Your service drive is filled with loyal customers who trust your dealership and are physically in your store, yet most...

Read More

Edmunds on why appeal of used EVs could surge as gas prices keep rising & affordability remains challenging

Wednesday, Mar. 11, 2026, 10:30 AM

PODCAST: Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tuesday, Mar. 10, 2026, 10:57 AM

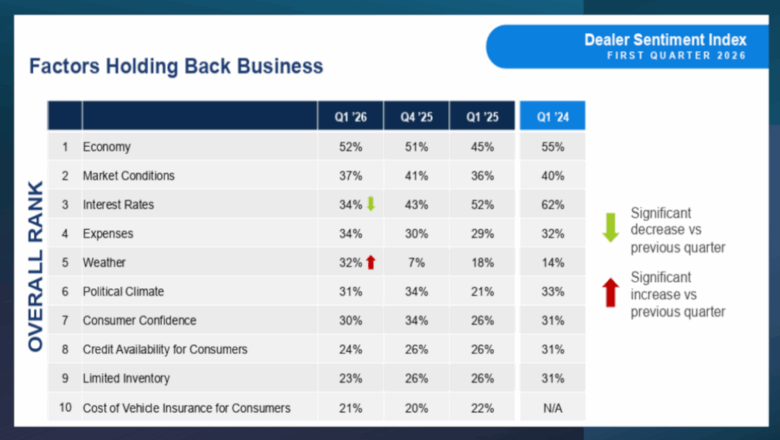

Already the top factor holding back dealership business, potential economic headwinds build

Monday, Mar. 9, 2026, 10:53 AM

Jessica Gonzalez of InformedIQ on growing ‘AI and fraud fatigue’

Jessica Gonzalez, vice president of customer success and general manager of automotive at InformedIQ, appeared again on the Auto Remarketing Podcast to describe growing “AI and fraud fatigue” and other topics connected with auto finance. Listen Here

Wednesday, Mar. 11, 2026, 04:17 PM

Carleton’s Tim Yalich on how critical accurate payment information is to today’s car shoppers

Tim Yalich, who now is vice president of business development for Carleton, returned for an appearance on the Auto Remarketing Podcast. Yalich explained how much more crucial accurate payment information is to today’s car shoppers in an environment with some ... Listen Here

Tuesday, Mar. 10, 2026, 02:48 PM

Widewail CEO Cuyler Owens

Cuyler Owens is CEO of Widewail, a reputation and customer experience platform for the auto industry Cuyler joined Widewail as CEO in December, following nearly three years as chief revenue officer of TrustRadius, and time with Dell, Vmware and Dealerware. ... Listen Here

Monday, Mar. 9, 2026, 08:09 PM

New York AG reaches 6th dealer settlement in past 12 months

Wednesday, Jun. 29, 2016, 02:13 PM

SubPrime Auto Finance News Staff

For the third time in the span of about a year, New York attorney general Eric Schneiderman announced a settlement with a dealership regarding either the advertising or the financing practices conducted by the store. The most recent development is ... [Read More]

Ally appoints Cary to board as Feinberg departs

Wednesday, Jun. 29, 2016, 02:08 PM

Lance Dagenhardt, Correspondent

Ally Financial has added a former General Electric executive to its own board of directors. The company announced this week that William “Bill” Cary has been appointed to the Ally board of directors, filling the role left by Cerberus Capital ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

The Dealer’s Guide to Smarter GPS Tracking

A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Dealers still see subprime availability as big players adjust

Monday, Jun. 27, 2016, 03:50 PM

Nick Zulovich, Senior Editor

The size of the U.S. subprime population is getting smaller — at least that’s what FICO says. And large finance companies such as General Motors Financial again acknowledged that the segment of its portfolio composed of subprime paper will continue to ... [Read More]

SNAAC named top workplace in Cincinnati again

Monday, Jun. 27, 2016, 03:44 PM

Lance Dagenhardt, Correspondent

Security National Automotive Acceptance Co. (SNAAC) was recently named a top workplace in the Cincinnati area, due to positive feedback from employees. SNAAC announced that it has been selected as one of Greater Cincinnati’s Top Workplaces for the third time ... [Read More]

Subprime population drops to lowest point in a decade

Friday, Jun. 24, 2016, 03:42 PM

Nick Zulovich, Senior Editor

While Federal Reserve chair Janet Yellen made her semiannual visit to Capitol Hill this week and shared her thoughts on how much interest rates might rise, FICO highlighted how the auto finance customer population that often is charged the highest ... [Read More]

EFG Companies taps Roennau as vice president of compliance

Friday, Jun. 24, 2016, 03:35 PM

SubPrime Auto Finance News Staff

Reflecting the company’s ongoing mission of driving operational compliance for its dealership clients, EFG Companies appointed Steve Roennau as vice president of compliance this week. EFG highlighted that Roennau brings a 30-year history of driving bottom-line results in automotive F&I, ... [Read More]

Dealer Funding to stop originating as of June 29

Thursday, Jun. 23, 2016, 01:49 PM

Nick Zulovich, Senior Editor

SubPrime Auto Finance News has learned Dealer Funding — a finance company specializing in subprime auto financing for both franchised and independent dealerships — “has paused all new business activities as part of an evaluation of its ongoing business operations.” ... [Read More]

Fitch cautious about summertime subprime ABS movement

Wednesday, Jun. 22, 2016, 03:30 PM

SubPrime Auto Finance News Staff

Fitch Ratings shared its latest update on the topic becoming more of a pressing issue for finance company executives this year — the performance of subprime auto loan ABS. While analysts noticed overall losses and delinquencies improved again in May, ... [Read More]

RouteOne eContracting now available to all Southeast Toyota Finance dealers

Wednesday, Jun. 22, 2016, 03:26 PM

SubPrime Auto Finance News Staff

The stream of developments from RouteOne continued on Tuesday as the company expanded its partnership with Southeast Toyota Finance, the provider of automotive financing for 176 Toyota dealers in the southeastern United States. The expansion includes eContracting on RouteOne’s automotive ... [Read More]

Auto defaults dip again as composite rate sets 10-year low

Tuesday, Jun. 21, 2016, 03:39 PM

Nick Zulovich, Senior Editor

As the overall default reading recorded its lowest point dating back a decade, the auto loan segment of the S&P/Experian Consumer Credit Default Indices made another move away from the 1-percent level in May, dipping 5 basis points below the ... [Read More]

X