Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Agora welcomes Mancero as managing director

Tuesday, Mar. 5, 2024, 11:02 AM

SubPrime Auto Finance News Staff

A familiar name in the subprime auto finance industry now is part of Agora Data. The fintech company — which provides technology, capital and guidance with predictable contract performance and analytics for the subprime space — announced the appointment of ... [Read More]

Open Lending gives Economic Vehicle Accessibility Awards to 20 finance providers

Tuesday, Mar. 5, 2024, 10:35 AM

SubPrime Auto Finance News Staff

Soon after releasing its full Vehicle Accessibility Report, Open Lending Corp. recognized 20 credit unions and banks on Tuesday through its inaugural Economic Vehicle Accessibility Awards (EVAAs). Executives highlighted the winning banks and credit unions are Open Lending partners that ... [Read More]

PODCAST: Discussing sharper alternative data with Equifax

Monday, Mar. 4, 2024, 11:53 AM

SubPrime Auto Finance News Staff

Alternative data isn’t new in auto financing. But Lena Bourgeois, senior vice president of vertical markets at Equifax, explained why alternative data is now more refined to the benefit of finance companies of all sizes. Bourgeois discussed that topic and ... [Read More]

NAF Association opens nominations for Jack Tracey Pinnacle Award

Monday, Mar. 4, 2024, 11:53 AM

SubPrime Auto Finance News Staff

It might be tough to top the emotional scene that unfolded when the National Automotive Finance Association gave the inaugural Jack Tracey Pinnacle Award last year. But undoubtedly the association will try as it opened nominations for the accolade to ... [Read More]

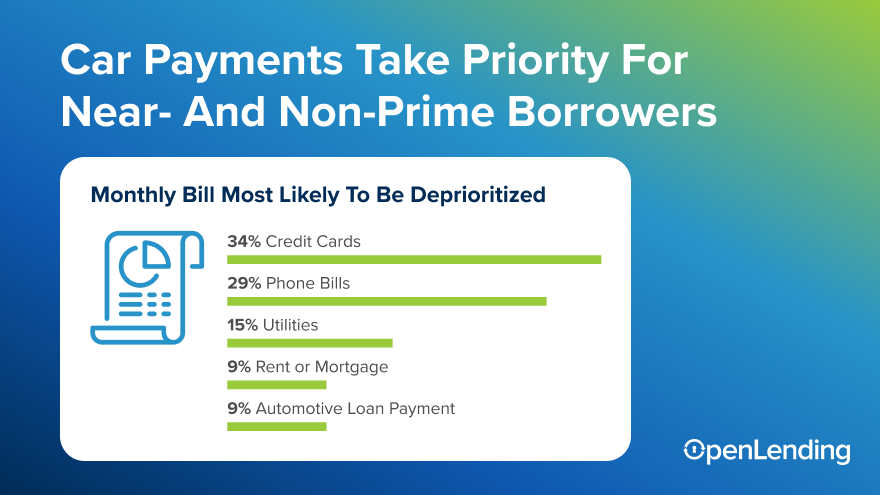

4 more findings from Open Lending’s 2024 Vehicle Accessibility Report

Friday, Mar. 1, 2024, 11:11 AM

SubPrime Auto Finance News Staff

As the company pledged to do when releasing some initial findings late in January, Open Lending Corp. pushed out its entire 2024 Vehicle Accessibility Report this week. The report aims to illustrate how traditional underwriting practices have alienated and excluded ... [Read More]

Title Twins gain more capability through West Virginia’s Clearinghouse

Friday, Mar. 1, 2024, 11:07 AM

SubPrime Auto Finance News Staff

Twin sisters Tracie Lane and Molly Johnson established Washington State Titling Services almost a year ago because of the challenges they experienced working at dealerships in the Northwest. This week, the pair said their sister company — the Title Twins ... [Read More]

Experian spots ‘natural’ reaction to higher interest rates in Q4 data

Thursday, Feb. 29, 2024, 10:55 AM

SubPrime Auto Finance News Staff

Sometimes a trend surfaces in the car business that’s “natural,” like what Experian noticed after compiling its auto finance data for the fourth quarter. According to Experian’s State of the Automotive Finance Market Report released on Thursday, the average interest ... [Read More]

CFPB seeking more data about repossessions & contract modifications

Wednesday, Feb. 28, 2024, 11:26 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau wants more data from finance companies as an extension of its project started a year ago focused on the number of vehicles repossessed and contract modifications. According to a post recently published in the Federal ... [Read More]

SAFCO adds former Off Lease Only legal expert as general counsel

Wednesday, Feb. 28, 2024, 11:25 AM

SubPrime Auto Finance News Staff

Southern Auto Finance Co. (SAFCO) recently made its second strategic move so far this year, appointing Marissa Kaliman as its vice president of compliance and general counsel. SAFCO highlighted Kaliman brings a wealth of expertise to its senior leadership team, ... [Read More]

PODCAST: How 700Credit now sees auto financing & retailing

Wednesday, Feb. 28, 2024, 11:24 AM

SubPrime Auto Finance News Staff

Cherokee Media Group’s Nick Zulovich reconnected with Ken Hill, who is managing director of 700Credit. They shared a conversation about auto financing, regulations and fraud during this episode of the Auto Remarketing Podcast recorded at NADA Show 2024 in Las ... [Read More]

X