Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Former United Auto Credit & Westlake executive becomes SAFCO’s new chief risk officer

Tuesday, Nov. 26, 2024, 11:21 AM

SubPrime Auto Finance News Staff

On Monday, Southern Auto Finance Co. (SAFCO) welcomed Brian Hopper as its new senior vice president and chief risk officer, bringing more than 20 years of expertise in risk management and strategic portfolio oversight to the company that specializes in ... [Read More]

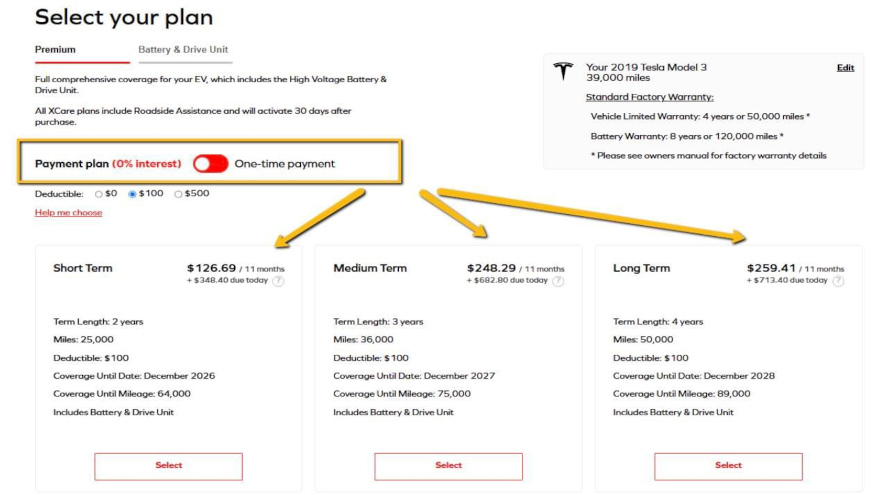

Xcelerate Auto partners with Service Payment Plan to launch interest-free payment plan for EV warranties

Monday, Nov. 25, 2024, 12:04 PM

SubPrime Auto Finance News Staff

Xcelerate Auto, a Texas-based provider of electric vehicle leasing, financing and warranty solutions, recently introduced a new payment option for its XCare EV Protection plan. Through an exclusive partnership with Service Payment Plan (SPP), Xcelerate now can enable customers to ... [Read More]

CFPB examines carveouts in state data privacy laws for financial institutions

Monday, Nov. 25, 2024, 12:03 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau recently released a report examining federal and state-level privacy protections for consumers’ financial data. The regulator said its report noted that protections under federal regulations for financial data have limits. Yet, officials pointed out many ... [Read More]

Cox Automotive sells off another F&I tool as Vitu to acquire Dealertrack’s titling division

Monday, Nov. 25, 2024, 11:39 AM

SubPrime Auto Finance News Staff

Cox Automotive began the year by selling its product cancellation and refund tool to F&I Sentinel. Then on Monday, Vitu, an innovator in vehicle-to-government (V2Gov) technology, announced it has entered into a definitive agreement to acquire the Dealertrack registration and ... [Read More]

Top 3 findings of Near- and Non-Prime Consumer Brief from Open Lending

Friday, Nov. 15, 2024, 10:22 AM

SubPrime Auto Finance News Staff

On Thursday, Open Lending Corp. released a Near- and Non-Prime Consumer Brief, the latest installment in its quarterly series of data reports on vehicle registrations. Despite continued challenges in the vehicle market, the report highlighted new-vehicle registrations have risen and ... [Read More]

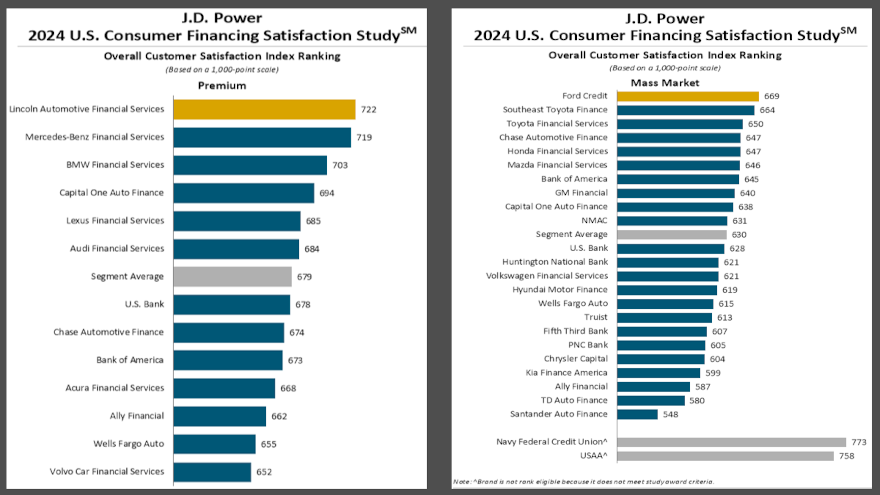

Revamped JD Power Consumer Financing Satisfaction Study focuses on ‘financially vulnerable’

Thursday, Nov. 14, 2024, 10:00 AM

SubPrime Auto Finance News Staff

Beyond the rankings of finance companies for how they met consumer expectations, a focal point of the J.D. Power 2024 U.S. Consumer Financing Satisfaction Study was what analysts classified as “financially vulnerable.” J.D. Power measures the financial health of any ... [Read More]

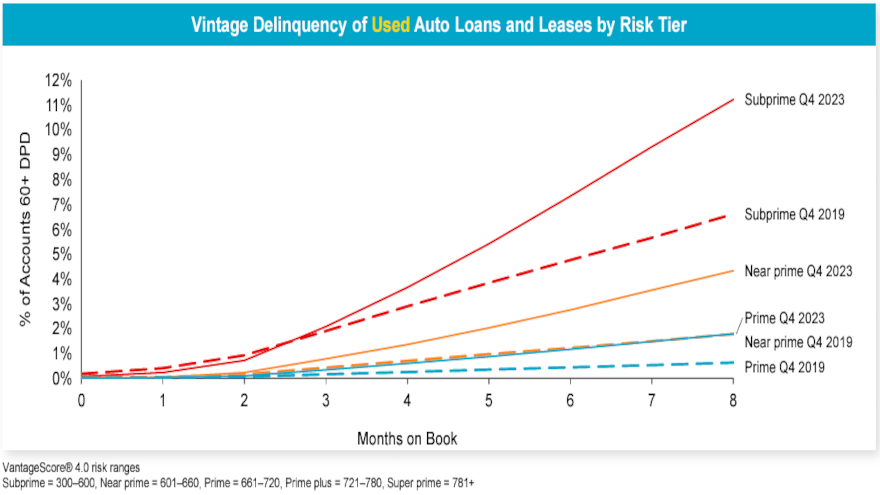

More insight from Equifax & TransUnion about Q3 delinquency

Wednesday, Nov. 13, 2024, 02:39 PM

SubPrime Auto Finance News Staff

Both Equifax and TransUnion discussed delinquency in auto finance this week, with one of the credit bureaus highlighting the rate associated with subprime used-car paper booked less than a year ago. TransUnion indicated that serious consumer-level delinquency rates — contracts ... [Read More]

First 2 recipients of donations from new Endurance Cares program

Wednesday, Nov. 13, 2024, 11:15 AM

SubPrime Auto Finance News Staff

Endurance on Tuesday announced the launch of its social impact initiative, Endurance Cares, with two donations totaling $20,000. The provider of auto protection plans in the U.S. said these contributions are part of Endurance Cares’ mission to foster community growth ... [Read More]

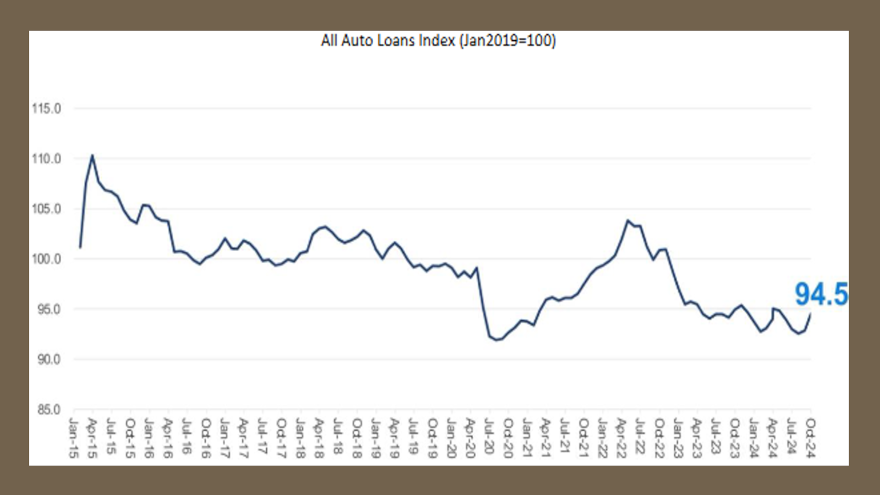

Credit availability eases again in October

Wednesday, Nov. 13, 2024, 11:14 AM

SubPrime Auto Finance News Staff

The Dealertrack Credit Availability Index in October posted the largest month-over-month increase in auto credit access since March 2022. Cox Automotive reported this week that the index reading came in at 94.5 in October, up 2.2% from the September reading ... [Read More]

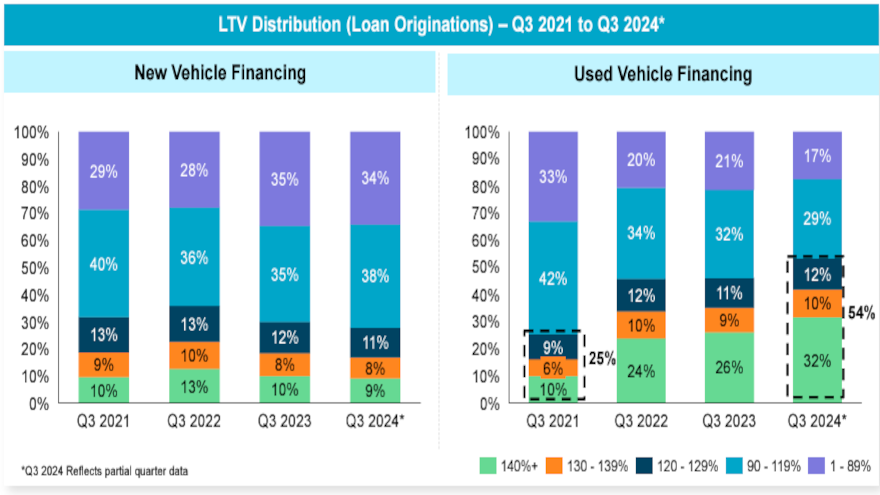

TransUnion: LTVs above 120% for used cars have doubled in past 3 years

Tuesday, Nov. 12, 2024, 10:23 AM

SubPrime Auto Finance News Staff

Along with taking an overall look at monthly payments and delinquency, the auto portion of the Q3 2024 Quarterly Credit Industry Insights Report (CIIR) from TransUnion detailed a metric that might illustrate the callbacks, dialogue and negotiations that dealerships and ... [Read More]

X