Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

ARA reacts to Supreme Court overturning Chevron Doctrine

Wednesday, Jul. 17, 2024, 02:02 PM

SubPrime Auto Finance News Staff

The American Recovery Association board sent an industry message this week, reacting to the Supreme Court’s 6-3 decision overturning what’s been widely known in legal circles as the Chevron Doctrine. ARA first gave a brief explanation of what the Chevron ... [Read More]

Hellman & Friedman becomes majority investor in Safe-Guard

Wednesday, Jul. 17, 2024, 11:05 AM

SubPrime Auto Finance News Staff

Safe-Guard Products International announced this week that it has closed on a majority investment from Hellman & Friedman, one of the world’s largest private equity firms. Specific financial details were not included in a news release from the provider of ... [Read More]

F&I Sentinel partners with defi SOLUTIONS, helping mutual clients with compliance needs

Wednesday, Jul. 17, 2024, 11:04 AM

SubPrime Auto Finance News Staff

F&I Sentinel finalized a partnership with defi SOLUTIONS on Tuesday in a move designed to increase efficiency and accuracy through automation, while improving F&I product compliance for auto finance companies, dealers and product providers. Through the partnership, defi XLOS and ... [Read More]

US Court of Appeals sets time for CARS Rule arguments

Monday, Jul. 15, 2024, 11:17 AM

Nick Zulovich, Senior Editor

Hudson Cook partner Eric Johnson made a clever quip on LinkedIn late last week. “So, Friday is typically a slow news day? Think again,” Johnson wrote in this post because the U.S. Court of Appeals for the Fifth Circuit closed ... [Read More]

Line\5 & MenuMetric integrate to streamline F&I product selection

Monday, Jul. 15, 2024, 11:15 AM

SubPrime Auto Finance News Staff

Line\5 announced a new integration with MenuMetric last week in a move the service providers said can generate a seamless and efficient experience for both dealerships and their customers. This strategic partnership aims to enhance the efficiency of F&I product ... [Read More]

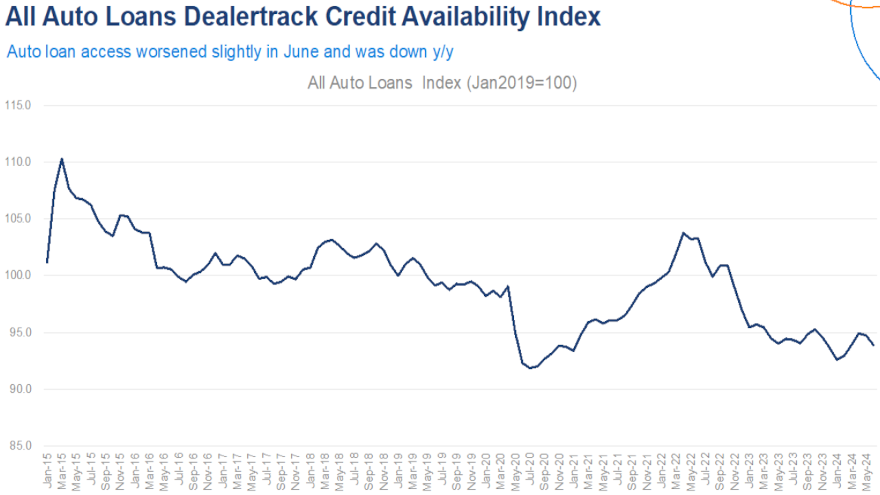

Dealertrack index for June shows more credit tightening

Thursday, Jul. 11, 2024, 10:42 AM

SubPrime Auto Finance News Staff

First, Edmunds highlighted how much negative equity and lengthening terms surfaced within auto financing booked during the second quarter. Then, Cox Automotive pointed out how difficult it might have been to get approved for auto financing at all last month. ... [Read More]

Open Lending adds another insurance provider to boost Lenders Protection

Wednesday, Jul. 10, 2024, 11:58 AM

SubPrime Auto Finance News Staff

Open Lending Corp. is looking to help consumers land both auto financing and car insurance. The provider of risk analytics solutions for financial institutions announced on Wednesday a partnership with Securian Financial Group in a move designed to enable Open ... [Read More]

Trust Science & Conecta partner to help finance companies find ‘invisible prime prospects’

Wednesday, Jul. 10, 2024, 11:57 AM

SubPrime Auto Finance News Staff

Two service providers now are collaborating to help finance companies build originations with “invisible prime prospects.” On Tuesday, Trust Science and Conecta Marketing Group announced a strategic partnership. The companies explained Trust Science’s artificial intelligence-powered credit decisioning platform will enhance ... [Read More]

CFPB penalizes Fifth Third Bank again for auto-finance activities

Wednesday, Jul. 10, 2024, 11:53 AM

SubPrime Auto Finance News Staff

For the second time in the past decade, Fifth Third Bank is facing a multi-million-dollar penalty from the Consumer Financial Protection Bureau (CFPB) involving its activities with auto financing. The CFPB said on Tuesday that it’s taking enforcement actions against ... [Read More]

Final-payment collecting catches CFPB’s attention

Tuesday, Jul. 9, 2024, 09:58 AM

SubPrime Auto Finance News Staff

Just ahead of Fourth of July, the Consumer Financial Protection Bureau released its summer installment of Supervisory Highlights, which included the regulator’s examination of auto financing servicing activities. The bureau said it primarily assessed servicers’ compliance with the Consumer Financial ... [Read More]

X