A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

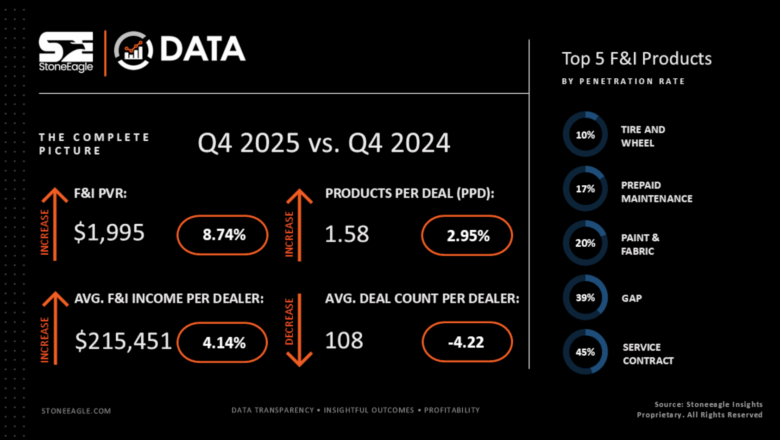

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Huntington Bancshares Declares Quarterly Cash Dividend

Monday, Jan. 9, 2012, 12:00 AM

Nick Zulovich

COLUMBUS, Ohio — Huntington Bancshares announced late last week that it has declared a quarterly cash dividend on its Floating Rate Series B Non-Cumulative Perpetual Preferred Stock. The dividend is $1.5469 per share. Officials also noted that the dividend is ... [Read More]

Auto Financing Panel Discussions Highlight Consumer Bankers Association’s Upcoming Event

Monday, Jan. 9, 2012, 12:00 AM

Nick Zulovich

ARLINGTON, Va. — With panels about how buyers obtain vehicle financing, the Consumer Financial Protection Bureau and more, the Consumer Bankers Association is packing several discussions into a three-day event. Officials from the National Automobile Dealers Association, the American Financial ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Valley First Credit Union Switches to VINtek ELT Services

Friday, Jan. 6, 2012, 12:00 AM

Nick Zulovich

PHILADELPHIA — VINtek recently highlighted Valley First Credit Union selected the company as its technology provider to better manage members' vehicle titles. Valley First Credit Union is based in Modesto, Calif., and serves nearly 53,000 members through eight locations in California. ... [Read More]

ABA Finds Direct Auto Loan Delinquencies Extend Unprecedented String of Low Levels

Friday, Jan. 6, 2012, 12:00 AM

Nick Zulovich

WASHINGTON, D.C. — Direct auto loan delinquency levels continued on an unprecedented stretch of low readings during the third quarter, according to the American Bankers Association's Consumer Credit Delinquency Bulletin. The auto loan category dropped below its previous low-water mark ... [Read More]

AFSA Vehicle Finance Conference: Time is Running Out for Discounted Bellagio Rate

Friday, Jan. 6, 2012, 12:00 AM

Nick Zulovich

LAS VEGAS — Those planning to head to the American Financial Services Association’s 16th Annual Vehicle Finance Conference and Exposition might want to make hotel reservations this weekend, at the latest. AFSA reminded attendees this week that the Las Vegas Bellagio, the ... [Read More]

Altes Spots Potential Pitfalls of Voluntary Repossessions

Friday, Jan. 6, 2012, 12:00 AM

Nick Zulovich

DAYTONA BEACH, Fla. — Veteran repossessor and Time Finance Adjusters executive Patrick Altes believes there has been an industry myth circulating for years about how voluntary repossessions are expected to unfold easier for both agents and lenders. However, Altes takes ... [Read More]

CARS Officially Launches Right to Cure Auction for Repossessed Units

Wednesday, Jan. 4, 2012, 12:00 AM

Nick Zulovich

RALEIGH, N.C. — Along with forging two other partnerships with technology providers for compliance and more, Consolidated Asset Recovery Systems officially began its Right to Cure Auction through relationships with Copart and Asset Nation. As CARS discussed previously in leading ... [Read More]

AutoCreditApproved.com Broadens Certified Dealer Network

Wednesday, Jan. 4, 2012, 12:00 AM

Nick Zulovich

NASHVILLE, Tenn. — Officials from AutoCreditApproved.com, a website that connects consumers with poor credit to willing lenders, recently added a certified dealership partner in Nashville, Tenn. The site now is connected with Wholesale Inc. AutoCreditApproved.com chief executive officer Sean Bradley ... [Read More]

ABI: A Double-Digit 2011 Bankruptcy Drop Reflects Consumer, Commercial Recovery

Wednesday, Jan. 4, 2012, 12:00 AM

Nick Zulovich

ALEXANDRIA, Va. — As 2011 comes to an end, a look back on the year reveals that consumers and businesses may be recovering from the credit crisis of 2008, and are likely to continue their progress this coming year. Total ... [Read More]

Welcome to SubPrime News Update Three Times a Week

Wednesday, Jan. 4, 2012, 12:00 AM

Nick Zulovich

CARY, N.C. — As Cherokee Automotive Group launches our first week of e-newsletters in 2012, our readers will see some changes. With our new schedule, we are making some shifts and increasing the frequency of SubPrime News Update to three times ... [Read More]

X