A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

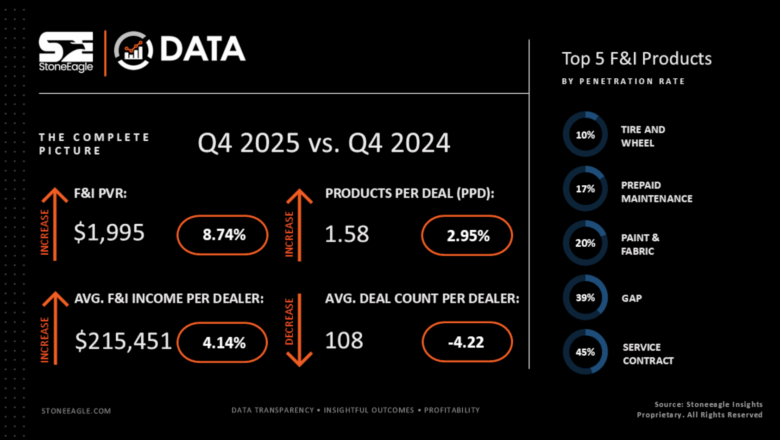

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

Latest Stories

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

CFPB director nominee shares plan to reshape bureau during Senate hearing

Friday, Feb. 28, 2025, 10:05 AM

SubPrime Auto Finance News Staff

The Senate Banking Committee hosted a two-hour hearing on Thursday to question the nominee to be director of the Consumer Financial Protection Bureau, along with nominees to be the Under Secretary of Commerce, chairman of the Council of Economic Advisors ... [Read More]

15 credit unions and banks receive Economic Vehicle Accessibility Awards from Open Lending

Thursday, Feb. 27, 2025, 10:38 AM

SubPrime Auto Finance News Staff

This week, Open Lending announced the 2024 winners of its second annual Economic Vehicle Accessibility Awards (EVAAs). The winning banks and credit unions are Open Lending partners that drive vehicle access through financing opportunities for creditworthy near- and non-prime borrowers. ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

ARA about to close voting for 9 industry awards

Wednesday, Feb. 26, 2025, 01:52 PM

SubPrime Auto Finance News Staff

The American Recovery Association is in the closing days of accepting votes for nine industry awards that will be given at the 2025 North American Repossessors Summit. ARA will gather votes through Friday for the accolades, which will be announced ... [Read More]

Agora Data delves into powersports sector with $12M transaction

Wednesday, Feb. 26, 2025, 11:02 AM

SubPrime Auto Finance News Staff

Agora Data is now in the powersports business. The consumer fintech company specializing in advanced capital solutions and AI-driven loan performance analytics, has completed a $12 million transaction providing liquidity for Model Finance, a powersports finance company. This move represents ... [Read More]

New AVP set to join NextGear, which eyes notable growth this year

Wednesday, Feb. 26, 2025, 11:01 AM

SubPrime Auto Finance News Staff

NextGear Capital is looking to expand its portfolio this year, so the provider of inventory finance solutions serving more than 17,000 independent dealers announced plans to add a new executive. Set to join the team as AVP of corporate operations ... [Read More]

AutoPayPlus names Rodak as controller

Monday, Feb. 24, 2025, 10:29 AM

SubPrime Auto Finance News Staff

Last week, AutoPayPlus by US Equity Advantage announced the hiring of Patricia Rodak as its controller to oversee the company’s accounting functions, financial reporting and compliance efforts. Rodak brings more than 25 years of financial leadership experience, with expertise in ... [Read More]

Explaining slow February on finance & retail fronts

Monday, Feb. 24, 2025, 10:28 AM

Nick Zulovich, Senior Editor

It’s now the last week of February, and you might be struggling to hit your financing and retailing targets for the month. Data and assessments from sources such as Cox Automotive, the IRS and the University of Michigan could explain ... [Read More]

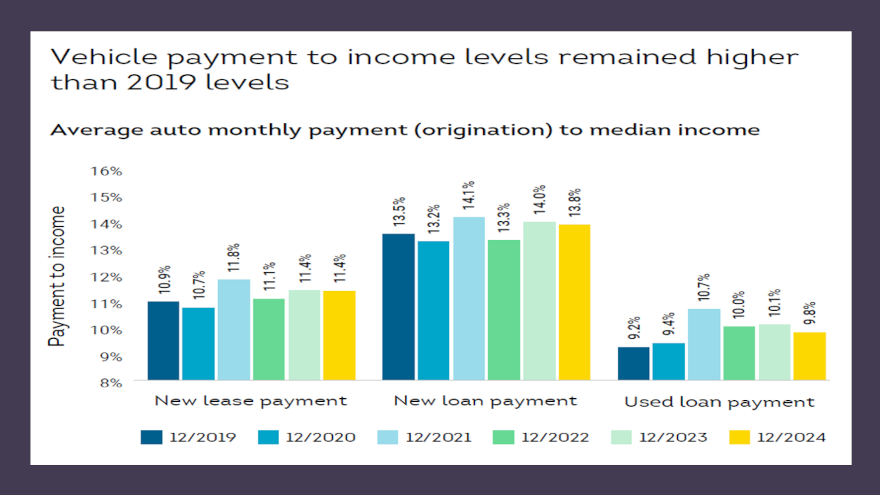

TransUnion: Modest growth in auto finance coming this year

Friday, Feb. 21, 2025, 10:17 AM

SubPrime Auto Finance News Staff

While perhaps not a clip that will set records, TransUnion is expecting some growth in auto financing this year. Previously held back by stubbornly high inflation, rising interest rates and elevated home and vehicle prices, TransUnion said this week that ... [Read More]

New Protective Asset Protection report highlights dealer gains in F&I

Thursday, Feb. 20, 2025, 11:31 AM

SubPrime Auto Finance News Staff

Here’s a positive trend happening in the finance office at one in five dealerships, according to Protective Asset Protection. The provider of F&I programs and services said at least 75% of the car buyers at that store purchased F&I products ... [Read More]

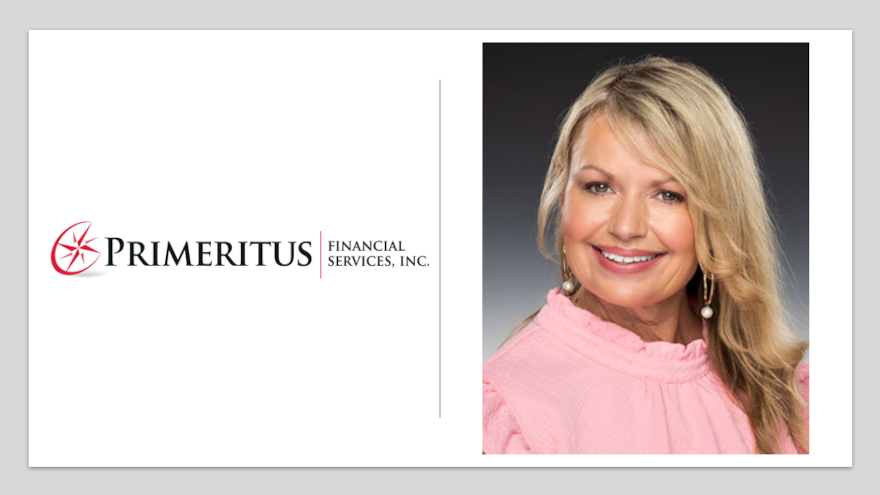

Carson’s successful path leads to promotion at Primeritus

Wednesday, Feb. 19, 2025, 01:41 PM

SubPrime Auto Finance News Staff

Misty Carson’s productivity and successes at Primeritus Financial Services have led to an executive promotion within the provider of repossession management, skip-tracing and remarketing services for the auto finance and insurance industries. On Tuesday, Primeritus announced the promotion of Carson ... [Read More]

X