A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

FTC’s Holyoak discusses debt collection when recapping regulator’s activities to reduce fraud

Monday, Nov. 11, 2024, 11:02 AM

SubPrime Auto Finance News Staff

Commissioner Melissa Holyoak represented the Federal Trade Commission last week at the Freedom from Fraud event presented to Utah’s Pacific-Islander community. After sharing what she called “sobering statistics,” Holyoak delved into multiple ways the FTC tries to curb fraud, drilling ... [Read More]

Experts give auto-finance outlook after another Fed rate cut & Trump election victory

Friday, Nov. 8, 2024, 11:13 AM

Nick Zulovich, Senior Editor

It’s been a busy week. Donald Trump claimed victory in his bid to return to the White House on Tuesday, and the Federal Reserve cut interest rates again on Thursday. Those developments might not directly impact the vehicles your dealership ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Results & recommendations from federal audit of CFPB’s information security program

Thursday, Nov. 7, 2024, 10:49 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau got to experience what it’s like to go through an examination. The Office of Inspector General (OIG) within the Federal Reserve recently released findings and recommendations of its 2024 audit of the CFPB’s information security ... [Read More]

ARA still accepting nominations for 9 industry awards

Wednesday, Nov. 6, 2024, 12:12 PM

SubPrime Auto Finance News Staff

The American Recovery Association is still collecting nominations for nine industry awards that will be given at the 2025 North American Repossessors Summit. ARA will gather nominations through Friday for the accolades to be announced during the event that’s on ... [Read More]

5 components of Treasury Department’s National Strategy for Financial Inclusion

Wednesday, Nov. 6, 2024, 11:10 AM

SubPrime Auto Finance News Staff

Last week, the U.S. Department of the Treasury released a new project dubbed the National Strategy for Financial Inclusion in the United States. Treasury officials said they identified objectives and recommendations for policymakers, industry, employers and community organizations to advance ... [Read More]

CPS sees savings of $1M per quarter using SentiLink’s fraud prevention tools

Monday, Nov. 4, 2024, 10:43 AM

SubPrime Auto Finance News Staff

On Monday, Consumer Portfolio Services recapped the success stemming from its decision to partner with SentiLink, a provider of advanced identity verification and fraud detection solutions. The subprime auto finance company said the partnership enabled CPS to improve its fraud ... [Read More]

FTC now sending more than $1M to impacted customers of Wisconsin dealer group

Monday, Nov. 4, 2024, 10:43 AM

SubPrime Auto Finance News Staff

Roughly a year after a Wisconsin auto dealer group was penalized by the Federal Trade Commission and the Wisconsin attorney general for what authorities deemed to be discriminatory F&I activities, the FTC is beginning to send more than $1 million ... [Read More]

NAF Association touts success of Compliance Champions Workshop

Thursday, Oct. 31, 2024, 09:55 AM

SubPrime Auto Finance News Staff

The National Automotive Finance Association orchestrated another successful event this week. The focus again was compliance. NAF Association officials said more than 50 auto finance professionals gathered in Irving, Texas, for their Compliance Champions Workshop. They said attendees engaged in ... [Read More]

Foster’s 40-year career now includes being named Repossession Agent of the Year

Wednesday, Oct. 30, 2024, 01:15 PM

Nick Zulovich, Senior Editor

Auto finance usually isn’t a dangerous profession. But being a repossession agent certainly can be when delinquent contract holders respond with violence as the recovery professional is tasked with taking back the collateral for failure to stay current on monthly ... [Read More]

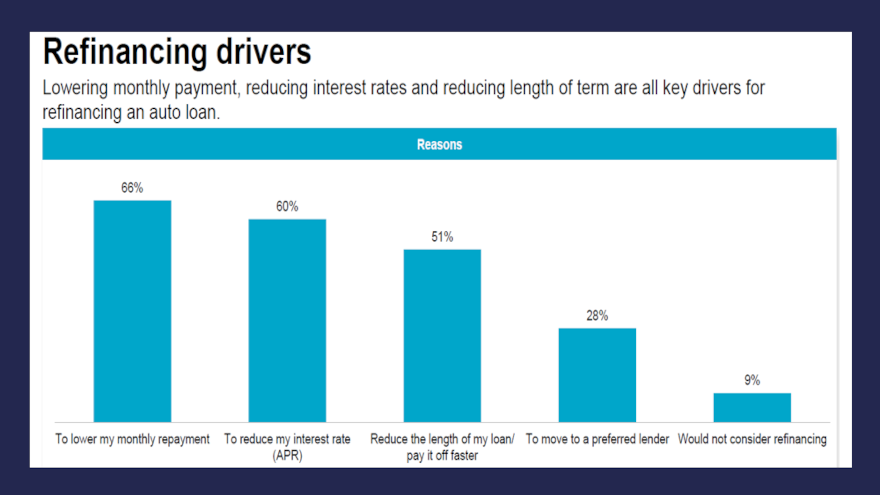

New TransUnion research highlights broad interest in refinancing

Wednesday, Oct. 30, 2024, 10:44 AM

SubPrime Auto Finance News Staff

The customer who took delivery at your dealership a year or more ago might still like the vehicle but not the monthly payment. With the rates appearing to be on a downward path, TransUnion wanted to gauge consumer interest in ... [Read More]

X