Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Federal & state regulators revisit elder financial exploitation

Tuesday, Dec. 10, 2024, 10:32 AM

SubPrime Auto Finance News Staff

It might very well be the case that a 97-year-old consumer is applying for financing to take delivery of a $97,000 luxury SUV. Or it could be someone with illegal intentions trying to take advantage of that elderly individual. Last ... [Read More]

S&P Global Ratings offers 2025 forecast, answers worldwide economic questions

Monday, Dec. 9, 2024, 11:18 AM

SubPrime Auto Finance News Staff

Let’s take a worldwide economic outlook courtesy of S&P Global Ratings, which touched on both domestic and international trends that could eventually impact automotive financing and retailing. Analysts said last week that economic soft landings in many major economies and ... [Read More]

RouteOne co-founder joins Lender Compliance Technologies

Friday, Dec. 6, 2024, 10:42 AM

SubPrime Auto Finance News Staff

Lender Compliance Technologies (LCT) reinforced its executive team on Thursday as the previous Emerging 8 honoree continues to roll out Refund Control, a finance company-managed cloud platform for tracking and managing F&I product cancellations and consumer refunds. Joining LCT as ... [Read More]

PODCAST: Experian connects vehicle collateral quality with defaults

Friday, Dec. 6, 2024, 10:41 AM

SubPrime Auto Finance News Staff

Experian Automotive senior director Jim Maguire came to Used Car Week 2024 in Scottsdale, Ariz., with a straightforward premise for his presentation: the connection between vehicle collateral quality and the likelihood of default. After spending time with attendees, Maguire gave ... [Read More]

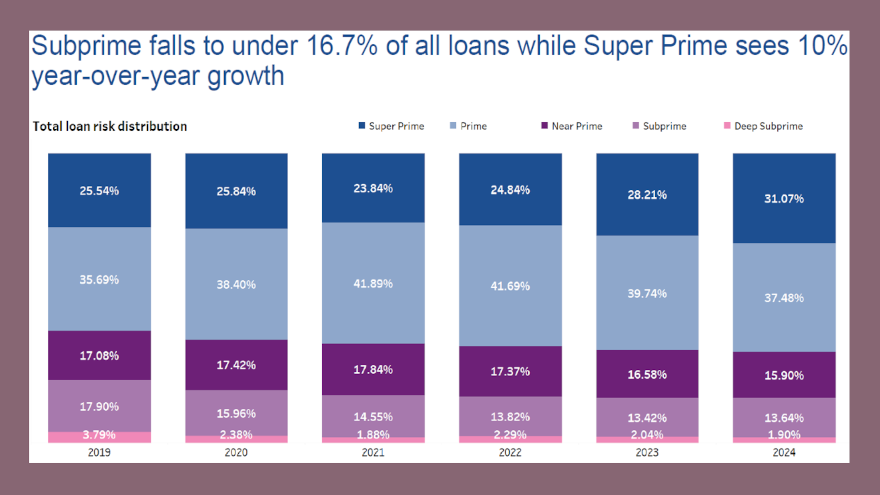

Experian: Affordability continues to be major factor in Q3 financing

Thursday, Dec. 5, 2024, 09:52 AM

SubPrime Auto Finance News Staff

Affordability evidently isn’t just a consideration within the subprime market. Experian highlighted on Thursday that affordability also is pushing some prime and super prime consumers to return to used vehicles. That’s just one of the findings included in Experian’s State ... [Read More]

PODCAST: Talking product refunds at Used Car Week

Wednesday, Dec. 4, 2024, 01:46 PM

SubPrime Auto Finance News Staff

We continue our episodes of the Auto Remarketing Podcast originating from Used Car Week 2024 in Scottsdale, Ariz., with another conversation about product refunds — perhaps one of the most complex parts of auto finance. Nancy Coleman of Stellantis Financial ... [Read More]

Multiple workplace honors for Credit Acceptance & RoadVantage

Wednesday, Dec. 4, 2024, 11:08 AM

SubPrime Auto Finance News Staff

It’s been a fall filled with accolades for Credit Acceptance and RoadVantage, which both received honors for their workplaces. While RoadVantage was among the honorees in the Austin American-Statesman’s Top Workplaces recognition program for the fourth time, Credit Acceptance added ... [Read More]

CFPB unveils proposal to stop data brokers from selling sensitive personal data to scammers, stalkers & spies

Tuesday, Dec. 3, 2024, 10:50 AM

SubPrime Auto Finance News Staff

Perhaps this proposal from the Consumer Financial Protection Bureau (CFPB) is an idea that everyone can support. The bureau on Tuesday proposed a rule that it said will rein in data brokers that sell Americans’ sensitive personal and financial information. ... [Read More]

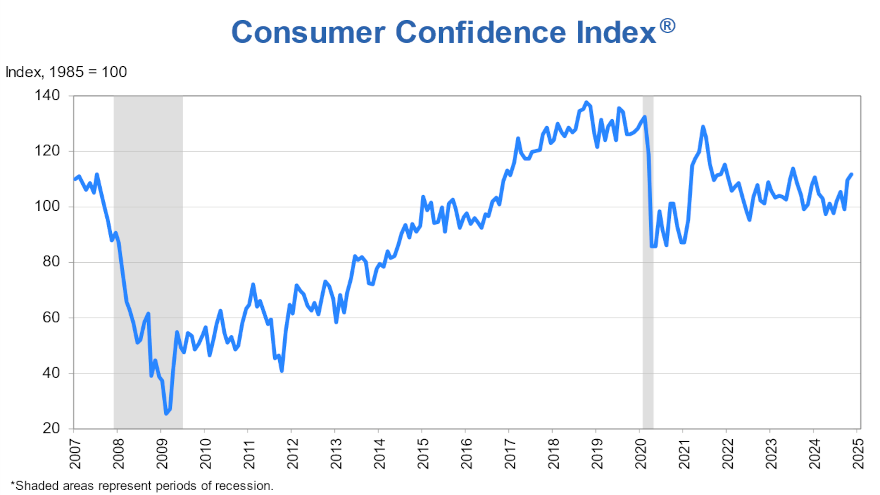

Current economic sentiments point to positive outlook for vehicle sales

Monday, Dec. 2, 2024, 11:02 AM

SubPrime Auto Finance News Staff

Perhaps consumers are thankful for more than just the tasty Thanksgiving turkey and navigating through awkward family conversations around the dinner table. Insight from both the Conference Board and Comerica Bank pointed toward trends that might benefit dealerships and finance ... [Read More]

FTC acknowledges closed-door meeting about unfair fees

Wednesday, Nov. 27, 2024, 10:09 AM

SubPrime Auto Finance News Staff

Executives inside and outside of automotive who might already be skeptical of what happens in Washington, D.C., probably aren’t surprised a major federal agency conducted a closed-door meeting. But the Federal Trade Commission acknowledged that it orchestrated one last week ... [Read More]

X