A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

Dealertrack Compliance Guide turns 20

Wednesday, Jan. 15, 2025, 11:37 AM

SubPrime Auto Finance News Staff

Cox Automotive hit a longevity milestone with one of its resources for dealerships. On Tuesday, the industry giant released its annual Dealertrack Compliance Guide for 2025, its 20th edition. As the automotive industry remains stable yet faces major market shifts ... [Read More]

Beck’s next stop in automotive is with Agora Data

Wednesday, Jan. 15, 2025, 11:35 AM

SubPrime Auto Finance News Staff

Jeremy Beck has embarked on another segment of his professional journey in automotive. Beck, whose career includes time with the National Independent Automobile Dealers Association, APCO Holdings, GWC Warranty and Ally Financial, now is vice president of sales strategy for ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

EFG Companies: 2025 is full of opportunities for dealers and lenders

Tuesday, Jan. 14, 2025, 10:44 AM

SubPrime Auto Finance News Staff

Four top leaders at EFG Companies acknowledged economic challenges, including vehicle affordability, inflation, and interest rates, made for some rough sledding for automotive financing and retailing in 2024. But the quartet thinks this year is going to be much different, ... [Read More]

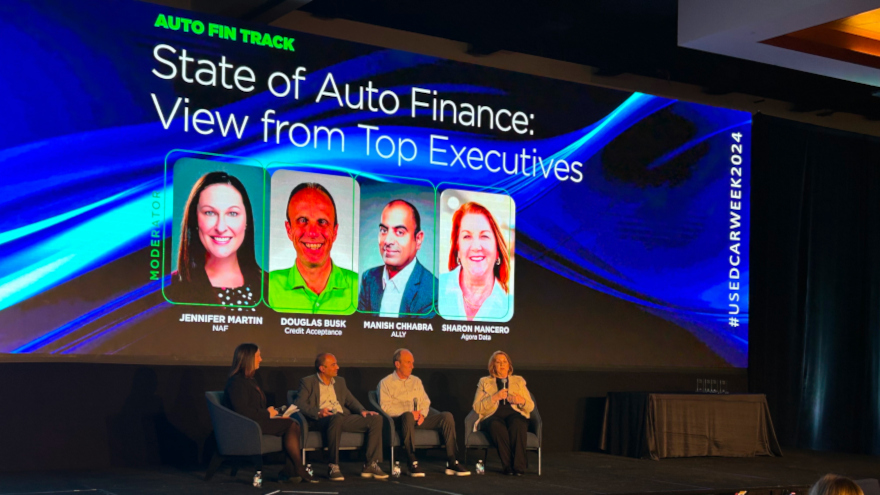

PODCAST: Executives on subprime market & 2025 expectations

Monday, Jan. 13, 2025, 11:29 AM

SubPrime Auto Finance News Staff

We continue our episodes of the Auto Remarketing Podcast originating from Used Car Week 2024 in Scottsdale, Ariz., with an executive panel moderated by Jennifer Martin of the National Automotive Finance Association. Discussing the subprime market, expectations for this year ... [Read More]

ARA & MBSi partner to streamline compliance mandates in repossession & recovery

Monday, Jan. 13, 2025, 11:29 AM

SubPrime Auto Finance News Staff

More synergy in repossession and recovery spaces surfaced on Monday. The American Recovery Association (ARA) and MBSi announced a new partnership providing MBSi users the ability to accept ARA’s Compliance System within its RecoveryConnect platform. The move is meant to ... [Read More]

Glenview Finance lands new VP, relationship with RouteOne

Friday, Jan. 10, 2025, 11:00 AM

SubPrime Auto Finance News Staff

Glenview Finance made a couple of moves this week to reinforce its market position; one associated with personnel and the other with technology. Along with bringing aboard a new vice president of business development who previously spent nine years with ... [Read More]

Vitu finalizes acquisition of Dealertrack registration & titling businesses from Cox Automotive

Friday, Jan. 10, 2025, 10:59 AM

SubPrime Auto Finance News Staff

Vitu, a leading innovator in vehicle-to-government (V2Gov) technology, announced this week that it has successfully closed on its acquisition of the Dealertrack registration and titling businesses from Cox Automotive. Through a development first revealed just before Thanksgiving, the acquired businesses ... [Read More]

Flagship Credit Acceptance welcomes new chief risk officer

Thursday, Jan. 9, 2025, 11:26 AM

SubPrime Auto Finance News Staff

An executive whose career includes time with DriveTime Automotive and Capital One now is with Flagship Credit Acceptance. Continuing a string of industry executive moves to begin the year, Flagship Credit Acceptance on Wednesday appointed Matthew Long to be its ... [Read More]

LCT welcomes former EY managing director to board of advisors

Wednesday, Jan. 8, 2025, 11:32 AM

SubPrime Auto Finance News Staff

Lender Compliance Technologies (LCT) has a new resource to guide its way through the world of compliance solutions for managing F&I product refunds. LCT on Tuesday announced the appointment of Bob Johnson to its board of advisors. The company said ... [Read More]

CFPB targets Experian via lawsuit over credit report errors

Wednesday, Jan. 8, 2025, 11:32 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) is suing Experian, claiming the nationwide consumer reporting agency is unlawfully failing to properly investigate consumer disputes. According to a news release distributed on Tuesday, the CFPB alleges that Experian does not take sufficient ... [Read More]

X