Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Carleton addresses 3 questions about Leap Year

Tuesday, Feb. 27, 2024, 09:58 AM

SubPrime Auto Finance News Staff

Carleton reminded the financial services industry that February doesn’t end until Thursday because it’s Leap Year. While sales personnel might see the extra day as an opportunity to lift performance, the provider of compliant financial calculations and lending document generation ... [Read More]

Details of upcoming repossession webinars from ARA & Weltman

Monday, Feb. 26, 2024, 12:00 PM

SubPrime Auto Finance News Staff

Educational webinars from the American Recovery Association (ARA) and Weltman, Weinberg & Reis Co. are scheduled in the coming days, with both sessions focused on complex topics associated with vehicle repossessions. Coming first, ARA has a session titled, “License Plate ... [Read More]

PODCAST: Talking auto-finance data again with Experian’s Melinda Zabritski

Friday, Feb. 23, 2024, 12:29 PM

SubPrime Auto Finance News Staff

We get into the auto-finance numbers again during this episode of the Auto Remarketing Podcast recorded at NADA Show 2024 in Las Vegas. Experian’s Melinda Zabritski reviewed the latest quarterly trends as well as other metrics the industry is generating ... [Read More]

ComplyAuto rolls out AI-powered compliance engine for dealerships

Friday, Feb. 23, 2024, 10:54 AM

SubPrime Auto Finance News Staff

This week, ComplyAuto launched Guardian, an artificial intelligence and machine learning engine designed to assist dealerships in adhering to sales, F&I and advertising regulations. ComplyAuto said Guardian offers a significant advantage for an industry frequently scrutinized by the Federal Trade ... [Read More]

DriveItAway explains great timing of alliance with Partners Personnel

Friday, Feb. 23, 2024, 10:53 AM

SubPrime Auto Finance News Staff

The newest partnership forged by DriveItAway Holdings arrived at a time when CEO John Possumato said the company’s exclusive “Pay as You Go” app-based subscription might be needed even more. Possumato pointed out that rejection rates for auto finance applications ... [Read More]

Newest Open Lending partner brings insurance expertise

Wednesday, Feb. 21, 2024, 11:09 AM

SubPrime Auto Finance News Staff

On Tuesday, Open Lending Corp. gained its third partnership so far this month, aligning with insurance pricing solution provider Akur8 to complement its proprietary Lenders Protection platform. The provider of risk analytics solutions for financial institutions highlighted that this partnership ... [Read More]

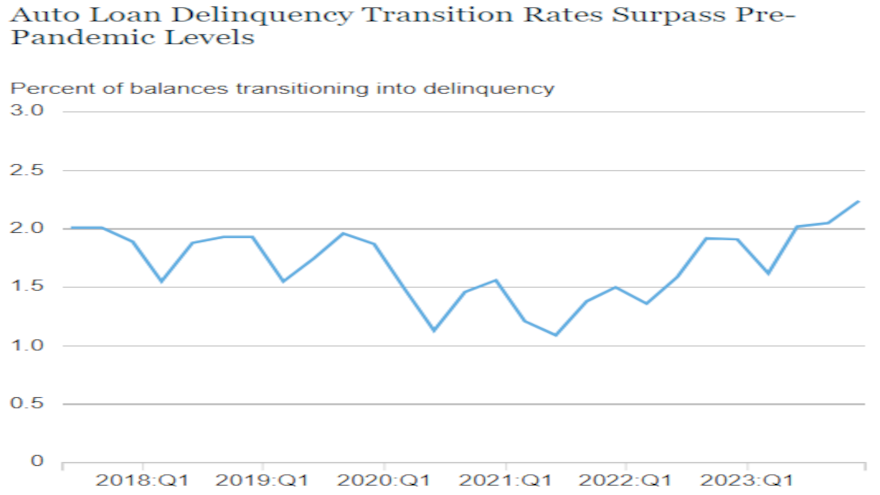

Consumers eager to buy cars as credit availability & portfolio trends soften

Tuesday, Feb. 20, 2024, 10:48 AM

SubPrime Auto Finance News Staff

Despite tighter credit availability and one view of delinquencies showing them higher now than before the pandemic, at least one consumer-driven economic reading showed that people are eager to buy a car. In this economic roundup from three different sources, ... [Read More]

6 features of DriveSmart’s first mobile app

Monday, Feb. 19, 2024, 12:46 PM

SubPrime Auto Finance News Staff

Last week, DriveSmart launched its first mobile app — GoDriveSmart — for iOS and Android devices. The vehicle service contract administrator highlighted the app offers users access to all perks of their vehicle service contract in one space, including 24/7 ... [Read More]

CFPB unveils revised supervisory appeals process

Monday, Feb. 19, 2024, 11:27 AM

SubPrime Auto Finance News Staff

Coming off of tabulating how much into the billions its enforcement actions totaled last year, the Consumer Financial Protection Bureau (CFPB) issued a procedural rule on Friday, updating the process by which financial institutions can appeal supervisory findings. Officials said ... [Read More]

Launcher finalizes another alliance; this time with goal of serving Hispanics

Friday, Feb. 16, 2024, 10:34 AM

SubPrime Auto Finance News Staff

Launcher landed its second alliance of the week on Thursday with the newest one aimed at expanding access to credit within the Hispanic market. Launcher now is integrated with Conecta Marketing Group in order to help finance companies optimize their ... [Read More]

X