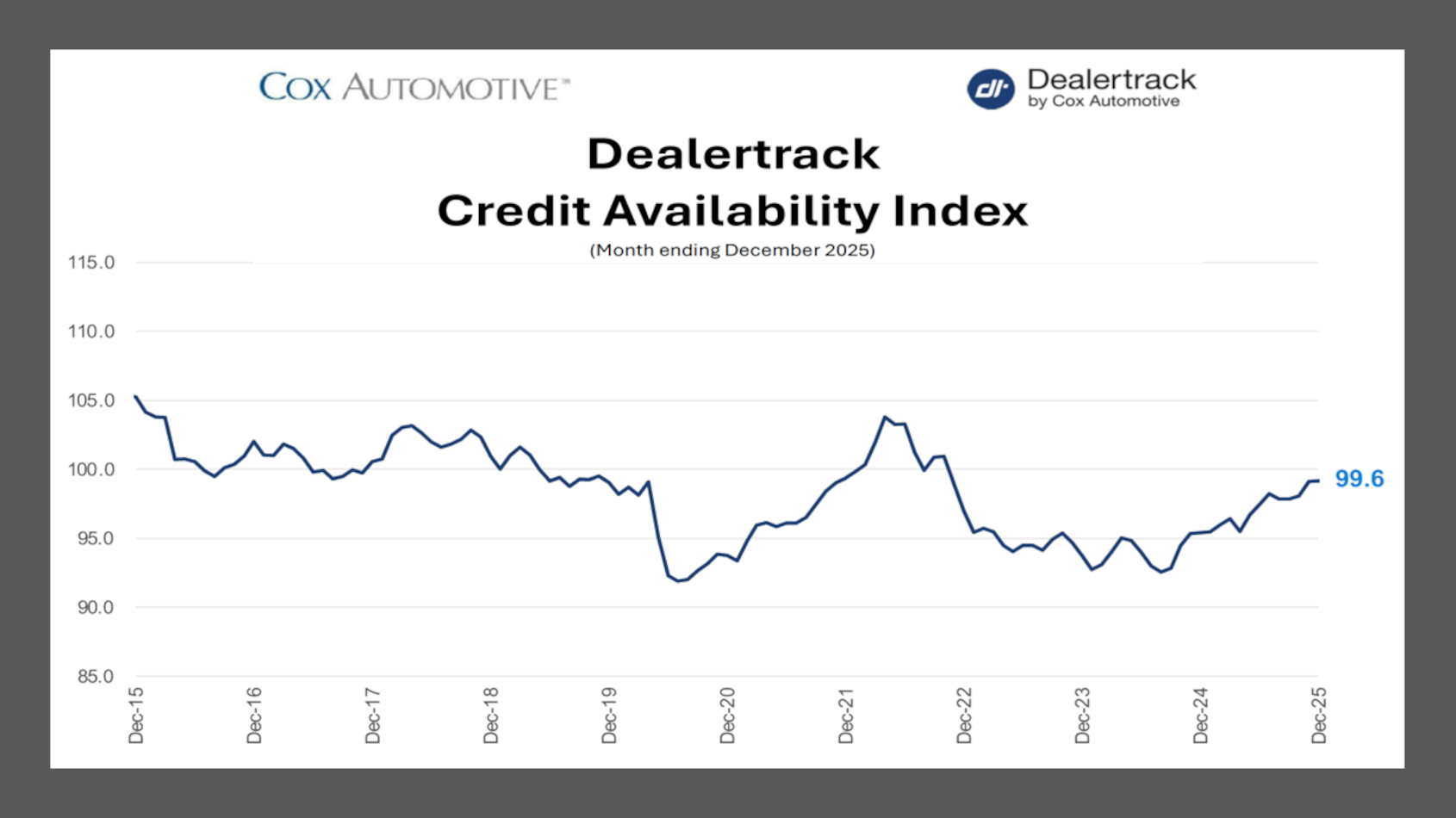

December auto-credit availability climbs to best level in more than 3 years

Monday, Jan. 12, 2026, 10:39 AM

SubPrime Auto Finance News Staff

Jonathan Gregory recapped 2025 from the credit-granting perspective since the December Dealertrack Credit Availability Index reached its highest point of year and reflected the best level since October 2022. The Cox Automotive senior manager of economic and industry insights on ... [Read More]

X